Economics vs. Fiction on Human Nature

Economics and fiction both seek to describe and explain human nature. Measured against what makes fiction feel realistic, the tales of mainstream economists don’t ring true. Yet they govern us.

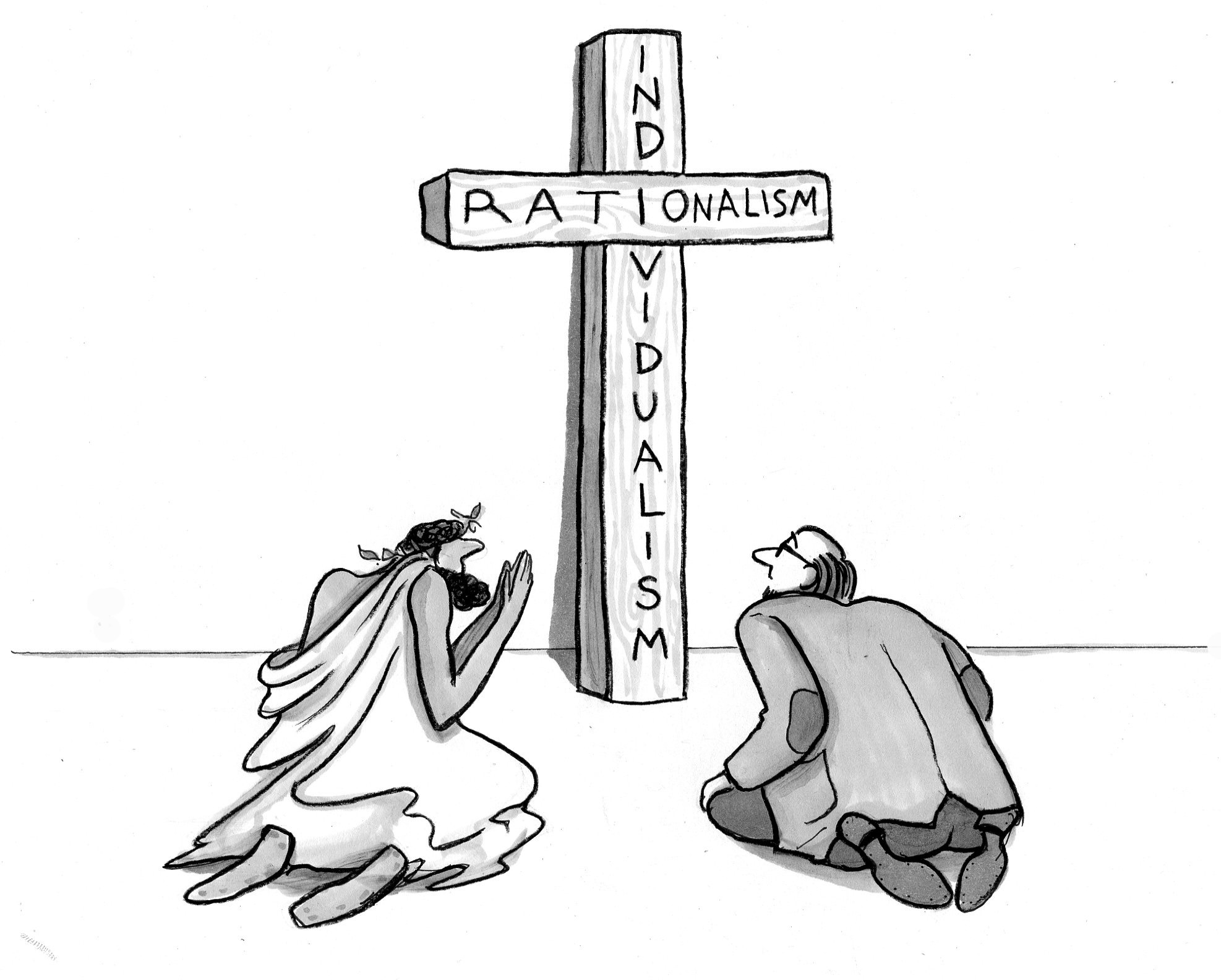

1. Economic orthodoxy says we are selfish, rational, individual utility maximizers. Everyday experience, and basically the whole of the arts, and much empirical science, all testify that that mischaracterizes most humans.

2. Individualism is a W.E.I.R.D. sampling error (western, educated, industrialized, rich, democratic). Most cultures remain sociocentric. Even WEIRDers have measurable mixed motivations: A Dutch study found 20% were “individualists,” (seeking absolute gain); 65% were “cooperators” (joint gains); and 7% “competitors” (relative payoffs). Human types vary.

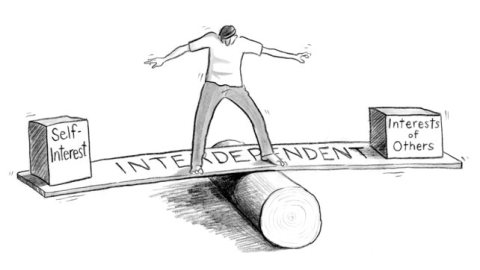

3. A “naturalistic” economics must incorporate our evident behavioral heterogeneity — and address the empirically observable emotions that novelists know drive the logic of our actions. No realistic account of human behavior can ignore multiple motives (including “self-regarding” motives, like greed, and “other-regarding” ones, like sympathy).

4. Reducing the “thousand other springs” of human motivation to “utility” is a vast oversimplification. And few maximize; most muddle. Jerome Kagan says we want money, status, power, or other goods, for “the feelings” they permit. And utility has the taint of tautology (a self-fulfilling assumption: whatever we do was done to maximize it).

5. Self-deficient by nature, we only survive socially and cooperatively. Out-cooperating other species and groups is what we do (we are the giraffes of non-kin cooperation). Yet economists typically ignore the mechanisms that evolved to solve the central challenges of team survival. They often discount what drives credible fiction, the social and moral emotions (fast thinking) that shape “relational rationality.”

6. Fiction’s functions include transmitting a culture’s recognized patterns — norms, social-coordination rules (morals), character types, and typical scenarios. The rational-for-self-only single cartoon-character-type stories of economics can promote excessive individualism, which undermines the logic of group survival (e.g., the misnamed tragedy of the commons).

7. Cultures that don’t limit group-damaging individualism, that don’t balance self-only-interest with group cooperation, don’t thrive (and risk suicidal “rationality,” even in cancer-cell-groups). Markets aren’t cures (often misinformed, they mindlessly and misrationally make miscalculations, risking mass disorders).

8. Robert Frank (the “Darwin’s wedge” guy) has added empirical emotional motivations into his economics (Passions Within Reason). He knows what every good storyteller knows: social and moral emotions drive the logic of how we manage life’s complexities.

The supposedly scientific literature of economics needs characters as realistic as fiction requires (to escape its unbehavioral mono-motivated “theory-induced blindness”).

Illustration by Julia Suits, The New Yorker cartoonist & author of The Extraordinary Catalog of Peculiar Inventions