wealth

A cartogram makes it easy to compare regional and national GDPs at a glance.

When does a healthy desire for wealth morph into greed? And how can we stop it?

A new study finds that factors influencing where you’re born continue to affect your earnings throughout life.

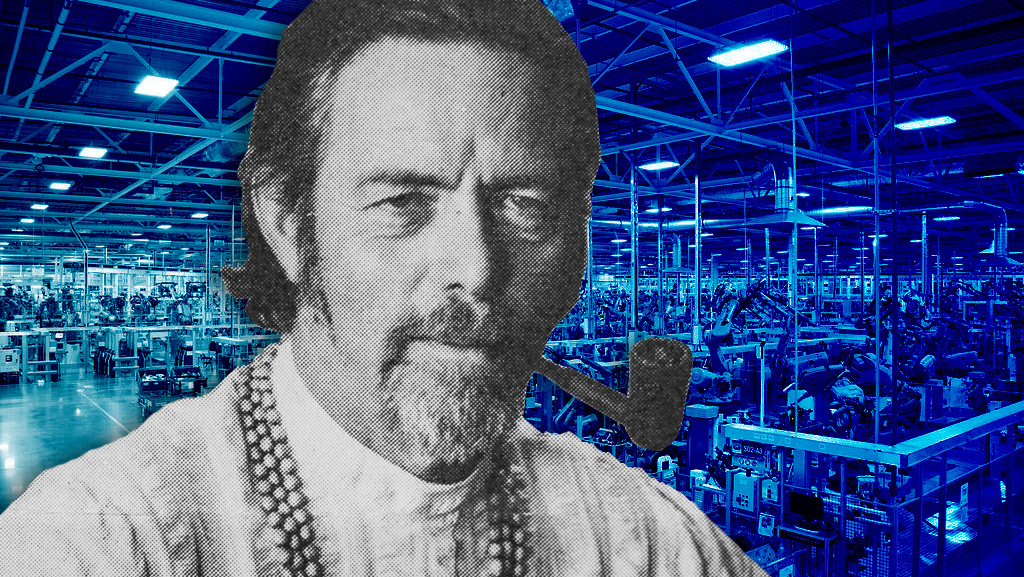

A guaranteed basic income is an old solution to a new problem of labor automation.

Economist Jeffrey Sachs discusses how the megarich can help millions of children by donating 1 percent of their wealth.

▸

7 min

—

with

George Bernard Shaw quipped that a rich man ‘does not really care whether his money does good or not, provided he finds his conscience eased and his social status improved by giving it away’. Was he right?

Want to live in an energy efficient masterpiece? This startup has turned a costly overhaul into an opportunity for investors.

▸

6 min

—

with

The stress we take on at work now will surely pay off in retirement, right? Well, brace yourself.

The world economy is often measured in terms of money, but is this the best method?

A global risk report by the World Economic Forum lists populism and social division among the top five trends that will determine global markets in 2017 and beyond.

In spite of rumors, billionaire Corona beer founder Antonino Fernández’s estate will not be distributed among the residents of his home town.