investment

The questions about which massive structures to build, and where, are actually very hard to answer. Infrastructure is always about the future: It takes years to construct, and lasts for years beyond that.

Money can buy happiness — if you spend it on others, research suggests.

Science confirms what you already knew about being helpful to others.

▸

5 min

—

with

Our brains believe $10 today is more tangible than $100 next year.

Humans are wired for short-term thinking according to neuroscience, making it difficult to save for retirement.

▸

6 min

—

with

A socially minded franchise model makes money while improving society.

A new study explores how investors’ behavior is affected by participating in online communities, like Reddit’s WallStreetBets.

People often make a killing in stocks, but there are other ways to potentially turn major profits.

Is Bitcoin akin to ‘digital gold’?

A new survey found that 27 percent of millennials are saving more money due to the pandemic, but most can’t stay within their budgets.

Miso Robotics has already served up over 12,000 hamburgers.

Finances can be a stressor, regardless of tax bracket. Here are tips for making better money decisions.

▸

15 min

—

with

Less than 1% of all venture capital funding in the US is given to Black entrepreneurs. Now is the time for that to change.

Big Think’s co-founder and CEO, Victoria Montgomery Brown, offers six pieces of advice to founders in her forthcoming book.

Transparency no doubt keeps organizations more accountable, but public companies need to reconnect with their true owners.

▸

4 min

—

with

Good relationship capital can change your business forever, explains Shark Tank investor Daymond John.

▸

4 min

—

with

If you feel like you’re on a hamster wheel in life, it might be time for a powershift.

▸

4 min

—

with

It takes more than a good idea to land a shark as a business partner.

▸

5 min

—

with

More frequent sex has been linked with higher income rates, according to a 2013 study.

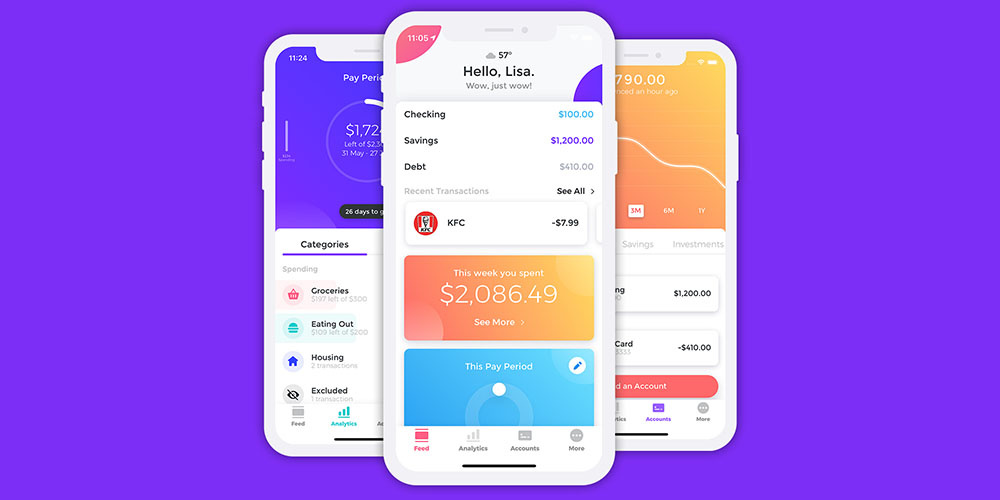

Get your finances in shape with this powerful money manager.

How reframing your emotions and changing your daily behavior can help you save money.

The space station sector has exciting potential as more private companies enter the conversation.

▸

6 min

—

with

To stay on top in the business world, you have to make sure your business model matches the times.

▸

4 min

—

with

The green market is growing exponentially. But will the U.S. seize the economic opportunity?

We’re living longer than ever, but few of us will save enough to afford this historical boon.

Recent advances indicate that the idea could work.

What are the best ideas out there to innovate our rapidly changing education system? The Lumina Foundation has partnered with Big Think to find them.

▸

4 min

—

with

New report shows the extent of China’s hidden power as the developing world’s creditor.

Astronaut company Virgin Galactic will become first to be publicly traded.