behavioral economics

Our brains did not evolve to shop on Amazon.

Money can buy happiness — if you spend it on others, research suggests.

Our brains believe $10 today is more tangible than $100 next year.

The same parts of the brain that help us navigate complex social interactions can also drive us to make wildly bad investments.

Information economics suggests that “no news” means somebody is hiding something. But people are bad at noticing that.

These new status behaviours are what one expert calls ‘inconspicuous consumption’.

How will the current challenges to the global economy pressure it to change?

▸

4 min

—

with

Economics professor Stephen M. Miller shares his insights in this exclusive interview.

From understanding human aggression to epigenetics, Stanford University offers all 25 lessons of this fascinating course for free on YouTube.

When facing a tough decision, it pays to trust your gut.

It’s not the act of buying but how you spend money that improves happiness and life satisfaction.

Need to know how an election will turn out? Call your bookie.

Looking at the 2011 earthquake in Japan, researchers found that natural disasters make men — but not women — more fond of taking risks.

A study from May 2018 found that most lottery winners report greater life satisfaction over a long-term period.

Here’s how the government improves your life without you knowing it.

▸

8 min

—

with

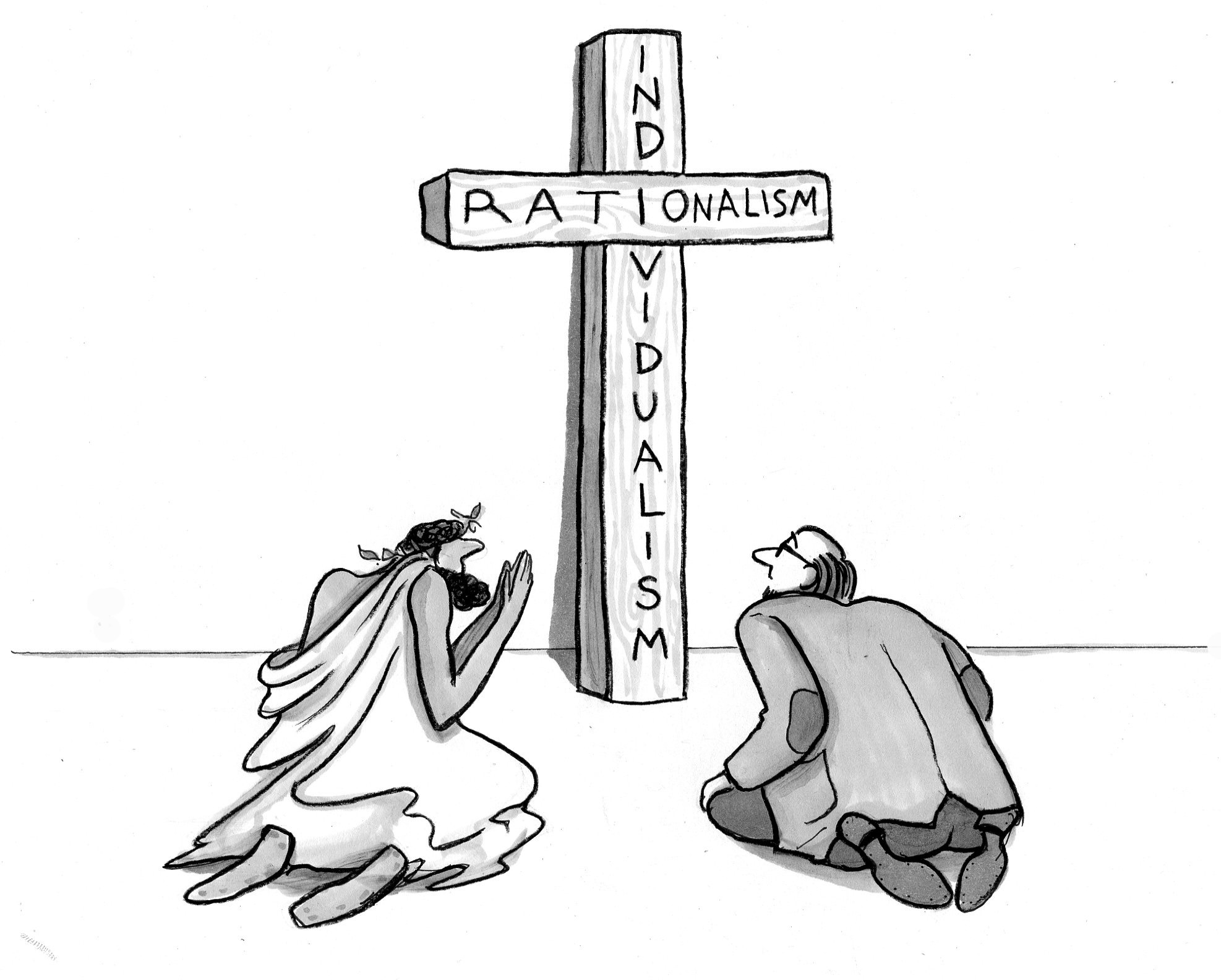

How did our world come to be ruled by a view of human nature that contradicts the testimony of much of history, and the bulk of the arts, and your daily experience? Mathoholics are to blame.

“My theory is true, if I do say so myself.” SPOT stands for “Spontaneous Preference For Own Theories,” and it’s a newly identified cognitive bias.

Want to make someone an offer they can’t refuse? Understand how our minds are hung up on loss aversion, says former FBI negotiator Chris Voss.

▸

3 min

—

with