XAPO CEO Wences Casares discusses how most of the regulations needed for bitcoin are already in place for gold and other currencies.

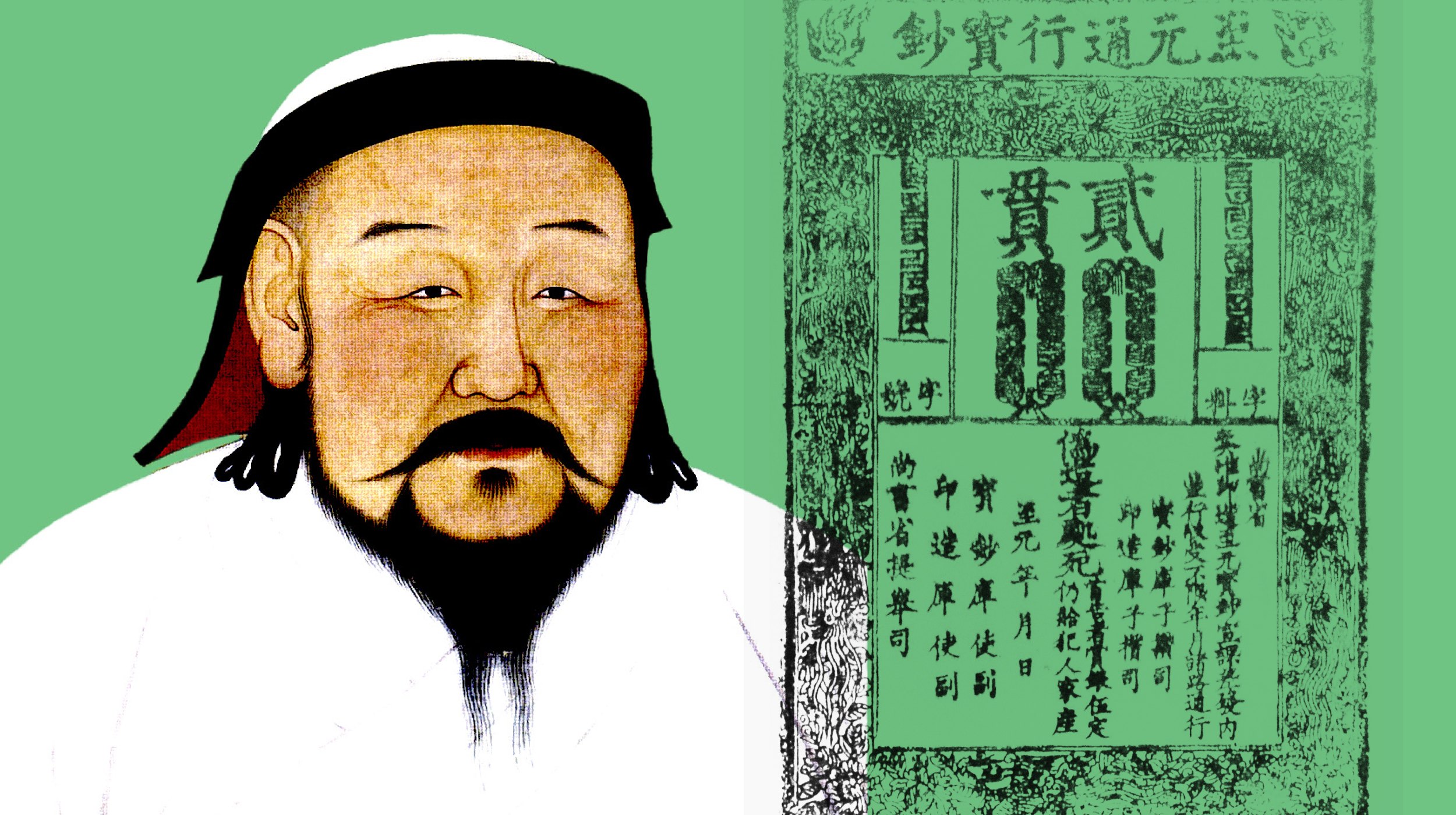

Wences Casares: Bitcoin may be the most important social experiment going on right now. And because it is at the social level it’s an experiment. Technologically it’s not an experiment, it is robust and it works. But because at the social level it’s an experiment there’s still a chance that it fails. And therefore it’s risky and nobody should invest in bitcoin an amount of money that they cannot afford to lose because of that risk. But there’s also a chance that it works out well and if it works out well it may be the first thing in 5,000 years that finally replaces the gold standard which has been the standard for quite a very long time. And it becomes a new meta currency that sits atop all currencies. I don’t think bitcoin should or would ever replace any national currencies. I think that salaries need to be paid in local currencies and countries need to have their monetary policies and you need lenders and the systems that we have in place probably need to stay at that level. But people need to have options and I think that bitcoin will become probably the currency of the Internet or of the digital world. But also in that sense a new currency that sits atop all currencies. And for certain transactions that you do either because they’re on the Internet or because they’re international it makes more sense to do them in bitcoin than in any other currency eventually.

Gold is decentralized. Nobody decides how much gold there is. It’s decentralized. There’s not one company or one country or one person deciding how much gold there is. There’s also not one company, one country, one person deciding what’s the price of gold. It’s decided in the market. And also there’s not one person, one country or one company deciding what you can exchange gold for. It’s totally decentralized. And it’s also sort of anonymous. If I pay you with something – for something with gold there’s no trace of that. If I pay you for something with cash it’s absolutely anonymous. So I think that we need to regulate bitcoin to have basic consumer protections, to prevent criminal activity on it, to prevent money laundering. But I think doing so is not hard and I think doing so is doable with the regulations that we already have in place to account for cash. Cash is very anonymous and we have regulations in place to manage the anonymity of cash.

And each country has regulations to address people having foreign currency. So between the relations that exist for cash, gold and foreign currency you have all of the regulatory infrastructure you need to deal with bitcoin. But you do not need to – what we are seeing right now is because a lot of the regulators are still getting their arms around bitcoin, the first reaction is a scared reaction that tends to overregulating which that wouldn’t be good for the regulators, wouldn’t be good for the industry but I think we will get there and it’s not so complicated.

Directed/Produced by Jonathan Fowler, Elizabeth Rodd, and Dillon Fitton