What Good Is Davos?

The world’s elite have descended upon Davos. But the recent publication of a report claiming that the financial crisis was “avoidable” casts a shadow over what could be the world’s most expensive and exclusive retreat. “The greatest tragedy would be to accept the refrain that no one could have seen this coming and thus nothing could have been done,” the report concludes. So why did the smartest and most powerful minds fail to predict the coming crisis in 2008?

In his interview with Big Think, Kevin Steinberg, the COO of the World Economic Forum USA, tells an illuminating story about an interactive workshop performed at Davos 2008, less than nine months before the financial bubble would ultimately burst. During the exercise, teams of global investment professionals were asked to allocate money to different industry sectors and then consider the implications of those allocations for the global economy’s growth in the coming year. The professionals were then offered the option of privately putting as much money as they’d like “under the mattress” or in a safe bank—and the results came as quite a surprise given the buoyant mood, Steinberg explains in the video below.

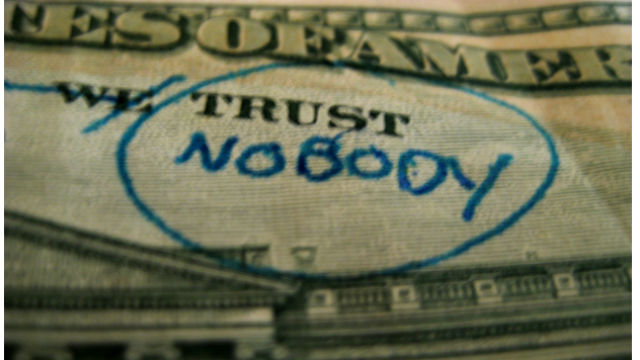

Publicly the atmosphere was jovial and bullish, but privately a good majority of the money managers feared—correctly—a deep correction in the world’s economy. Why weren’t these fears addressed? Did the atmosphere of Davos prevent them from acknowledging the anxieties that most secretly harbored?

“A lot of what we decide is influenced by what’s going on around us” explains Legg Mason Capital Management’s Chief Investment Strategist, Michael Mauboussin. Watch a portion of his interview below for a number of examples of how our decisions and behavior is unconsciously affected by our environment.

If simply writing down a phone number can alter one’s ability to make a simple estimate, could the insular, exclusive nature of the World Economic Forum be preventing the world’s leaders from acting in the best interests of society?