Why churches don’t pay taxes and how much money the public could gain if they did

Everyone pays taxes, right? Well, everyone except churches and one-percenters with offshore accounts. How is it that religious organizations have such a sweet deal?

Actually, churches are not alone in this benefit. They and other religious organizations are treated like charities that provide social benefits to society. They tend to help the poor, work to reduce crime and generally hold a positive influence over their communities.

Making churches tax-exempt can also be considered an enforcement of the separation of church and state, with the government not interfering in religious affairs. Not being taxed especially helps smaller churches, which would otherwise close due to their tiny budgets which are dependent largely on donations.

Still, what if we did tax them? While these numbers are estimates based on a University of Tampa study, we could get up to $83.5 billion of additional revenue if religious institutions paid into the government’s coffers like the rest of us. That’s not enough to get us universal health care, which could run from $1.38 billion to $2.8 trillion per year, according to ranging figures offered by Bernie Sanders and the Committee for a Responsible Federal Budget. But it could be almost enough to end extreme poverty in the world, not just in America, according to a report by Oxfam.

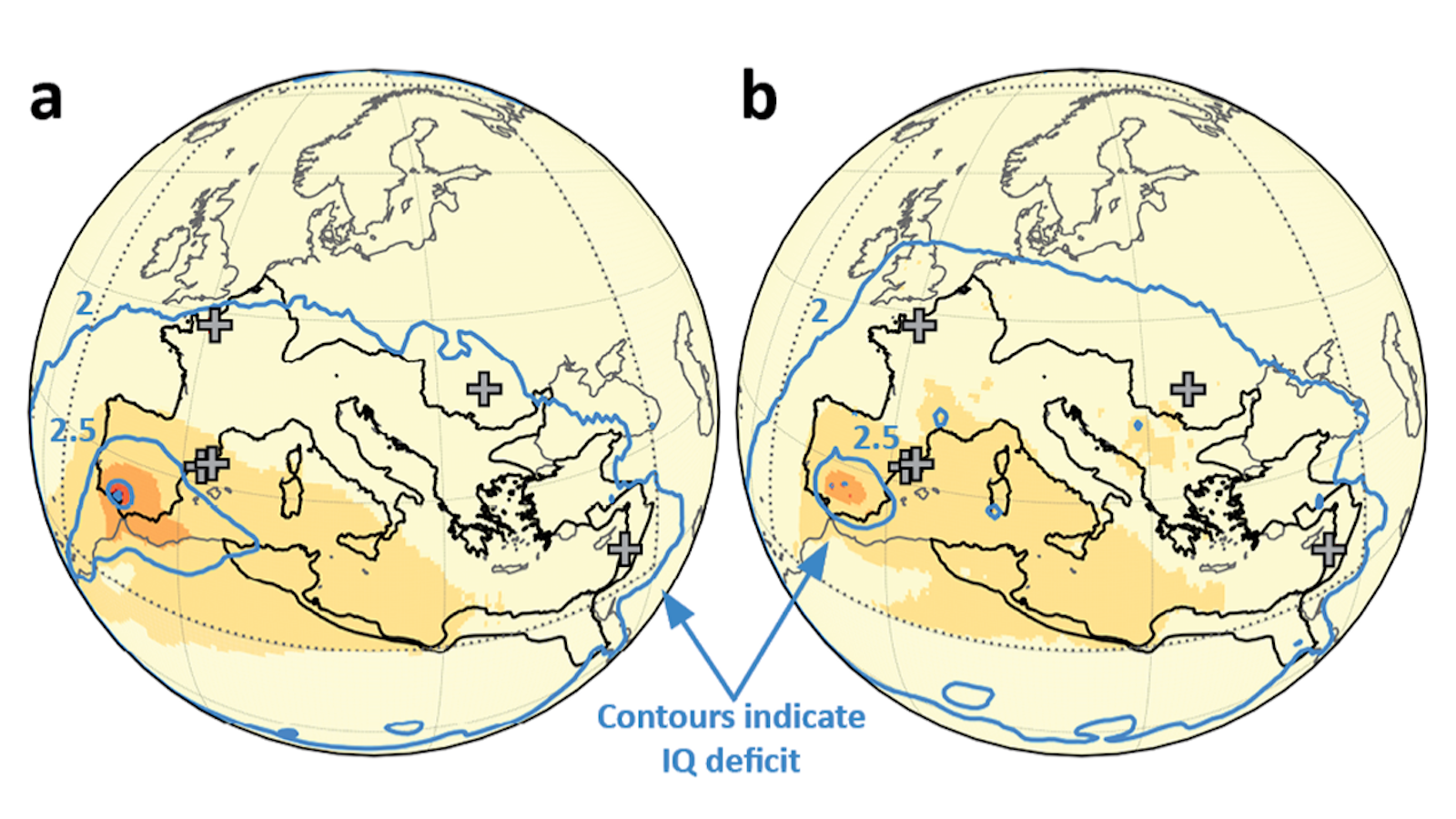

The idea of having churches tax-exempt is not new. It goes back to the times of the Roman Emperor Constantine (272-337 AD) who gave the Christian church a pass on all taxes. Most of the original thirteen American colonies gave tax relief to churches, says Focus on the Family.

Satirist John Oliver highlighted how easy it is to start a church in America due to purposefully vague IRS tax laws and regulations. He created the Church of Our Lady of Perpetual Exemption, proclaiming himself Megareverend.

Who else has a church? The Kardashians. They’ve been accused of supporting the Life Change Community Church as their own personal tax haven.

Indeed, according to the tax law specialist Virginia Richardson in an IRS-produced video, the IRS’s tax guide“makes no attempt to evaluate the content of whatever doctrine a particular organization claims is religious”. The only requirement is for the beliefs to be “truly and sincerely held” while keeping the organization’s actions legal.

Churches and other religious organizations are supposed to stay out of politics but they usually hold indirect influence and often endorse particular candidates, according to Religious News Service.

Will anything change in the tax status of churches? It’s hard to bet on that in such a religious country as the United States. About half of America claims to go to Church at least once a month. On the other hand, with the values of many Americans threatened by the ideological cuts advanced by the Trump administration that target the disadvantaged, the social safety net, and the education system, one wonders if at some point the tax status of Churches and religious organizations should also not be up for debate.

—