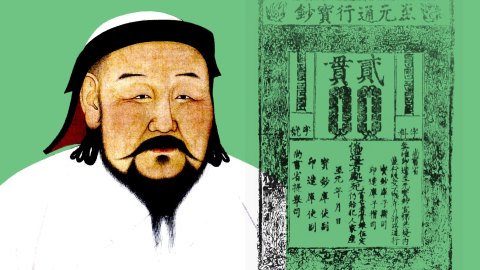

Genghis Khan’s grandson introduced paper money—and inadvertently tanked the Mongol Empire

- The Mongolian ruler Kublai Khan introduced a paper currency that was used from China to the Middle East.

- Backed by silver, this currency — also known as the chao — helped connect the various regions of the Mongol Empire into a unified economy.

- Although the chao eventually disappeared, its legacy occupies a central role in the history of money.

When the Venetian merchant Marco Polo traveled to Asia in the late thirteenth century, he was shocked to learn that the inhabitants of Mongolian China went about their daily business using paper money. This currency, commonly known as the chao, had been introduced to the region in 1260 by Kublai Khan, grandson of the fabled conqueror Genghis Khan.

Of all the innovations Polo encountered in the east, including gunpowder and eyeglasses, paper money was perhaps the most outlandish. Back in his native Venice, not to mention any other place in the known world at that point in time, people used money that was made from copper, silver and gold: materials which had intrinsic as opposed to artificial value.

Chao notes, by contrast, derived their value not from their material (the inner bark of China’s silkworm-feeding mulberry tree), but from faith in and obedience to the Mongolian government that validated them via official seals. The economic reality Kublai created endures to this day: “All these pieces of paper,” Polo later recounted in his Book of the Marvels of the World, “are issued with as much solemnity and authority as if they were of pure gold or silver.”

Kublai’s government — China’s Yuan dynasty — took unprecedented action to ensure that this otherwise worthless form of currency remained both valuable and practical. Under Kublai’s watch, paper money spread from China to the Middle East, turning the concept from an oddity into a normality.

Paper money before Kublai Khan

Although Kublai was not its inventor, paper money did indeed originate in China. Rather than being implemented by a single ruler or administration, it evolved gradually over the course of hundreds of years. Archeological excavations of Shang dynasty tombs trace the history of Chinese money in general back to the 6th century B.C. Originally, this money took the shape of copper coins.

The material was an obvious choice for many reasons. Copper coins were durable, difficult to counterfeit, and held intrinsic value. But they were also heavy and impractical, so much so that — by the 7th century C.E. — there arose a network of agencies where overburdened merchants could deposit their purses in exchange for promissory notes.

In time, these notes — made from paper — were themselves accepted as valid forms of payment. China’s promissory agencies were regulated and eventually incorporated by the Song dynasty, which ruled from 960 until 1279 C.E. During this time, the Song issued what is thought to be the first government-produced paper money in history: the jiaozi.

Jiaozi notes, William Goetzmann and Geert Rouwenhorst describe in “The Origins of Value: The Financial Innovations that Created Modern Capital Markets,” were created in factories owned and operated by the Song. Each note was made using a variety of fibers and given an expiration date of three years in order to discourage forgery.

At first, different regions of China printed their own jiaozi notes. Eventually, however, the Song introduced a single currency that could be used throughout the empire. This currency remained in circulation for only nine years, disappearing completely when China was conquered by Mongols and placed under direct management of Kublai Khan.

The origins of the chao in Yuan China

The chao was Kublai Khan’s second attempt at issuing paper money. He had tried once before, in 1253, to introduce a local currency known as the jiaochao under the jurisdiction of his predecessor Möngke Khan. Circulation of the jiaochao was restricted to Kublai’s own fiefdom, with the neighboring fiefs all issuing their own currencies.

According to researchers Guan Hanhui and Mao Jie, the use of multiple currencies “seriously hindered commercial development and domestic trade” throughout the Mongol Empire. The chao would be different. By Kublai’s orders, it was used from Yuan China to the Middle East. Local coins were outlawed, forcing people to redeem their wealth in the newly issued currency.

Studying the monetary problems that plagued the Song and Jin dynasties, Kublai’s government introduced a number of precautionary measures to ensure that paper money was readily adopted by its apprehensive constituents. Anyone who refused to accept the chao, or preferred to pay in other currencies, was sentenced to death. More importantly, taxes could only be paid in chao.

The legacy of Kublai’s monetary experiment is manifold. As Guan and Mao declare in their article, “The Mechanism of Paper Money in Yuan China,” Kublai’s government was the first “both in Chinese and world history to use paper money as the sole medium of circulation.” When defining money, contemporary economists often list general acceptability as a key characteristic.

The Yuan China scholar Xiaojin Qiao went a step further, calling the chao the first historical instance of fiat money, or money which is not backed by an intrinsically valuable commodity like gold or silver. Other researchers have contested this proclamation; according to Guan and Mao there is evidence to believe that the chao — unlike paper money used during the Song and Jin dynasties — could be converted into silver at a fixed rate.

The advantages and disadvantages of Kublai’s paper money

The question of the silver standard notwithstanding, scholars generally agree that paper money contributed to the welfare of Mongol society in important ways. Mu Hongli, a researcher from Beijing Normal University discussed by Guan and Mao, “noticed that the unification of currency under Kublai Khan’s monetary reform promoted economic development in Yuan China.”

With a single currency, trade between different regions along the Silk Road became easier to organize and regulate. Kublai established institutions to ensure that the chao was adopted in even the remotest corners of his empire. The sole exception, apparently, was Yunnan Province in southern China, where residents had historically used shells instead of coins.

Even more remarkable than the chao itself were the various actions that Kublai’s government took to ensure the currency’s value remained fixed in turbulent times. New notes were printed sparingly to prevent hyperinflation. The government even set up its own granaries to offset the market when, following poor harvests or natural disasters, rice prices rose.

Paper money had its shortcomings, too. These became especially evident in wartime, as Kublai’s campaign against the Song dynasty took a hefty toll on the Mongol Empire’s silver reserves. When these reserves were fully depleted, newly printed chao notes could no longer be backed up and their value depreciated rapidly.

The Yuan dynasty was crippled by inflation, a problem that continued until its collapse in 1368. Disillusioned by Kublai’s failed experiment, the succeeding Ming dynasty briefly printed unbacked paper money before returning to silver in 1450. The material was once again an obvious choice, as trade with Spanish-occupied Mexico and Peru had fully replenished China’s reserves.

The future of paper money

The history of the chao reveals the pros as well as the cons of paper money. On the one hand, its universality can connect economies that would otherwise remain separated by time and custom. On the other, its lack of intrinsic value means spending power can plummet on a dime when people’s faith in the government or agency that issues the money falters.

This happened to Kublai Khan during his war against the Song. It also happened, to a lesser extent and in a much more complicated way, at the start of the 2008 financial crisis. In the face of this global recession, a mysterious individual known as Satoshi Nakamoto developed Bitcoin — a currency whose value is based on cryptography rather than the reputation of social institutions.

The history of the chao also contains an important lesson about the use of gold or, in case of the Mongols, silver standards. While these standards help control inflation and depreciation, they can also cripple an economy when reserves are depleted. For this exact reason, the U.S. government abandoned the Gold Standard in 1971 and has stuck to fiat money ever since.

No economic model is completely foolproof, but flaws in the system can be navigated through cautious planning and critical thinking. Above all, Kublai Khan and his dynasty are remembered for the high level of scrutiny with which they managed their economy. Although this economy eventually collapsed, Kublai’s constituents enjoyed decades of prosperity and innovation.