Gamification: can video games change our money habits?

- Gamification is the process of incorporating elements of video games into a business, organization, or system, with the goal of boosting engagement or performance.

- Gamified personal finance apps aim to help people make better financial decisions, often by redirecting destructive financial behaviors (like playing the lottery) toward positive outcomes.

- Still, gamification has its risks, and scientists are still working to understand how gamification affects our financial behavior.

The human brain is a pretty lazy organ. Although it’s capable of remarkable ingenuity, it’s also responsible for nudging us into bad behavioral patterns, such as being impulsive or avoiding difficult but important decisions. These kinds of short-sighted behaviors can hurt our finances.

However, they don’t hurt the video game industry. In 2020, video games generated more than $179 billion in revenue, making the industry more valuable than sports and movies combined. A 2021 report from Limelight Network found that gamers worldwide spend an average of 8 hours and 27 minutes per week playing video games.

Good at gaming, bad at saving

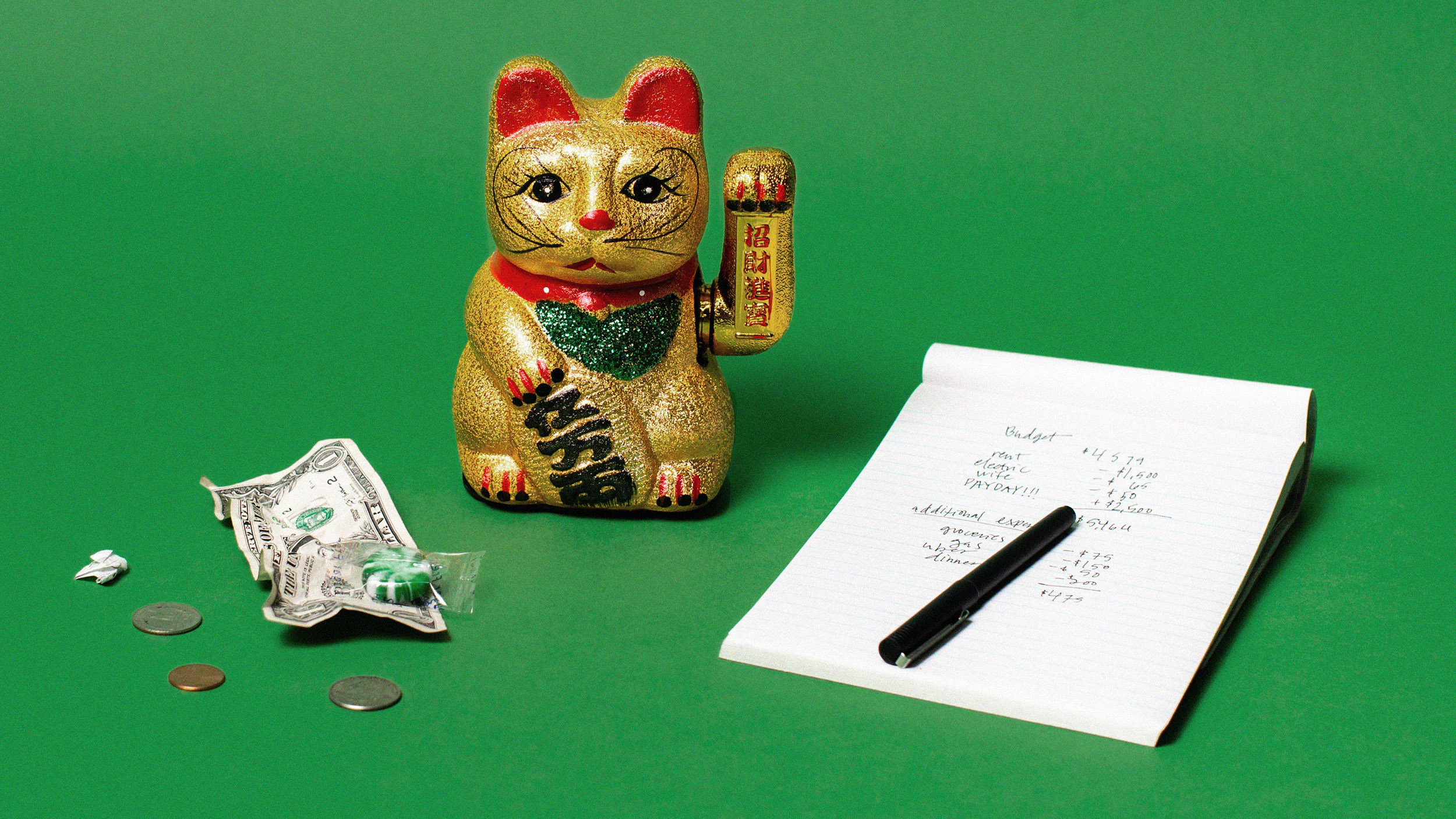

It’s not necessarily bad that Americans spend millions of dollars and hours on video games. But consider another set of statistics: 25 percent of Americans have no retirement savings at all, while roughly half are either living “on the edge” or “paycheck to paycheck,” according to a recent report on the FinancialResilience of Americans from the FINRA Education Foundation. Meanwhile, experts predict that Social Security funds could dry up by 2035.

So, why don’t people save more? After all, the benefits of compounding interest aren’t exactly a secret: Investing a few hundred bucks every month would make most people millionaires by retirement if they start in their twenties. However, the recent FINRA report found that many Americans have alarmingly low levels of financial literacy, a topic that’s not taught in most public schools.

Even for the financially literate, saving money is psychologically difficult

But what if we could infuse the instant gratification of video games into our long-term financial habits? In other words, what if finance looked less like an Excel spreadsheet and more like your favorite video game?

A growing number of finance applications are making that a reality. By using the same strategies video game designers have been optimizing for decades, gamifying personal finance could be one of the most efficient ways to help people save for the future while reaping instant psychological rewards. But it doesn’t come without risks.

What is gamification?

In simple terms, gamification takes the motivating power of video games and applies it to other areas of life. The global research company Gartner offers a slightly more technical definition of gamification: “the use of game mechanics and experience design to digitally engage and motivate people to achieve their goals.”

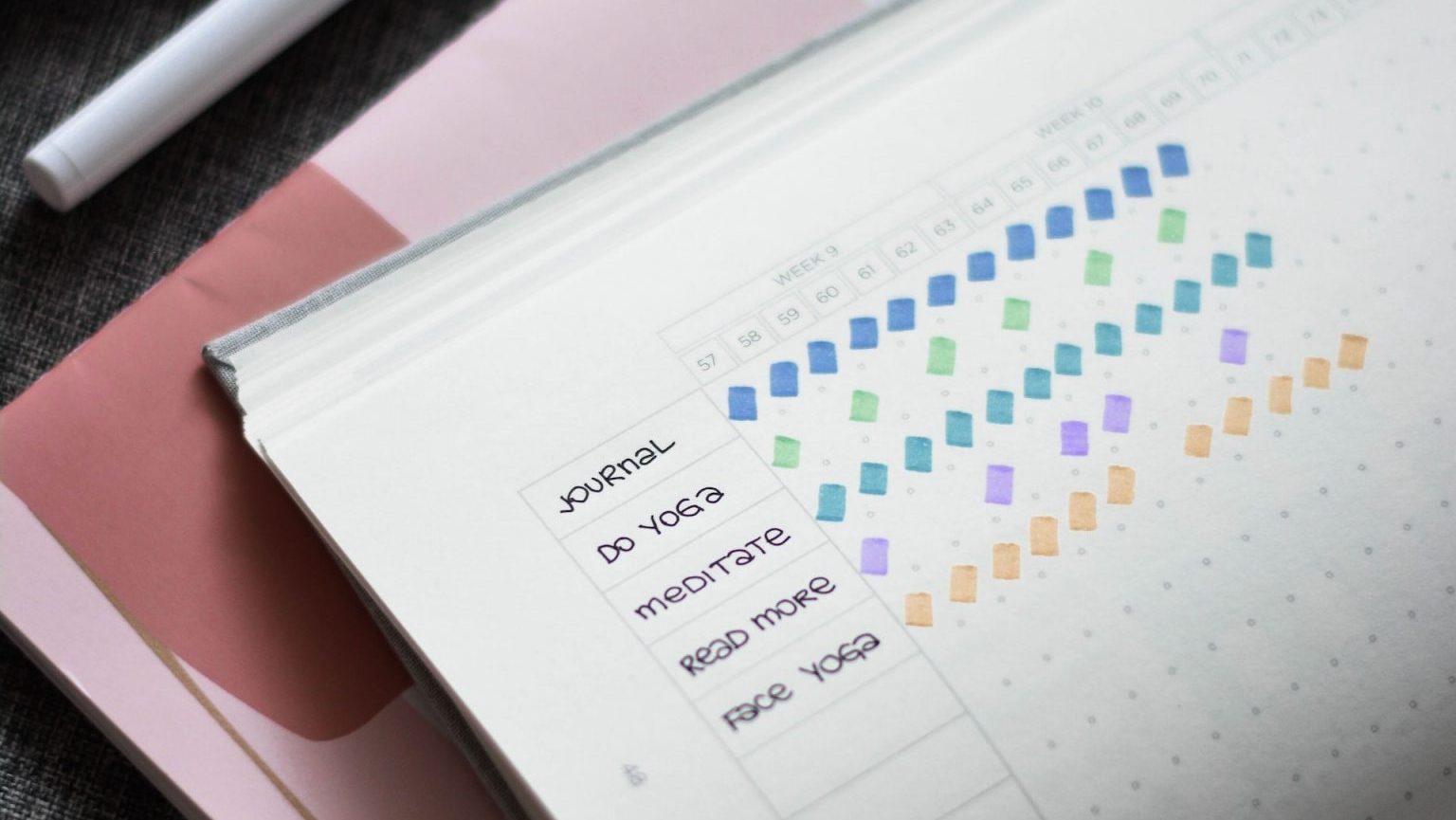

The odds are you have encountered gamification already. It’s utilized by many popular apps, websites, and devices. For example, LinkedIn displays progress bars representing how much profile information you have filled out. The Apple Watch has a “Close Your Rings” feature that shows how many steps you need to walk to meet your daily goal.

Brands have used gamification to boost customer engagement for decades. For example, McDonald’s launched its Monopoly game in 1987, which essentially attached lottery tickets to menu items, while M&M’s gained consumer attention with Eye-Spy Pretzel, an online scavenger hunt game that went viral in 2010.

In addition to marketing, gamification is used in social media, fitness, education, crowdfunding, military recruitment, and employee training, just to name a few applications. The Chinese government has even gamified aspects of its Social Credit System, in which citizens perform or refrain from various activities to earn points that represent trustworthiness.

Finance is arguably one of the best-suited fields for gamification. One reason is that financial data can be easily measured and graphed. Perhaps more importantly, financial decisions occur in the background of almost everything we do in modern life, from deciding what we eat for lunch to where we are going to spend our lives.

Gamification doesn’t just make boring stuff fun; it’s also an effective way to change our behavior. Used properly, it can also disrupt our habits.

The nature of habits

It’s tempting to think that we make our way through life by thoughtfully considering the information before us and making sensible choices. That’s not really the case. Research suggests that about 40 percent of our daily activities are performed out of habit, a term the American Journal of Psychology defines as a “more or less fixed way of thinking, willing, or feeling acquired through previous repetition of a mental experience.”

In other words, we spend much of our lives on autopilot. From an evolutionary perspective, it makes sense that we rely on habits: our brains require a lot of energy, especially when we’re faced with tough decisions and complex problems, like financial planning. It’s relatively easy to rely on learned behavioral patterns that provide a quick, reliable solution. However, those patterns don’t always serve our long-term interests.

Saving money is a good example. Imagine you have $500 with which to do whatever you want. You could invest it. Or you could go on a shopping spree. Unfortunately, the brain doesn’t process these two options the same way; in fact, it actually processes the investing option as something like a pain stimulus.

Why gamification works

Saving is painful. But can’t people simply choose to be more financially responsible? In short: Yes, but it takes a lot of effort. After all, when it comes to changing behavior, willpower is only part of the equation.

Some psychologists think willpower is a finite resource, or that it’s like an emotion whose motivational power ebbs and flows based on what’s happening around us. For example, you might establish a monthly budget and stick to it for a couple weeks. But then you get stressed. The next time you’re out shopping, you might find it harder to resist making an impulsive purchase in your stressed-out state.

“A growing body of research shows that resisting repeated temptations takes a mental toll,” the American Psychological Association writes. “Some experts liken willpower to a muscle that can get fatigued from overuse.” In the terminology of psychology, this is called ego depletion.

Gamification offers a way to outsource your willpower. That’s because games offer psychological rewards that can motivate us to perform certain actions that might otherwise have seemed too boring, taxing, or emotionally draining. What’s more, gamifying parts of your life is less of a change of mind and more of a change of environment.

A 2017 study published in Computers in Human Behavior noted that “enriching the environment with game design elements, as gamification does by definition, directly modifies that environment, thereby potentially affecting motivational and psychological user experiences.”

The study argued that games are most motivational when they address three key psychological needs: competence, autonomy, and social relatedness. It’s easy to imagine how games can tap into these categories. For competence, games can feature badges and performance graphs. For autonomy, games can offer customizable avatars. And for social relatedness, games can feature compelling storylines and multiplayer gameplay.

Gamification and the brain

Games can motivate us by satisfying our psychological needs and giving us a sense of reward. From a neurological perspective, this occurs through the release of “feel-good” neurotransmitters, namely dopamine and oxytocin.

“Two core things have to happen in the brain to influence your decision-making,” Paul Zak, a neuroscientist and professor of economic sciences at Claremont Graduate University, told Big Think. “The first is you have to attend to that information. That’s driven by the brain’s production of dopamine. The second thing, you’ve got to get my lazy brain to care about the outcomes. And that caring is driven by emotional resonance. And that’s associated with the brain’s production of oxytocin.”

When released simultaneously, these neurotransmitters can put us into a state that Zak calls “neurologic immersion.” In this state, our everyday habits have less control over our behavior, and we’re better able to take deliberate action. It’s an idea Zak and his colleagues developed over two decades of using brain-imaging technology to study the nature of extraordinary experiences.

As he wrote in an article published by the World Experience Organization, neurologic immersion can occur when experiences, including video games, are unexpected, emotionally charged, narrowing one’s focus to the experience itself, easy to remember, and provoking actions.

“The components of the extraordinary come as a package, not in isolation from each other,” Zak wrote. “It’s the ‘action’ part that is key to finding immersion. Extraordinary experiences cause people to take an action, whether it’s donating to charity, buying a product, posting on social media, or returning to enjoy an experience again.”

Games can invoke these types of immersive experiences.. But how exactly are financial organizations using gamification to help people “level up” their financial futures?

Gamifying personal finance

Banks and financial companies have been using gamification for years. What started with simple concepts, like PNC Bank’s “Punch the Pig” savings feature, has evolved into a diverse field of games that are helping people stick to budgets, save money, and pay off debt.

What’s surprising about the gamification of personal finance is that some of the most successful apps are redirecting destructive financial behaviors, like buying lottery tickets, toward positive outcomes. One example is an app called Long Game, which uses an approach called “lottery savings.”

“People actually really love the lottery,” Lindsay Holden, co-founder and CEO of Long Game, told Big Think. “The lottery today is a $70-billion-dollar industry in the U.S., and the people that are buying lotto tickets are the people that least should be buying lotto tickets. And so how can we redirect that spend into something that’s helping them in their lives?”

Long Game’s answer is to encourage users to make automatic or one-time investments into a prize-linked savings account. As users make investments, they earn coins that can be used to play games, some of which offer cash prizes. But unlike the real lottery, the prize money comes from banks that are partnered with Long Game, meaning users can’t lose their principal investment.

Blast is a savings app aimed at traditional gamers. The platform lets users connect a savings account to their video game accounts. Users then set performance goals in the video games, such as killing a certain number of enemies. Accomplishing these goals triggers a pre-selected investment into the savings accounts. In addition to earning interest, users can also win prize money by accomplishing certain missions or placing high on public leaderboards.

“Gamers tell us they feel better with the time they spend gaming when they know they are micro-saving or micro-earning in the background,” Blast co-founder and CEO Walter Cruttenden said in a statement.

Fortune City takes a different approach to gamified finance. The app encourages users to track their spending habits, which are represented by visually appealing graphs. As users log expenses, they’re able to build buildings in their own virtual city. The expense categories match the types of buildings users can construct; for example, buying food lets users construct a restaurant. It’s like “SimCity” meets certified public accountant.

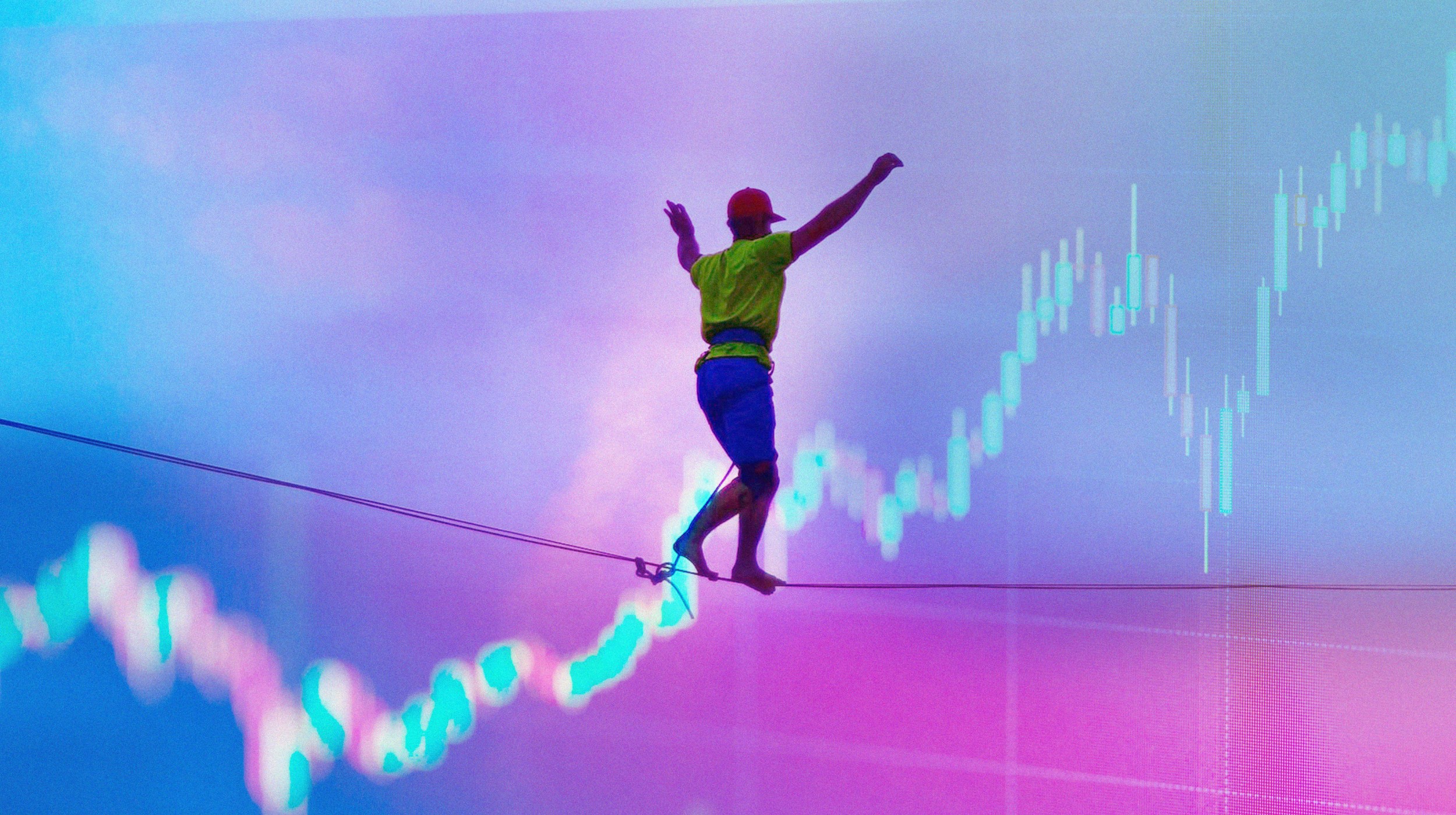

The risks of gamification

Gamifying your finances might help you save money, but it doesn’t come without risks. After all, receiving extrinsic rewards when we perform a behavior can affect our intrinsic motivation to repeat that behavior both positively and negatively. It’s a phenomenon called the overjustification effect.

In addition, gamified finance apps can also be addictive and encourage risky financial behavior. Robinhood, for example, uses visually appealing performance metrics and lottery-like game elements to incentivize the trading of stocks and cryptocurrencies. But while investing in these assets might be a good financial decision for some people, Robinhood arguably encourages its users to be “players” in the difficult world of trading, not necessarily rational investors.

What’s more, gamification doesn’t seem to work for everyone.

“From social psychology and behavioural economics, we know that the most likely [result of] gamification [is that you] will motivate some people, will demotivate other people, and for a third group there’ll be no effect at all,” noted a 2017 study on gamification and mobile banking published in Internet Research.

But given that 14.1 million Americans are unbanked, and millions more struggle with financial literacy, it’s reasonable to think that gamified finance apps could help many people work toward financial independence.

“One of the most interesting things we’ve found is that people want help when it comes to making difficult decisions,” Zak told Big Think. “In my view, any app that helps you be a more effective saver is probably a good app. But I think we have to do a lot more work to really understand the underlying neuroscience of gamification. And so we need to continue to design games that teach you more about how to ‘level up in life,’ not just level up in the game.”