money

Fraud is a $5 trillion “industry.” But not all its perpetrators look alike. Kelly Richmond Pope, a professor of accounting, breaks down who commits fraud — and why.

▸

8 min

—

with

Financial experts explain 4 types of money behavior.

▸

6 min

—

with

We’re afraid to talk about money–and that costs us.

▸

7 min

—

with

Your emotional brain is being manipulated to shop more, but there are ways to resist.

▸

6 min

—

with

Our brains did not evolve to shop on Amazon.

Science confirms what you already knew about being helpful to others.

▸

5 min

—

with

Money can buy happiness — if you spend it on others, research suggests.

Humans are wired for short-term thinking according to neuroscience, making it difficult to save for retirement.

▸

6 min

—

with

Our brains believe $10 today is more tangible than $100 next year.

Fintech companies are using elements of video games to make personal finance more fun. But does it work, and what are the risks?

Playing video games could help you make better decisions about money.

▸

6 min

—

with

Powerful branding can not only change how you feel about a company, it can actually change how your brain is wired.

▸

6 min

—

with

The same parts of the brain that help us navigate complex social interactions can also drive us to make wildly bad investments.

Why your brain wants you to follow the crowd.

▸

6 min

—

with

It could lead to a massive uptake in those previously hesitant.

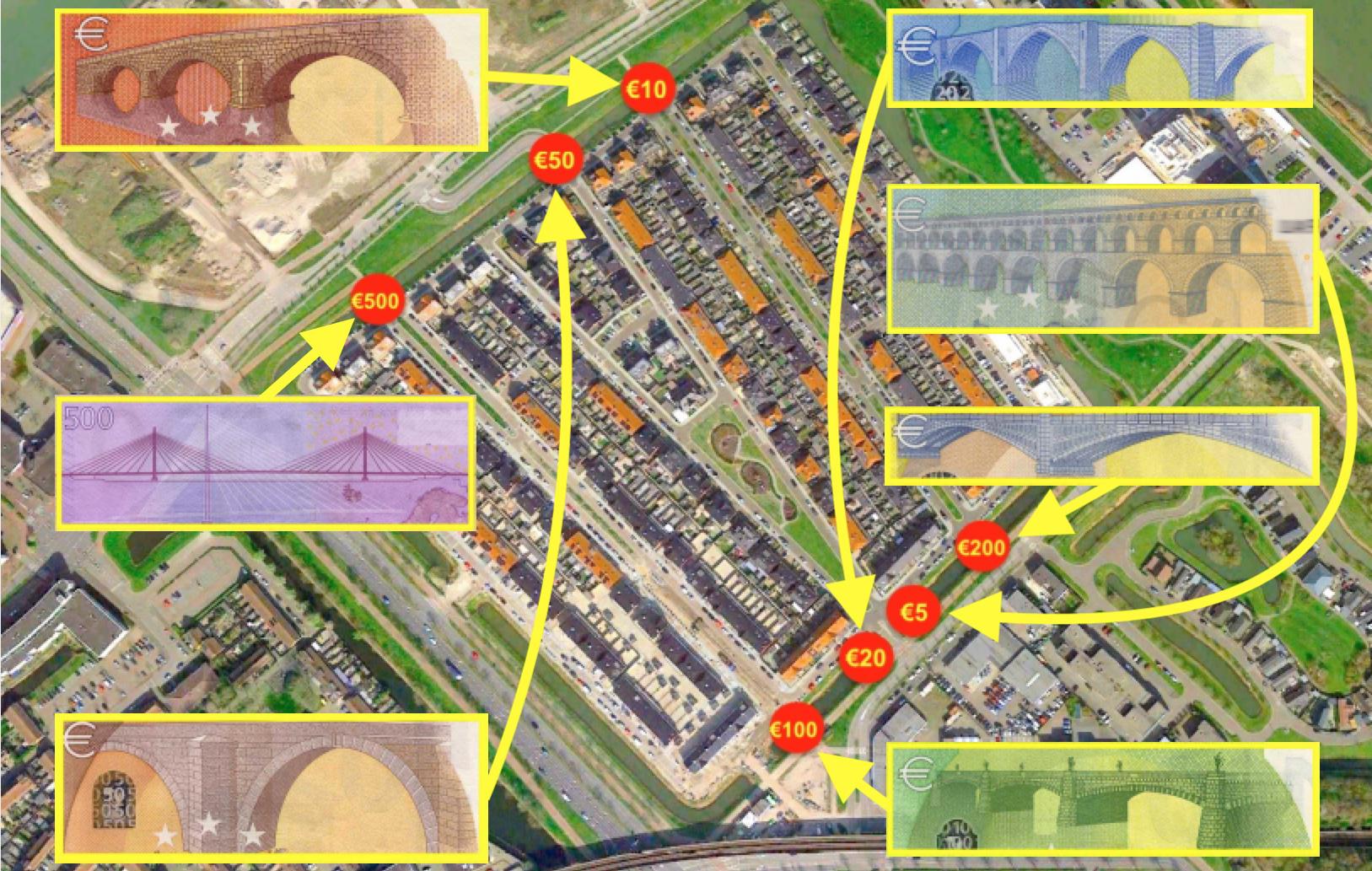

The European currency features buildings that didn’t exist, until Spijkenisse made them in concrete

Understand everything that goes behind payroll, debits, credits, and more with this 25-hour course collection.

It’s insidious and destructive, but there are some things you can do to develop a healthier relationship with material things.

A study of 1.6 million people ties high incomes with more positive emotions and fewer negative ones, but only towards the self.

The more you donate, the greater your chances.

A crash course in the history of money, the birth of Bitcoin, and blockchain technology.

▸

17 min

—

with

Inequality in wealth, gender, and race grew to unprecedented levels across the world, according to OxFam report.

There is no going “back to normal.”

A new study casts doubt on previous research showing that emotional well-being plateaus at an income of $75,000 per year.

People often make a killing in stocks, but there are other ways to potentially turn major profits.

Is Bitcoin akin to ‘digital gold’?

Having grown kids still at home is not likely to do you, or them, any permanent harm.

A new survey found that 27 percent of millennials are saving more money due to the pandemic, but most can’t stay within their budgets.

Miso Robotics has already served up over 12,000 hamburgers.