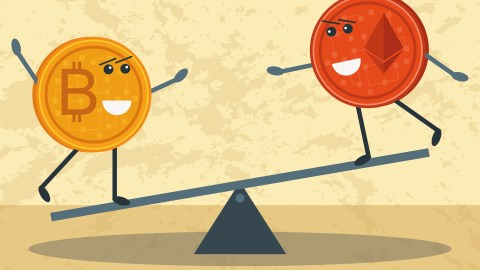

So what’s the actual difference between Bitcoin and Altcoins?

- Bitcoin has long been the king of the cryptocurrency market.

- New coins and tokens have shaken up the status quo with unique use cases and innovations.

- Bitcoin has responded with its own improvements, leading to a healthier market.

When it comes to cryptocurrency, Bitcoin has long been the king of the hill thanks to its status as the founder of the young industry and its first-mover appeal. A decade later, the original cryptocurrency is still the most valuable one on the market, at one point even reaching as high as $20,000 for a single Bitcoin. Today it is far from alone in the field. As blockchain (the technology that cryptocurrency is based on) evolved, so did the number of coins available, and the things these new coins’ blockchains could accomplish.

These new cryptocurrencies dubbed “altcoins” use the same decentralized concept as Bitcoin but take things a step further with unique features. Ethereum, the second most popular cryptocurrency, introduced the idea of “smart contracts”, code that can automatically execute agreements between two parties using blockchain technology. This opened the floodgates for the development of new use cases and applications for crypto.

More importantly, Altcoins have improved on overall functionality, processing transactions faster than bitcoin, and generally scaling to meet expanding demand for their services. As the market for Altcoins continues to expand, it’s easy to wonder if Bitcoin’s lead will end soon, or if it will be able to keep up with the new generation of cryptocurrencies.

A new take on old problems

Bitcoin was originally developed as an idea for alternative, decentralized digital currency that could eventually replace fiat money like the dollar and the euro. As such, it was built for simple transactions and uses a peer-to-peer consensus mechanism to power a network to collectively verify transactions, adding them to the “chain”, which is comprised of a string of transactions in batches called blocks. As a payment mechanism, bitcoin still falls far short of methods like credit cards and even other digital payment tools. Moreover, verifying (“mining”) transactions is resource intensive and expensive.

Newer coins use different mechanisms to reduce both the cost and complexity of mining and can process many more transactions per second than bitcoin’s paltry seven. Additionally, some of these new cryptocurrencies use technology such as smart contracts, which let them build innovative apps directly on the blockchain.

Coins like Ripple and Dash, for example offer a fresh take on the transactability and speed of payments. Ripple is designed to facilitate centralized cross-border transactions between large corporations and institutions. Dash claims to have transaction speeds as fast as 1 second per transaction, focuses on superior security, and an easy ecosystem for individuals to manage their money.

In its original state, Bitcoin simply can’t compete with these newer, more focused coins. Bitcoin was built as a catch-all currency, and its creator likely didn’t envision the multiple use cases of blockchain technology. This imbalance has led pundits and industry veterans to repeatedly claim that Bitcoin is on its way out.

Old coins can learn new tricks

It seems that rumors of Bitcoin’s end were greatly exaggerated and instead of fading into obsolescence, it’s evolved to catch up to the Altcoin market, expanding its usability. In fact, Bitcoin still has the larger user base, which comes with mainstream appeal and substantial interest from developers. Now, it’s fighting off newcomers by adding new tools and functionality over time.

Instead of building the next Bitcoin, many projects have chosen instead to build on the existing Bitcoin architecture, adding new features that make the currency more usable in various situations. RSK, for instance, gives users smart contract capabilities for Bitcoin, opening the doors for app development. Whereas this was once Ethereum’s major draw, Bitcoin is now encroaching on that territory with expanded functionality from RSK’s platform.

Similarly, tools like the Lightning network let users take their Bitcoin transactions off chain, taking the burden off the main Bitcoin blockchain and speeding up the pace at which peripheral transactions can be verified. These solutions don’t change Bitcoin’s original design but make it more competitive against younger and newer coins looking to claim the spotlight. In fact, improving these issues will only expand Bitcoin’s usability and mainstream popularity.

A flourishing ecosystem

Although in theory Bitcoin could eventually be capable of doing everything Altcoins can, the reality is that it still benefits from the competition. As yet, blockchain is a young technology which requires a thriving ecosystem to truly develop and become valuable to society. Moreover, Bitcoin could do well to avoid feature creep and lose its value. The beauty of blockchain is that it allows for cryptocurrencies to be used for much more than just paying for things.

Tools like Golem, a blockchain-powered crowdsourced super-computer, or Fishcoin, which tracks fish and seafood from the sea to millions of kitchens for ethical fishing and sustainable operations, take the concept of blockchain in experimental new directions. Bitcoin is designed to be a digital currency, and it’s only getting better at it. However, in a world where data is transactional by design, nearly any idea will inevitably be revolutionized by transplanting it into a decentralized ecosystem—and Bitcoin is the root of it all.