Will China Control Credit Markets?

What’s the Big Idea?

When credit rating agencies like Moody’s and Standard & Poor’s publicly rate companies and nations on their capability to repay loans, they have the power to move markets and the trillions of dollars represented therein. When a rating agency downgrades the credit of a company or a country, investment money flees, as has been the case in the fallen European economies of Greece, Ireland and now Portugal. But who controls these companies and what are their interests? Much criticized for their failures during the prelude to the financial crisis, just what are the motives of credit rating agencies?

What’s the Most Recent Development?

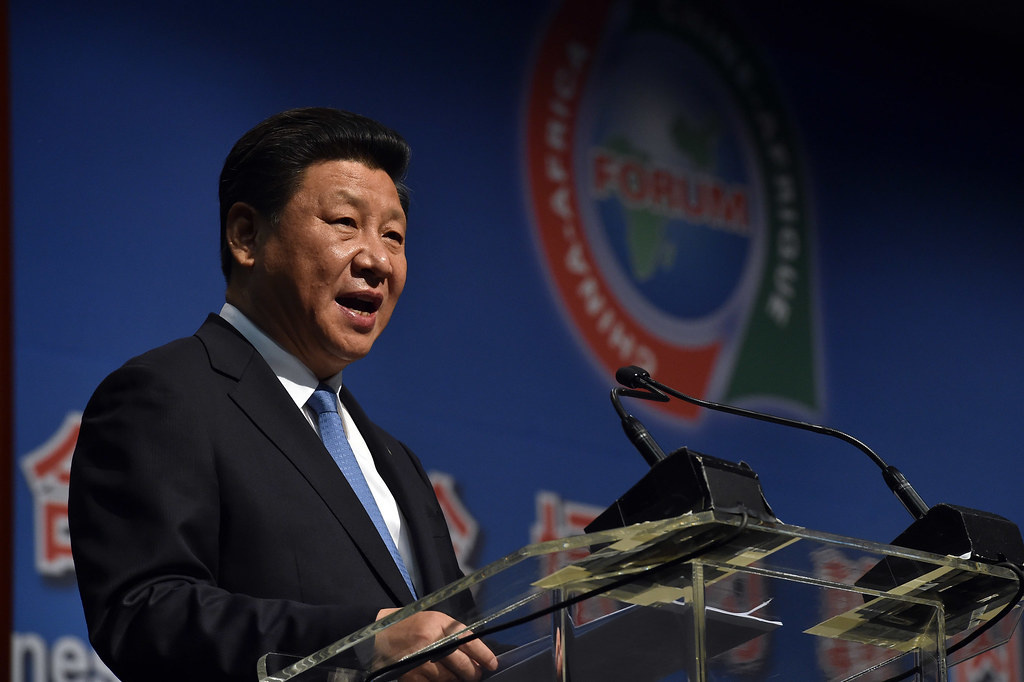

As Western economies are saddled with debt and embarrassment for having started the global economic crisis, rising powers are seeking to assert their influence in the world of international finance. When China’s rising rating agency Degong Global downgraded the credit of the U.S., U.K. and Germany while upgrading China’s, political motives were suspected. Degong’s chairman Guan Jianzhong is critical of the fact that the most influential credit rating agencies are located in the most indebted countries. He wants a new international ratings agency to rule, with China playing a lead part.