blockchain

Bitcoin is often derided as volatile, but a new report suggests there is a method to the madness.

A crash course in the history of money, the birth of Bitcoin, and blockchain technology.

▸

17 min

—

with

Is Bitcoin akin to ‘digital gold’?

Innovative use of blockchain tech, data trusts, algorithm assessments, and cultural shifts abound.

Despite the hype, these technologies aren’t relevant right now. But they could be in the future.

▸

4 min

—

with

This is what you need to do to keep up with today’s digital progress.

▸

3 min

—

with

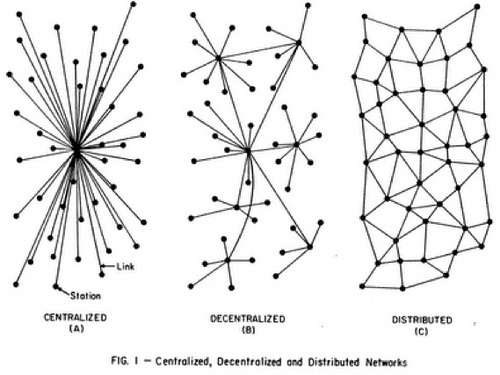

What’s the big promise of blockchain in business? Its ability to eliminate the middle man.

▸

3 min

—

with

In 2018, The New York Times published a comprehensive expose on the burgeoning crypto movement that detailed the luxurious lives of the newly crypto rich. The article, aptly titled, “Everyone […]

When it comes to cryptocurrency, Bitcoin has long been the king of the hill thanks to its status as the founder of the young industry and its first-mover appeal. A […]

Steve Wozniak doesn’t know if his phone is listening, but he’s minimizing risks.

The global financial system is under an increasing amount of pressure to get with the times and evolve to the needs of its customers. Crises like the 2008 housing bubble’s […]

Your next payday could be all digital.

Facebook was careful to say that Libra is not maintained internally and is instead serviced by a non-profit collective of companies.

With the interest of these tech giants, it looks like cryptocurrencies are here to stay.

The plan to stop megacorps from owning superintelligence is already underway.

▸

4 min

—

with

The Canadian professor takes issue with blocking free speech, but is he part of the problem?

The country’s paperless system serves as a model to other nations.

The social media company has long been expected to make a move into blockchain.

Cryptocurrencies have had their time in the spotlight. Now it’s time to focus on solving bigger problems.

A tech-minded approach to drug fraud could squash those who enable the deadly opioid crisis.

▸

5 min

—

with

The potential of blockchain might have been ruined for you by your unemployed cousin who wears Balenciagas to Thanksgiving dinner and told you to enter into the cryptocurrency market at […]

Back with another one of those block(chain)-rockin’ reads.

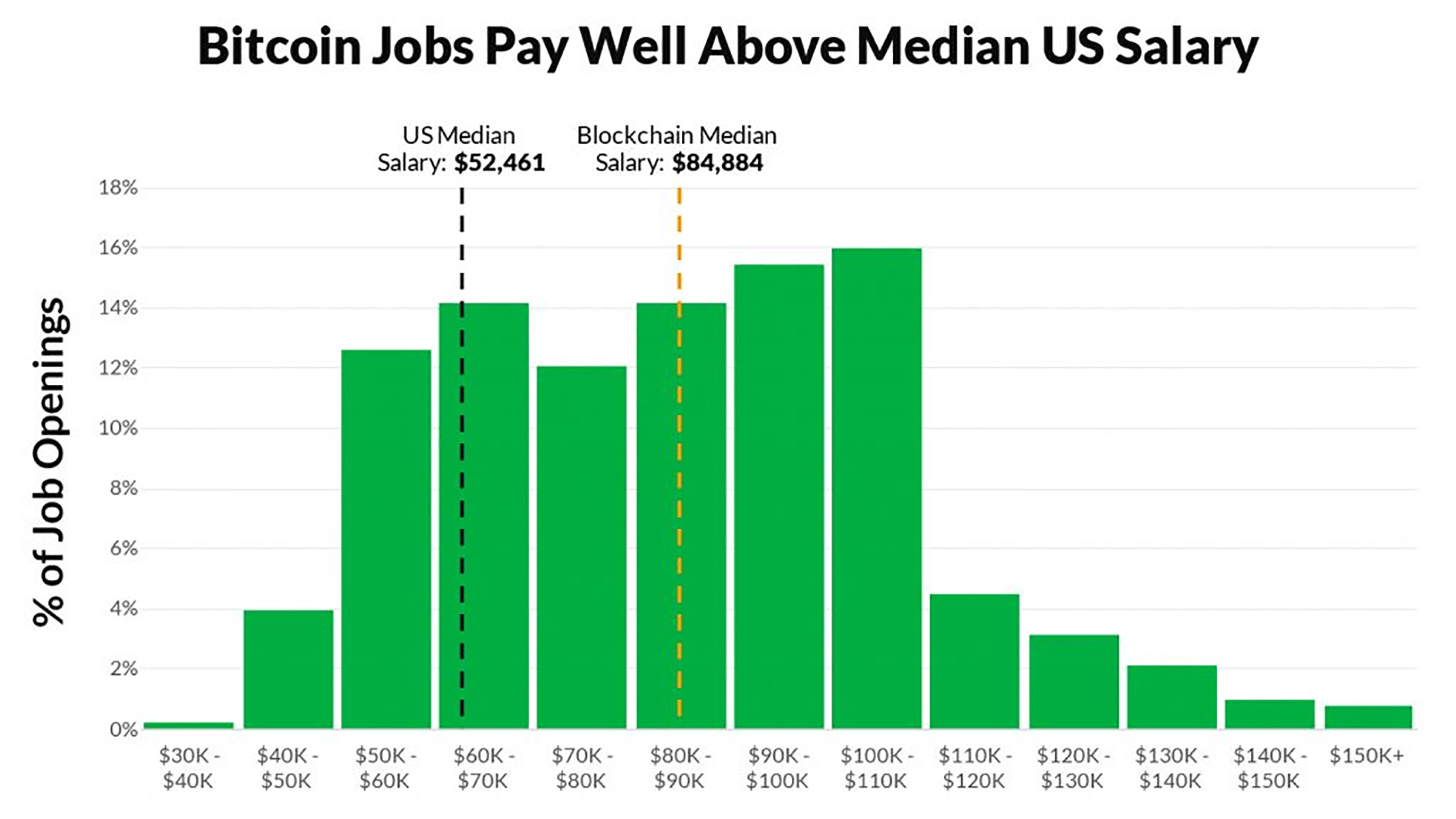

Research shows that employers are working to find more talent in the blockchain space, and they’re willing to pay higher rates for it.

As voting becomes digital, we should consider rewarding voters for taking part in the process.

What is a blockchain phone, and why would anyone want one?

According to new research carried out by Coinbase, we’re witnessing a significant rise in the number of universities teaching their students about blockchain and cryptocurrencies. It turns out that 42% […]

In Life After Google, George Gilder writes that we’re paying a heavy cost for “free.”

In the world of crypto, the more outlandish the idea, the more potentially disruptive.