Getting Too Tough on China?

It’s fashionable and easy to blame vast, mysterious, authoritarian China for our economic problems. It’s also not quite fair.

Sign up for the Smarter Faster newsletter

A weekly newsletter featuring the biggest ideas from the smartest people

In recent weeks members of Congress have again moved to punish China for keeping its currency at a low value relative to the dollar. It’s fashionable and easy to blame vast, mysterious, authoritarian China for our economic problems. It’s also not quite fair. In fact, China’s currency policy offers Americans a very mixed bag.

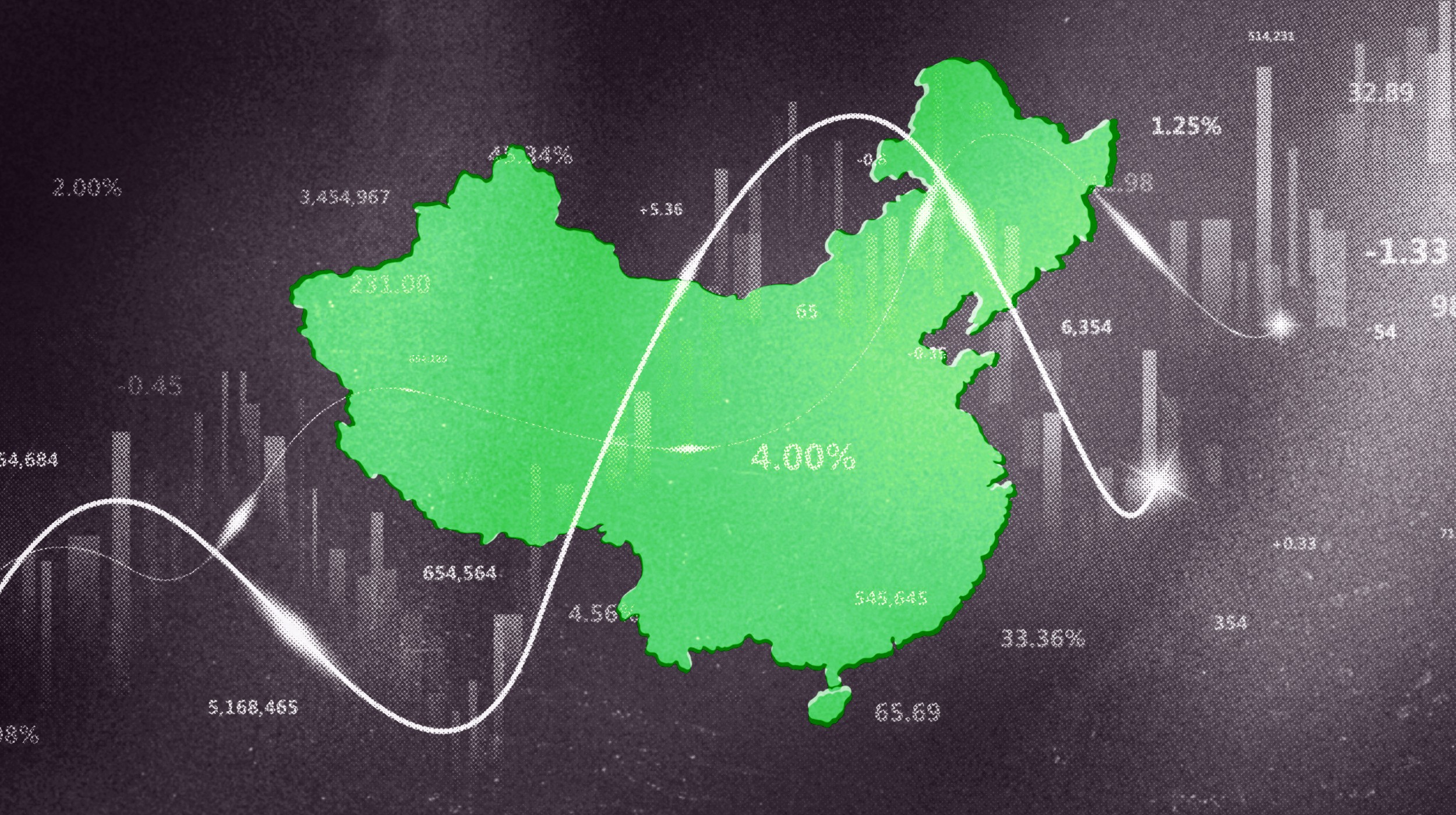

First, let’s look at the numbers. In the decade from 1995 to 2005, the China-United States exchange rate hardly moved from about 8.3 yuan to the dollar. Then began a gradual appreciation of the yuan that ended in the summer of 2008 at about 6.8 yuan to the dollar, an increase in the yuan’s value of about 22 percent in three years. For the next two years, during a sensitive period for the global economy, nothing changed. The upward trend finally resumed in the summer of 2010, with the yuan gaining another 8 percent since then.

The cumulative rise in the yuan since the summer of 2005 was about 32 percent – for most countries, a pretty big change. And even though the dollar has been losing ground against a lot of currencies, the yuan’s gains seem to fall within a reasonable range. Over the same period, the British pound lost value, and the euro and the Korean won gained only about 10 percent versus the dollar. At the other end of the spectrum, the Japanese yen and the Swiss franc both rose by roughly 40 percent.

Still, you could argue that the yuan began from a low base, and there’s no doubt that China bought dollars and other currencies by the billion; this helped to keep the value of the yuan lower than what it might otherwise have been. But what was the alternative? China had to do something with the foreign currency that piled up from its trade surpluses, and dollar-denominated assets were a pretty safe bet. Sure, China could have bought other currencies and allowed the yuan to appreciate a bit more against the dollar. Not doing so was a prop to China’s exports, but it was also a sign of confidence in the United States.

In addition, China’s purchases of dollar-denominated securities reduced the cost of borrowing for everyone in the United States, including consumers, by pumping money into American financial markets. What did we buy with these favorable interest rates? Well, yes, a lot of Chinese-made stuff. Yet all the Chinese imports – they amounted to thousands of dollars for every American – raised our living standards. They were cheap relative to manufactured goods from almost anywhere else, so we could afford to buy more stuff and nicer stuff as well.

Plus, what was true for households went double for companies. Inexpensive Chinese raw materials and goods lowered costs for American businesses. Lots of American businesses made money by importing Chinese products for sale to consumers, too.

But what about the issue the politicians talk about the most, the effect on American producers? GettIf the yuan has a low value relative to the dollar, American goods do indeed look very expensive in comparison to Chinese goods. This certainly hurts American companies struggling to compete with Chinese imports and exporters hoping to sell into the Chinese market.

It’s worth looking at exactly where this competition is taking place. Chinese costs in basic manufacturing are so much lower than American costs that the exchange rate is only a small part of the Chinese advantage. Plenty of big American companies have taken advantage of these low costs, too, by starting production in China – a logical way to serve the Chinese market. For things like toys and cars, currency is probably not the major issue.

As China moves up the skills ladder, though, its companies are starting to make products that do compete head-to-head with American output. This is where the real tension lies, and the tension will undoubtedly intensify in the years to come. It just doesn’t mean that the exchange rate issue is a no-brainer. Moving against China is and will always be a choice: to protect jobs in a select but growing group of industries while jeopardizing the cheap imports and loose credit that households have long enjoyed.

Politicians may not care much for these subtleties, especially when attacking China looks like a clear political win. That’s a shame. Given the complexities of the American-Chinese economic relationship, they might want to devote more of their energy to areas that have an unambiguously positive effect on the long-term potential of our economy to compete and grow. (More on them later.)

The cumulative rise in the yuan since the summer of 2005 was about 32 percent – for most countries, a pretty big change. And even though the dollar has been losing ground against a lot of currencies, the yuan’s gains seem to fall within a reasonable range. Over the same period, the British pound lost value, and the euro and the Korean won gained only about 10 percent versus the dollar. At the other end of the spectrum, the Japanese yen and the Swiss franc both rose by roughly 40 percent.

Still, you could argue that the yuan began from a low base, and there’s no doubt that China bought dollars and other currencies by the billion; this helped to keep the value of the yuan lower than what it might otherwise have been. But what was the alternative? China had to do something with the foreign currency that piled up from its trade surpluses, and dollar-denominated assets were a pretty safe bet. Sure, China could have bought other currencies and allowed the yuan to appreciate a bit more against the dollar. Not doing so was a prop to China’s exports, but it was also a sign of confidence in the United States.

In addition, China’s purchases of dollar-denominated securities reduced the cost of borrowing for everyone in the United States, including consumers, by pumping money into American financial markets. What did we buy with these favorable interest rates? Well, yes, a lot of Chinese-made stuff. Yet all the Chinese imports – they amounted to thousands of dollars for every American – raised our living standards. They were cheap relative to manufactured goods from almost anywhere else, so we could afford to buy more stuff and nicer stuff as well.

Plus, what was true for households went double for companies. Inexpensive Chinese raw materials and goods lowered costs for American businesses. Lots of American businesses made money by importing Chinese products for sale to consumers, too.

But what about the issue the politicians talk about the most, the effect on American producers? GettIf the yuan has a low value relative to the dollar, American goods do indeed look very expensive in comparison to Chinese goods. This certainly hurts American companies struggling to compete with Chinese imports and exporters hoping to sell into the Chinese market.

It’s worth looking at exactly where this competition is taking place. Chinese costs in basic manufacturing are so much lower than American costs that the exchange rate is only a small part of the Chinese advantage. Plenty of big American companies have taken advantage of these low costs, too, by starting production in China – a logical way to serve the Chinese market. For things like toys and cars, currency is probably not the major issue.

As China moves up the skills ladder, though, its companies are starting to make products that do compete head-to-head with American output. This is where the real tension lies, and the tension will undoubtedly intensify in the years to come. It just doesn’t mean that the exchange rate issue is a no-brainer. Moving against China is and will always be a choice: to protect jobs in a select but growing group of industries while jeopardizing the cheap imports and loose credit that households have long enjoyed.

Politicians may not care much for these subtleties, especially when attacking China looks like a clear political win. That’s a shame. Given the complexities of the American-Chinese economic relationship, they might want to devote more of their energy to areas that have an unambiguously positive effect on the long-term potential of our economy to compete and grow. (More on them later.)

Image Credit: Gina Sanders/Shutterstock.com

Sign up for the Smarter Faster newsletter

A weekly newsletter featuring the biggest ideas from the smartest people