simplicity

A fun and completely safe experiment for the family to try during quarantine.

▸

5 min

—

with

Simple tricks for hacking back your device.

▸

2 min

—

with

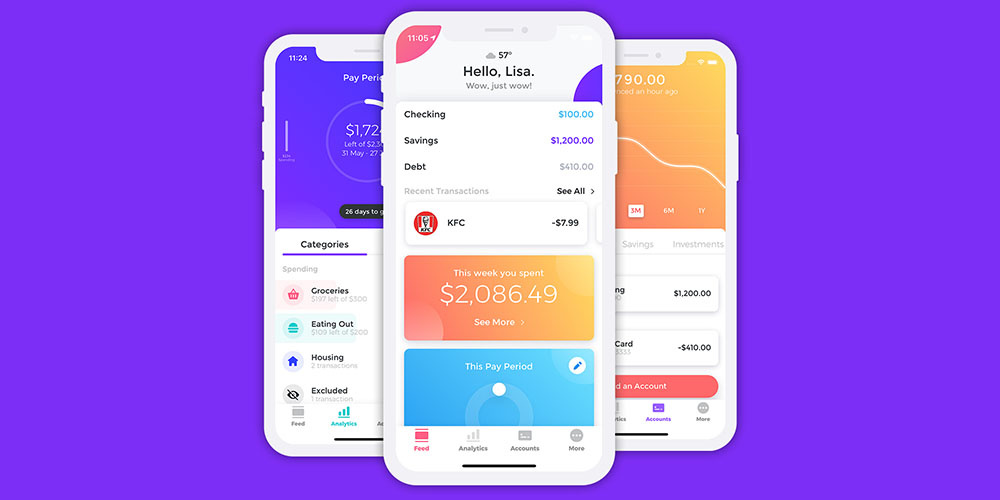

Get your finances in shape with this powerful money manager.

One way to limit clutter is by being mindful of your spending.

▸

4 min

—

with

It’s almost time for spring cleaning.

▸

5 min

—

with

The famed author headed to the pond thanks to Indian philosophy.

Writing by hand is the original concentration hack.

▸

5 min

—

with

Turns out simplicity is really, really complicated. Having worked with Steve Jobs for years as an advertising creative director on Apple products, Ken Segall has taken a blood oath to uphold the principles of simplicity.

▸

9 min

—

with