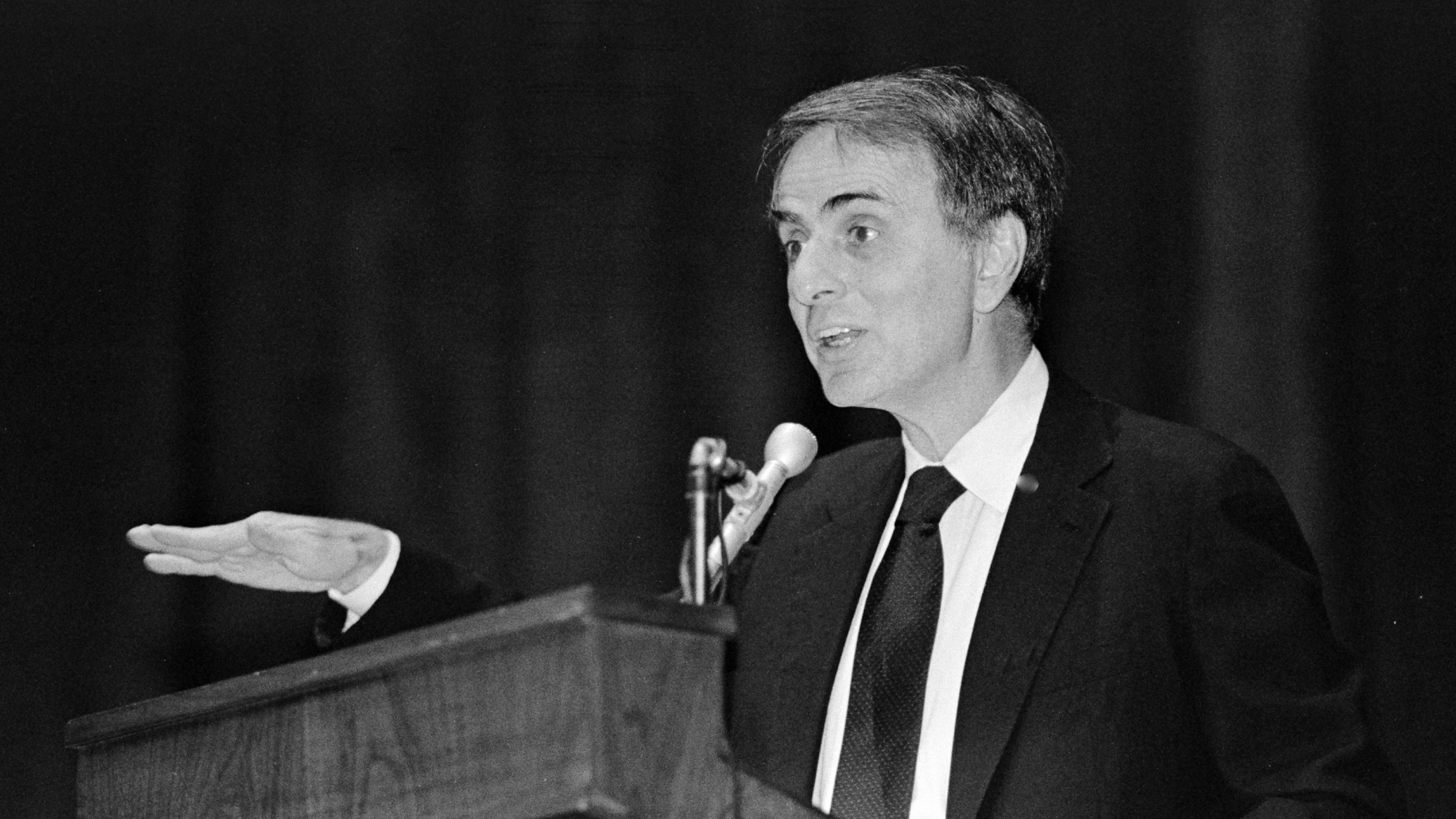

After the Copenhagen Climate Council was considered a failure, how should we prepare for COP-16 in Mexico? Big Think’s live roundtable on March 26, 2010 in Houston was moderated by Tom Stewart, Chief Marketing and Knowledge Officer at Booz & Co. On the panel: Peter Voser, CEO of Royal Dutch Shell; Vinod Khosla, founding CEO of Sun Microsystems; and Marc Stuart, Co-Founder of EcoSecurities.

Tom Stewart: Good afternoon andrnwelcome to The Road to Mexico, a Big Think forum sponsored by Shell OilrnCompany. I’m Tom Stewart; I’m thernChief marketing and Knowledge Officer of Booz And Company, the globalrnconsultant firm. My job today, myrnrole today is to moderate a discussion about Earth’s future. About the paths we might take towardrnglobal action on climate change.

rnrnWithrnme in this room are three distinguished and brilliant panelists whom we’ll hearrnfrom in a few minutes. Marc Stuart, the Founder of EcoSecurities, Vinod Khosla of Khosla Ventures, andrnPeter Voser, who is the Global CEO of Shell Oil Company.

rnrnBeforernwe do that, and before we turn to them, first I’d like to welcome the audience,rnnot only the audience in this room in Houston, Texas, but also a more globalrnaudience several hundred thousand strong across the world wide web thanks tornBig Think and Free Hurst Newspapers, The Houston Chronicle, San FranciscornChronicle, and SeattleIntelligencer.com. rn

rnrnWe’rernhere to talk about climate, energy, and the future of our planet. We’re in Houston because in Houston,rnalso this week is Shell’s Eco-Marathon Americas. Shell has been sponsoring its eco-marathon for many, manyrnyears with events in three continents in North America and in Europe and inrnAsia. The centerpiece of the Eco-Marathon is a contest in which student built, energy efficient vehiclesrncompete to travel the furthest using the least amount of energy. Alongside the eco-marathon, we’ve beenrnholding a series of discussions, this is the third, presented by Big Think andrnsponsored by Shell on the topic of our energy future.

rnrnEco-Marathonrnis this really, totally cool event. rnI was able to go over this morning and take a look at some of thernvehicles that are produced by the students; they are college students and highrnschool students; it sort of like a Soap Box Derby for nerds. For young people interested in innovation,rnenergy and transportation, the Shell Eco-Marathon offers a rare hands onrnopportunity to stretch the boundaries of fuel efficiency using real lifernexperiences in technology and this, for the first time, is going to be an eventrnwhere the Eco-Marathon Americas is actually held in an urban setting on cityrnstreets with the streets going right around this venue tomorrow afternoon. So in effect, you’ll be able to getrnhighway mileage from previous events and city mileage from these sort ofrnextraordinarily interesting cars through tomorrow. So, it’s a really neat event and will be followed by eventsrnin Germany and Malaysia later on in the year.

rnrnButrnthere is another race going on. rnIt’s a race involving the world’s energy needs and the world’s growingrnappetite for energy, and the Earth’s carbon carrying capacity. And it’s that race that makes the Eco-Marathon important and it makes this event important.

rnrnLastrnnight, a group met here to discuss what U.S. policy might be and what changesrnin U.S. policy might be made to try to get U.S. policy working for a greenerrnand more efficient energy future. rnWe talked a lot about the importance of putting a price on carbon, aboutrnthe need to align incentives so that large corporations, entrepreneurialrncorporations, and individuals in their own behavior all find the opportunity torndirect their energy toward the future we all know that we need.

rnrnToday,rnwe’re going to look more globally. rnFor nearly two decades, since the Earth Day Summit in Rio De Janeiro inrn1992, governments, companies, academics, and non-governmental organizationsrnhave been working to develop a framework for policy and action to prevent orrnmitigate climate change without inhibiting economic growth andrndevelopment. The issues aren’trneasy, as all of you know. Thernscience is complex; the scale of the problem is complex. I mean, even in the midst of a veryrnrapid technological change, the sheer size of the world’s energy infrastructurernmeans that rapid change still takes a long time to develop and to diffuse. And the politics of the problem; if therneconomics and the technology of the problem are complex, the politics of thernproblem, as many of you know in this room, are even more complex.

rnrnThernworld leaders who went to Copenhagen in December hoping for a new climaterntreaty came away with less than a lot of people thought they were going to get,rnand a lot of people hoped for. Arnlot of excitement around climate change seems to have dissipated. In Europe, the price of carbonrnfell. But the issue did not go away. Carbon is still poison to thernatmosphere, and while there have been questions about the accuracy of somernclimate change data, the evidence for impact continues to grow.

rnrnThernleaders who met in Copenhagen are going to be meeting again in Mexico, inrnCancun later on this year. It’srncalled the 16th COP, COP 16; the 16th conference of thernparties of that original Rio agreement of 1992.

rnrnWhatrnwe need to do and what I want to do this afternoon, is try to take a look atrnthe road to Mexico. The road fromrnhere to then, from now to then, and ask the question of our panelists andrninvite you also to join in the conversation about what we can do to getrnmomentum going again. Let mernquickly introduce the people who are seated beside me.

rnrnOnrnmy right, on your left as you are looking is Peter Voser, the Chief ExecutivernOfficer of Shell Oil Company; it’s a post he’s held since last July. Previously, he was the Chief FinancialrnOfficer and the Executive Director of Royal Dutch Shell, and Peter has taken onrnhimself as the head of one of the world’s great energy companies to imaginernwhat the energy company of the future will be and to make Shell become thatrncompany.

rnrnNextrnto him, Vinod Khosla is anrnEntrepreneur, Investor, and Tech Visionary. He is, as he was saying earlier, a man who bets big onrnradical technologies. That’s hisrnbusiness model. His venture firm,rnKhosla Ventures, is one of the leading investors in clean energyrntechnologies. He is also thernFounding CEO of Sun Micro Systems. rnSo, in a sense he’s gone from sun to solar in his career. And his venture capital career helpedrnfound Juniper Networks, Excite, Serent, and many other successfulrncompanies.

rnrnMarcrnStuart, no relation, he spells it incorrectly, is the Co-founder of EcornSecurities, a globally leading developer of greenhouse gas reduction productsrnand projects, carbon offsets, emission trading mechanisms, and the like. He is an expert on markets for carbonrnand also is on the board of the International Emissions TradingrnAssociations. Last year he wasrnnamed one of 30 green heroes by CNBC European Business Magazine. So, it’s a particularly terrific panelrnable to bring a lot of perspectives to this topic.

rnrnAndrnPeter, if I may, I’d like to begin with you and to essentially ask the questionrnthat I think many people in the audience and around the world are asking, whichrnis; what do we do to get progress going again globally in carbon and to try tornsort of get out of this sense that we have reached a pause and get forwardrnmotion started again? In particular,rnwhat can big companies like Shell do in support of that process?

rnrnPeterrnVoser:rnYeah, thanks for the question. Letrnme go back to the way I see Copenhagen. rnI think Copenhagen was pushed up tremendously and the expectations werernvery high as you actually described it. rnFor me, Copenhagen was just one milestone in a long journey and I thinkrnthat’s the way I would also take Mexico. We will have to move towards globalrnunderstanding, hopefully global agreements on how we move forward from a publicrnpoint of view, from a corporate point of view, from another stockholder’s pointrnof view. So, I think we should notrnmake the same mistake again and actually expect too much.

rnrnSornfor me, there is on the one side, a public debate on how we actually take this forward, what we want out ofrnMexico, and actually how we would like to structure global, regional, or industry frameworks in order to allowrnus actually to have a long-term program price, which is really essential for usrnso that we actually can invest and we can go forward as a global company, likernShell because at the end, we have to run an energy business which providesrnenergy today, tomorrow, in five years, but also in 30 years. So we cannot just stop tomorrowrnproviding that and we need to combine the efforts of the scientific on therntechnology side with going forward and producing more low carbon fuels, usingrnmore gas which is more enhanced with better NCO2 content compared to coal, forrnexample, etc., etc. So, that’s thernone side.

rnrnThernother side for me as a CEO is, let’s move on. Let’s actually do what we can do today. Let’s not wait until we have goodrnregulations and frameworks which actually allow us to invest. There’s a lot we can do in energyrnefficiency within our own operations. rnThere’s a lot we can do and eco-marathon is a brilliant example of howrnto move on the transport side to a lower carbon fuel world. Biofuels come to mind and other thingsrncome to mind. We are pushing gasrnand we are pushing gas and we are advocating that, not just in the UnitedrnStates, I was just in China over the weekend and we had a huge and long debaternand discussion about gas in China. rnHow can that help actually to help their climate change goals, etc?

rnrnAndrnthen the other one which we are pushing as well, is carbon capture storage andrntransportation, and how we can actually move that forward. We need to have it as a mitigation inrntechnology to actually give the industry and all the stakeholders a pushrnthere. So I think that’s all thernelements we are working on in Shell apart from actually pushing our advocacyrninto the Copenhagen/Mexico process in order to actually get the world to movernon to some global frameworks.

rnrnTom Stewart: Let me push you arnlittle bit on what you were saying on the second comment, that it’s time to –rnwhile we continue talking and building framework, it is also time to stoprntalking and start doing stuff. rnWhat are some of the things that can be done with major energy companiesrnto sort of put stretch targets on that good intention? To sort of say, all right, don’t just –rnhow ambitious can you be in just starting to do stuff while awaiting for thernpolicies and how can we increase this and sort of raise the heat on it?

rnrnPeter Voser: I think you can be quiternaggressive in this, but if you have stretch targets which we, fromrntime-to-time, get from the political side, which are not just achievable, Irnthink you are actually missing the boat here. You are missing the point. I think you need to give incentives in order to achieve bitrnand significant steps forward rather than actually putting a target in placernwhich cannot be achieved.

rnrnI’llrngive you an example. A few yearsrnago we got biofuels regulations in Europe, which is not possible to bernachieved. Now, they have to changernafter two years. I think we needrncommunication between the corporates, the technical side, the science side, andrnthe regulators to governments in order to come up with the right target. I think industry, when challenged,rnnormally delivers. We have goodrnexamples here on how you can drive technology and innovation. Shell has always been first in terms ofrntechnology and innovation. Werndon’t need to stretch target into goals, we will move. But you cannot expect that you have arnlight switch, light switch from this energy source to this one, overnight. It will just not happen.

rnrnTom Stewart: Vinod, let me ask you,rnyou’re in the business, among other things, of radical disruption. You’ve been quoted as saying, last weekrnI think, that coal could actually become the cleaner fuel than solar. And you said earlier today that thernbiggest thing that you think we need to do is to have economic gravity. Economic gravity always prevails andrnhow can we start to get that gravitational pull to strengthen. So, how can we get that gravitationalrnpull to strengthen so the people start moving?

rnrnVinod Khosla: Thanks Peter. I’m a big believer that in the end,rneconomic gravity always rules. Andrnthat environmentalists, by at large, trying to convert the rest of the worldrninto environmentalists are going the wrong way. We need to take environmentalists and turn them into what Irncall “pragmentalists”. Thatrnunderstand the role of economics, economic gravity in large social adoption ofrnnew energy sources, technologies, everything else.

rnrnHavingrnsaid that, I actually believe all the people, all the gurus, the experts, andrnwe can talk about expert forecasts, they are probably almost always wrong andrnrandom. We can come back to that;rnthere is statistical data to support it.

rnrnPeter Voser: I don’t need them, Irnbelieve you.

rnrnVinod Khosla: But those of you who arerninterested read a book called, “ExpertrnPolitical Judgment,”by Professor Tetlock, a 20-year studyrnof 80,000 forecasts; a very rigorous study. But we start believing these 20, 30, and 50 year forecastsrnfrom experts. We need to abandonrnthem and instead of exporting the past into these future forecasts, we need torninvent that future. We will alongrnwith that future, I am on record saying, I can’t imagine oil being more thanrn$30 a barrel by 2030. And thernreason is very simple, it will have to compete it’s way down to compete with biofuelsrnand cost of production of biofuels is the marginal cost of rent on land, and ifrnyou look at fundamental economics, that’s the number it will drive to in realrnterms, real dollars. There is nornquestion in my mind that we will have technologies that meet unsubsidizedrnmarket comparativeness against fossil fuels that are 100 percent renewable. Maybe better than 100 percent,rnwhich is where my comment where coal can in fact be cleaner than solar. That’s based on the technology we feelrnis waiting for commercialization that reduces the lifecycle of carbonrnproduction of power generation from coal to more than 100 percent. So, solar can only do 100 percent reduction inrncarbon emissions, this technology, by displacing products that could otherwisernproduce carbon can get up to 200 percent reduction.

rnrnI’llrnbe happy to go into it in more detail, but the main point is this. We have to bet on innovation andrntechnology. And technology that’srnradical and different and get our best talent working on this technology. And I would submit that five years ago,rnthere wasn’t a PhD student at MIT or Cal Tech, or Stanford, at least that Irnknew of, that was interested in working on energy recent. All the best minds went tornbiotechnology, nanotechnology, computer science, semi-conductor devices, not inrnenergy research. And that hasrnchanged, and that’s why the future will be different and why innovation willrnreach this point of unsubsidized market competitiveness. Because of that, I use my favoriternphrase, these technologies will meet Chindia price; the price at which Indiarnand China will adapt them without regulation. I believe we are far closer to that point than anybodyrnrealizes.

rnrnQuestion: Bureaucraticrnsurvival. Never put a date in thernsame sentence. So, you’re not arnbureaucrat, so I’m going to ask you to break that rule. You said these technologies will meetrnthe Chindia price, when?

rnrnVinod Khosla: So, I believe carbonrnsequestration today for many carbon point emitters, many coal plants. I’m not saying most, I’m not sayingrnall. Many coal sources can berncarbon negative, or carbon zero, in the next year or two without a price onrncarbon because they turn carbon dioxide in this case into useful buildingrnproducts that can be sold. And sorncarbon become, not a problem, but a feed stock. In the case of oil, I would say the same thing. I believe in the next year or so,rnrenewable oil sources can compete unsubsidized with crude oil. I also believe –

rnrnTom Stewart: The biofuels and thingsrnlike that –

rnrnVinod Khosla: Biofuels, right. I also believe on the consumption sidernof this, unlike and I wrote a blog that got me in a lot of trouble where Irnwrote a blog about two years ago, which said, “Prius is more green wash thanrngreen.” And it is more green washrnthan green. It is a completelyrnuneconomic technology and in the McKenzie study came out, hybridization ofrncause came out as the single most expensive way to reduce carbon in dollars ofrncosts per ton of carbon reduced. Irnbelieve it was about $100 per ton. rnAnd so we are picking technologies because the environmentalists lovernthem, that is pleasing to the political appetite and certain politicalrncommunities, and that’s the wrong way to go.

rnrnOnrnthe efficiency side. We’re working on engines that can have 50% more efficiencyrnwithout an increase in costs of internal combustion engines. And I believe those are near commercialrntoday. It’s pretty easy to do arnlight bulb. LED light bulb, and wernwill be introducing that within the next year, that’s cheap enough, that meansrnbelow $10, where it pays for itself within the first 12 months.

rnrnTom Stewart: You’re saying it’srnacross three of the four technologies you actually said within the next year orrn18 months, we reach a tipping point, and the fourth you didn’t –

rnrnVinod Khosla: I would say all four willrnbe commercial next year at retail, and I’ll add a fifth which is a major energyrnconsumer, I think air conditioning that is cheaper than today’s airrnconditioning and 75 percent less energy consumption. That’s most of the consumption, lighting, HVAC, transportationrnfuels.

rnrnTom Stewart: One of the things thatrnhappened in Kyoto was, some people felt that this 18 year string that startedrnwith Rio, with the Earth Day Summit in Rio, that we sort of played out thernstring. And what came out of Kyotornwas what was called a basic agreement, which was with the United States, India,rnChina, Brazil, and South Africa, right. rnAnd those five sort of separated themselves and said, “Let’s usrntalk. Let’s take this offline andrnwe’ll talk.” And Marc, thernquestion I wanted to ask you, and then I want to get to the market mechanismsrnthat seem to be somewhere between the future and actually achieving it, but thernquestion I want to ask you is; does the UN framework still have life inrnit? Should we actually just say,rnthat was then, this is now, has it outlived its usefulness, or do we need tornkeep it going, or should it be jettisoned and revitalized, I guess that’s the –

rnrnMarc Stuart: The process that began inrnRio and ended in Copenhagen is over. rnOkay, the top down UN-driven, caps on countries I do not think is goingrnto be revived. I think what yournare going to see, and I think what the basic agreement points us in therndirection to, is a much more heterogeneous policy environment the countries arerngoing to take on with different types of caps, wit intensity caps, withrnagreements on land use, with efficiency targets, with some with hard caps, etc.rnand with more types of collaboration there will be more bilaterally andrnmultilateral. You can obviouslyrnsee the U.S. and Mexico, for example coming in with some type of deal to mergerntheir carbon commitment going forward. rnOr, the U.S. and Chile, for example, is one that has been mooted, or thernEurope and Brazil, and obviously the big one is the U.S. and China. And that is something that embeds manyrnmore things than just simply climate and environmental concerns.

rnrnIrnthink that what Copenhagen showed is that impart, the climate issue hasrnactually outgrown the U.N. This isrnnow the big boys playing. This isrnaround big issues; this is national leaders, the executive branch talking torneach other on this. That neverrnhappened before and that is a very substantial move. And as such, the U.N. frankly, does not rate above thosernpeople and that is something you need. Where does the U.N. go from here? Clearly, Copenhagen was arndisaster. It was a disaster bothrnin terms of its overall – okay, well disaster is slightly strong. It was a disaster in terms of itsrnoverall outputs of what was expected and what came out, and it was not helpedrnby the fact that it was basically a logistical nightmare. And that put a lot of pressure onto peoplernand there was no real possibility to actually get people to work on thesernthings. And that was ultimatelyrnthe problem.

rnrnWhererndo we go from here? The U.N. hasrnto reestablish its credibility as a neutral arbiter, as a more of a technicalrnagency between countries rather than just simply, as I say a top down, we shallrndo these things collectively. Itrnneeds to look at – if we’re going to have different types of commitments, howrnare we going to adjust those against each other. How is one commitment going to look against another? How do you create some form of commonrncurrency, some sort of comparativeness to understand how things are workingrnbetween each other? Ultimately, werndo need markets. Okay? Markets have to be part of thernsolution. I disagree a little bit,rnI think that policy by definition shapes markets and puts them in place, andrnyou have to have that for this transitional phase. We have an enormous amount of capital stock out there thatrnwill require change over. Notrnevery single power plant is going to be able to put a something on the back endrnof it that will enable it to produce viable materials for the buildingrnstock. We do need ways of keepingrnwhat Kyoto showed us that markets and innovation sprout up everywhere as partrnof this process.

rnrnTom Stewart: So, what we need, andrnwhat I think I hear you saying, and Peter I want to ask you to comment on this,rnis that we may be coming up with a heterogeneous patchwork of agreements amongrnnations, a patchwork of policies, and that unless we have some sort of veryrnclear price signal that is so you have apples to apples to apples despite thisrnpatchwork. I mean, the problemrnwith the patchwork is that you could get a race to the bottom, right? I can find, oh here’s a loopholernthrough which I can dive. And whatrnwe’re trying to create is a race to the top. We’re trying to create the incentive so that you get a racernto the top. And Peter, as you lookrnat this future, first of all, do you think that is right? That we’re going to have this collectionrnof bilateral, multilateral agreements? rnAnd will that give corporations like Shell and you know, other largerncorporations the consistent global view that allows the race to the top, or dornwe run the risk of a race to the bottom?

rnrnPeter Voser: First of all, at Shell wernhave always said we want market solutions because that’s in the longer termrnwhat we will think will give us the incentives to actually invest at the lowestrncost possible in order to actually bring Co2 down to acceptable levels. We have also said we cannot be a puristrnon this one that everything works tomorrow; it will just not happen that. We are having 45,000 people inrnCopenhagen trying to sort something out; it will never work this way. So, I think I’m a more pragmatic and say we may start off with bilateral, multilateral, etc. in order to getrnactually going. And I think we canrnhandle that, but I think in the longer term, if the market really will functionrnand it needs to function, I think you will go towards a more globalized marketrnenvironment. Now, you can ask mernthe same questions, is it one year is it five years or 10 years? Do I care? Most probably I’m in the camp of I don’t care that much atrnthis stage, I want to get started to move.

rnrnSornI think, this – what we have said, I’m not entirely sure that everything worksrnin one year, but we can come back to this a little bit later. So therefore, market-based overall Irnthink you will have different countries doing it and regions doing itrndifferently at the beginning. Irnalso think we need, apart from the U.N. paralysis; we need also the industriesrnto start to work together. Yournneed, actually, the coal industry to come together. How do you measure actually, on a worldwide basis, what isrnbest practice? How do you want torndrive that? And I’ve got head ofrnrefineries here; we need the refinery industry to come up with stuff. We have benchmarks. I think we need to actually – andrnthat’s what I meant, we cannot wait until we have a global framework, we needrnto take the initiatives. Andrnindustries have always do work best if they have, as an industry to have arnchallenge. And we are normallyrnquite good at getting to the lowest cost solution. So I’m still convinced that we’ll go on the race to the top,rnbut I think it will be a kind of volatile bumpy road.

rnrnTom Stewart: And one of thernquestions I have, and this is actually one of the things that happens in therneco-marathon is that there is a certain minimum speed that – if I could go inrnthese wonderful vehicles – If I could go at zero speed, at the slowest possiblernambling rate, my miles per hour could be very good with a lot of technology, sornI think there’s a minimum average speed of I think 15 mph, or something likernthis, so that there is something that puts a little pressure on the studentrnengineers of these cars. But I’drnlike to take the issues here that Peter raised and add something that MarvinrnOdum, who is the President of Shell Oil company said, which is that in his datarnshow that in the energy field where you have these large interconnectedrnsystems, it takes almost a quarter of a century for a new energy technology torndevelop to the point where it can take one percent of the market. And I think that we would all agreernthat that’s too slow. And first ofrnall, you could challenge him on the data, I’m not sure he’s here to engage thernbattle, but first of all I don’t know if the data are right, but let’s assumernthat; how do we speed that up? Howrndo was get that clock speed a lot faster?

rnrnPeter Voser: So, I just want to clarifyrna few things quickly. Mark, Irndidn’t say that policy and politics are not important, in fact, they may be thernmost important thing that enables or disables it and though I believe therntechnologies will be here and proven technologies next year or so, deployingrnthem will take 25 years, broadly. rnSo, there’s a big difference in enabling technology that is proven thatrnyou can get an engineering report that says this works, to deploying itrnbroadly. And there’s a deploymentrncycle. In fact, the deployment cyclernvery much depends on politics and policy. And so we should be clear aboutrnthat.

rnrnThisrnissue of change and how fast it happens I think is a complete red herringrnbecause it’s tied to this issue of economic gravity. If people can make money at it, and I hear these forecasts;rnit takes tens of billions, or hundreds of billions of dollars to change thernrefinery infrastructure and you see these extrapolations. Let me give you a concrete example. In 1996 I had a similar conversation, Irnwas known as a telecom investor with the CEO. Every major telecom company in the United States, and I wasrntold nothing had changed in 50 years. rnAnd nothing had changed. rnAnd I was on the board of one of these and in fact, you couldn’t evenrnintroduce a new piece of equipment into the network without going through thernunions because there were union rules of how many pieces of equipment arntechnician could support. So,rnabout as regulated, and if you think the oil industry sensed it, if you changedrnthe long distance call rate by a penny, the Governor is going to call you,rnright? Every politician gotrninvolved with a 2% change in your phone rates. This was 1996. rnNot only that, I talked to the largest suppliers of equipment, peoplernlike Cisco and Lucent, and they said to me, based on the input that theirrncustomers were giving them, not one of them was ever going to internetrntechnologies for the core of the telecommunications network. Not one was ever going to go. In fact, the Cisco CTO Chief TechnologyrnOfficer told me they never would go above what’s called a technical term, OC12,rna certain data rate. Very low datarnrate, with internet technologies. rnEverything else would match the telecom infrastructure. And it was the worst infrastructurernthan energy because you had to be compatible with the foreign exchangerninstalled in Iowa 50 years ago. rnAnd those were still operational.

rnrnWithinrnthree to five years, Wall Street, because of new economics, was pouringrnhundreds of billions of dollars, no federal money, voluntary commitment to thisrnnew industry, laying fiber, hard construction problem, it’s a horrendous rightsrnof way problem when you’re going across everybody’s property to lay a cable,rnlegal nightmares. Hundreds ofrnbillions invested and five years after that conversation I had, not one carrierrnwould say they weren’t completely switching to internet protocols. That same kind of black swan phenomenarnwill happen in the energy business when the technology is proved economics. And the people who don’t adopt themrnwill go out of business.

rnrnTom Stewart: It’s like armrnwrestling. You know, we can be atrna stasis for a long time and then when you win, suddenly –

rnrnPeter Voser: Suddenly you go the way –rnLet me give you a stunning example. rnAll right. AT&T was arntop ten company in the world in 1996, five to seven years later, they for soldrnfor a song to Cingular. Peoplernforgot the small cellular start up that didn’t exist 10 years before. Bought AT&T and uses thatrnbank. AT&T disappeared. So, radical change can happen, itrnhappens regularly. In fact, Irncould give you 20 examples of such large change. And there’s some great graphs from analysts from MorganrnStanley to your specific question of how fast the rate of change isrnhappening. There’s a chart thatrnshows that 50 years ago, it would take 50 years to get to one percent ofrnsociety to adapting a new technology like radio. And then television, it was 30 years. Today, for a new technology, like Google,rnit’s three to five years to get 50% of the population to adopt it. There’s some stunning data on it. I think we are in this acceleratedrnphase.

rnrnTom Stewart: And you think we’rerngoing to be in that phase with the energy technologies as we were with therncommunications?

rnrnPeter Voser: If it is economicallyrndriven.

rnrnTom Stewart: And that’s where Irnwant to come to Mark for a second. rnBefore that, I actually want to tell the story years ago when I was atrnFortune I did a story about some of the early internet entrepreneurs. And a woman named Stacy Horn, whornstarted an online service back when it was dial up in New York. And she was using up all of the phonernlines to get to run her banks of modems in her third floor Greenwich Villagernapartment. And so what was thenrnBell Atlantic needed to run new lines from the intersection, where the trunkrnline was and that meant, New York being New York that the Bell Atlanticrntechnologists had to go from one basement to another because that’s where thernlines run through a bunch of brownstones. rnAnd they were going crazy because they couldn’t identify the owners ofrnthe buildings because the owners of the buildings were corporations withinrncorporations, within corporations in the Cayman Islands and da, da, da, da,rnda. And so no landlord would comernforth to admit that they could actually let the Verizon guy in until Stacy,rnwith an entrepreneurial spirit said to the Bell Atlantic guy, well in that casernthey’re not going to complain if you come, will they. And the guy shrugged and said, you know, you’re right. And so they just went right through andrnthe heck with the regulations drove the lines, and of course, modems are arnthing of the past, but that’s the kind of change in attitude that canrnhappen.

rnrnButrnMarc, this doesn’t happen without market mechanisms that give that strongrnsignal that drive the investment from Wall Street, or wherever it was, and therncurrent market mechanisms for carbon trading, the Kyoto mechanisms, are goingrnto expire in 2012, which you know, is two years from now. So, what happens? What happens to give the kind of marketrnthat we need to have economic gravity start playing this role?

rnrnMarc Stuart: It’s a really goodrnquestion, Tom. First of all, I’drnjust like to make a little comment on the new technology versus old technologyrnparadigm that we were just discussing. rnMy point would be that, yes, we’ve seen tremendous acceleration inrnintroducing new technologies, but they’ve all generally been into openrnspace. Into things that were notrnalready there, already providing the services. My electricity works perfectly well in my house. My light bulbs work well. My car works well. And displacing an existing servicernmechanism with a new one, I would tend to think needs that policy driver tornmake it a little more cost efficient because there’s inertia in the system, asrnwe heard from Shell. And that isrnmy only point. I agree withrnyou. And one of the problems withrnthe current carbon trading system under Kyoto is that it lasted only fivernyears. We only got five years ofrnvalue out of the CDM and we were only able to start doing things, really inrnabout 2004, 2005 when we realized there was going to be a market.

rnrnIrnwould argue that there was perhaps one technology development that was drivenrnby the CDM, one. Which was thernincineration of HFC’s, which was not necessarily –

rnrnTom Stewart: Hydrocarbon –

rnrnMarc Stuart: HFC of refrigerants. [00:37:59.09]

rnrnTom Stewart: Refrigerants, rightrnright. The ozone, the ozone -

rnrnMarc Stuart: That would be the onlyrntechnology I think was driven by the credit based market based system of thernCDM. If you give me a 20 or 30rnyear value stream for the environmental values that are created by beating arnbenchmark, and Peter was talking about benchmarks before, I am a ferventrnbeliever that we should be benchmarking every technology in the current, whatrnthey call additionally system within the CDM must be tossed away forever. Benchmarks and long-term capability tornearn would make an enormous difference to accelerating in that capital stockrnchangeover. Instead of it takingrn25 years, maybe we can get that down to 15 years, or instead of one area takingrn40 years, taking 20 years. This isrnthe kind of thing – we don’t have that right now. And right now, as I say, we’ve developed a globalrninfrastructure that is in place to seek out emission reductions throughout thernglobal economy. It has been halting;rnit has been imperfect, okay. Butrnit has developed, as I say, an entire culture that is out there looking forrnthese ways for reducing, and as I say you have the thousands of PhD’s doing thernbig science, I have the folks on the ground that are looking for ways ofrnputting things on the ground. AndrnPeter obviously has the same sorts of folks that are looking for things. You need both sides of it. Without having a market that gives yournthat kind of long-term stability, and Kyoto desperately failed in that, you’rernnot going to see the kind of interface between technology development tornexecution platforms throughout the world that is necessary.

rnrnTom Stewart: What are therndifferences between carbon and energy technologies and internet technologies isrnspeed. Right? I mean, you can get three guys inrna garage and give them 50 bucks and -

rnrnVinod Khosla: I’m sorry; I have torndisagree that telecommunications infrastructure –

rnrnTom Stewart: That’s different, Irnagree.

rnrnVinod Khosla: That changed in fivernyears. Do you know the minimum ifrnyou designed a new piece of equipment that was two years of testing in the Bellrncore network, before you can even introduce a piece of gear into the telecommunicationsrnnetwork, it was so mission critical I would submit, more mission critical thanrnmost of energy that the rigor around changing it was stupendous until companiesrnstarted going out of business because they didn’t have economics. And then suddenly all thatrnchanged. So, I just have to sortrnof disagree with that and disagree with sort of this notion that carbon pricingrnis as critical as people make it out to be.

rnrnTom Stewart: Peter, you were sortrnof nodding in agreement with Mark as he was talking. As you think of the importance, I guess of long-term marketrnsignals, to the decision you are making every day at Shell, what do you need inrna pricing mechanism or in a policy mechanism that gives you the ability to makernthose decisions in the right way? Andrnhow do we get there from a – well I’ll follow up with how do we get there fromrnwhere we are now?

rnrnPeter Voser: Look, I don’t think yournwill every get certainty. In anyrnbusiness which invests for 30-40 years, we have got a lot of uncertainty,rnyou’re starting with price uncertainties, technology uncertainties, governmentrnuncertainties because we have been nationalized and denationalized a few timesrnin many places. So, I think whatrnI’m looking for is at a framework going forward and the mechanism in which Irncan build trust over time. Andrnthat, I think a not far away. Therntwo gentlemen are not to far away either. rnI think we are all going off the market mechanisms at the end, you callrnit economical gravity, etc. Whatrnwe are looking for is actually an incentive to invest in order to – well that’srnwhat we are looking for. And Irnthink that will have boundaries in the longer term and these boundaries arernfirmer at a certain stage than they are at some other stages. So, I think we can achieve that and Irnthink we are not that far apart. Irnthink what I still struggle with some of the discussion actually, is I hearrntelecom and I hear other things, but I think the vast amount of investments, wernneed to cover the energy gross across the board mainly in emerging markets willrnnot be delivered by the breakthrough technology in the next five years becausernthey are not scalable in this time. rnSo, I think we need also, an investment environment to actually investrnin those areas, and I’m fully optimistic when I see China and India how they’rernpushing the renewables part, they will make big steps. They will not need 25 years, I dornagree, but the rest of the world may actually need those 25 years. But it’srnalso, how are we going to invest and finance between now and 2030 andrn2040? So, we will have on the onernside a job to do quite clearly, and we will have to keep the gross on therncontrol because energy, and I use this sentence quite a bit; energy powers yourrnlife, and it sustains your life. rnAnd we cannot afford to tell those who don’t have the energy intensityrnas we have it today in the U.S. or in Europe to tell them you have to wait 30rnyears. So, let’s just also bringrnsome realism in here. We need bothrnand we need vast amounts of money.

rnrnTom Stewart: And this sort of cutsrnin two directions. In the next 30rnyears, I think, a third of a billion people in India and a third of a billionrnpeople in China, and if I can do this math, that’s two-thirds of a billionrnpeople will be moving into cities. rnAnd city life tends to be more energy intensive than rural life andrncertain rural village life, which is what many of them are coming from. So they are going to be moving intornurban environments and consuming more energy than they used to. We’ve also done some data, just thernweek that General Motors declared bankruptcy, we published a white paper calledrn“The Best Years of the Automobile Industry are Ahead of it,” because we werernactually taking a global perspective and looking at the fact that as you lookrnat the development of India, China, Turkey, Mexico and a great many, Brazil, arngreat many other countries, a lot of them are passing that moment of GDP perrncapita, when suddenly they buy cars. rnAnd that’s happening in China right now with, you know, 25% growth inrnthe automobile market every year and I think that compounds at a – that meansrnin three years, you double it.

rnrnSo,rnyou have this extraordinary growth in opportunity for people, but also thisrnextraordinary growth in demand for energy. And this is, I think one of the reasons that Copenhagenrnfoundered, this sort of battle between the energy have’s, or the economicrnhave’s and the economic have not’s saying, hey we can’t. How can we get that conversation tornchange from a stand off, which it really is right now, it is sort of two bullsrnin gates like this and nobody’s moving? rnHow can we get that conversation to start moving to find a, hopefully, arnwin-win in there? Vinod, do yournwant to take a stab, I mean I’m up here; I don’t know why I’m up here.

rnrnVinod Khosla: Sure, I’ll pick up fromrnwhere Peter left because Peter made a very important point that I think isrnoften misunderstood. People needrnenergy to power their lives. And Irnlike to say, there are 500 million people on this planet that enjoy an energyrnrich life. We will lead fivernbillion, maybe nine billion people by 2050 to have an energy rich life. We won’t get there to energy savings orrnefficiency. So, the fact is, thernworld will need, two to 10 times more energy here in the foreseeablernfuture. The carbon cap and tradernKyoto protocol was deeply flawed in one very important way. It said, here’s a cap on carbon, and itrndidn’t differentiate between economies like India and China that wanted to growrn10% per year, and economies like Japan were growing less than 1% a year. You can’t have a cap independent of therneconomic growth rate. You can’trnhave a cap independent of whether the per capita income is $1,000 a year, orrn$35,000, what you can have, and I wrote a paper on this, it’s on my website, www.Khoslaventures.comrncalled, The Terms of Discussion Around Carbon Cap are Deeply Flawed. There should be discussions aboutrnthe carbon efficiency of GDP, rates of growth for every economy in thernworld. And that is the only basisrnthat can be morally described as fair. rnGrow at any rate, but subscribe to a global standard of carbonrnefficiency per dollar of GDP. Thatrnis a fundamental flaw in Kyoto and I was very glad to see that the Indian PrimernMinister at this discussion and I tried to influence him quite a bit last year. He took that position at Copenhagen andrnI’m very glad he did because it changed the discussion. It was the only substantial newrnposition that was taken which was carbon efficiency matters and they discussedrnit with their Chinese counterparts and China was in a similar –

rnrnSo,rnhaving said that, I want to also make another point. This is not as pessimistic an environment as peoplernthink. Copenhagen to me succeededrnin a very big way that people don’t realize. There was no treaty, there was no cap, but there isn’t arnCEO, yourself included, who would make an investment today in infrastructurernwithout considering carbon as a risk. rnSo, I was just talking to this young man who runs a $75 billionrninvestment fund. You don’t deployrn$75 billion without deploying it in infrastructure. And he said to me, “I can’t find any infrastructure investmentsrnthat are low carbon risk.” Thinkrnabout it. If you’re trying torninvest, you can protect it against terrorism, you can protect again nuclearrnattacks, you can protect against floods, but you can’t protect against carbonrnrisk. And so they don’t makerninvestments, they’re frozen. Inrnfact, that’s exactly why 150 coal plants, previously approved have beenrncancelled in this country. rnWhy? Because it’s a carbonrnrisk. So, I actually believernthings like Copenhagen and Kyoto have brought that risk to such a big level ofrnvisibility that it is a part of all corporate decision-making and 80 percent ofrnthe benefit of carbon pricing is already done. In fact, I’m certain it actually adds to the risk and hasrnpeople consider carbon.

rnrnTom Stewart: But in order then torntake that risk, or not take that risk, you have to be able roughly to quantifyrnit and that’s where we have a problem, Peter. At this point, the band of variability around that risk isrnsimply, I think it needs to get a little narrower.

rnrnPeterrnVoser:rnYeah, I know. I think we can deal the pricing because that’s the same as oil and gas, you needrnto have your views. Well, what wernneed to know are actually – it’s more the rules. It’s the legislations around it. Now, if that is, as you talked earlier, the country,rnregional, or global based, I think it will evolve.

rnrnTom Stewart: So, the risk is lessrneconomic than it is political, but the game might change in a dramatic way andrn–

rnrnPeter Voser: But for us, we are goodrnat quantifying. I mean, you bringrna very important point, but Shell has now, for more than a decade already, wernhave our carbon price assumption. rnAnd when we look at projects, we look at the carbon intensity, we price,rnwe look – we build that into our economics. So, this is not new for us and that’s why I called myrnCopenhagen, it’s a milestone in a journey but a very important one because wernare talking about it now.

rnrnTom Stewart: Marc, I think thatrnthere is one question about – factual question about Copenhagen that I’d like;rnI mean about Kyoto, that I’d like you to address. As I understand it, and I may be wrong here, so you canrncorrect me here. The Kyoto accordrnactually exempted the emerging markets from caps, but the fundamental idea wasrnthat when we come back to; we’ll bring you back into that same framework, isrnthat the way we square the circle of disagreement?

rnrnMarc Stuart: Exactly.

rnrnVinod Khosla: There are Tier Onerncountries and Tier Two countries.

rnrnMarc Stuart: Exactly. And then nobody in Copenhagen thoughtrnthat China, which had one-third the emissions of the United States in Kyotornwould be more than the U.S. afterwards. rnAnd I completely agree with Vinod. rnI think we need to move to an intensity basis, at that point even to arncapita basis after that, but the idea that benchmarking industries across thatrnis extraordinarily synergistic with that. rnAnd I think that all of these pieces do eventually come together, butrnit’s a very complex negotiating to get to that point.

rnrnTom Stewart: Quickly, what do you meanrnbenchmarking across industries? rnSo, we have a carbon intensity metric that we share across economies, dornwe also do the same thing sectorally, so we have a carbon intensity comparisonrnbetween Shell, BP, Exxon-Mobile, or between Coal, gas – so we have a wholernhorizontal and vertical layers in climate –

rnrnPeter Voser: Let’s take refineries, ifrnyou do refineries on a worldwide basis, you automatically come and you look atrnthe carbons behind, etc. etc. rnThat’s how we can –

rnrnTom Stewart: How much transparencyrnare you prepared to give?

rnrnPeter Voser: That’s why I used thernrefineries because you have actually a system already in place where therntransparency is there. And I thinkrnyou can drive this without having too much of a commercial sensitivity aroundrnit. Some others you can’t, but I’mrnpretty sure you can do a lot. I’mrnnot an expert, but you can do a lot on the upstream side as well when you havernoil production, etc., etc.

rnrnTom Stewart: I think in general,rnbusinesses tend to have a knee-jerk reflexive reaction against transparencyrnthinking that things will be competitive that turn out not to be, or turn outrnto be less competitive than they thought, so we could probably have morerntransparency than a lot of people might instinctively realize.

rnrnI’mrngoing to at this point, invite people in the audience, if you will, to askrnquestions. And we have microphonesrnhere. And if you will please getrnin line behind the microphones and we’ll take our questions. I’m going to ask you to do two things,rnplease. Number one is to identifyrnyour – three things. Number one isrnto identify yourself, number two is if you have to ask a question of a specificrnperson, ask a question of the specific person or the panel generally, andrnthree, I’m going to exercise moderator’s privileges and I’m going to cut offrnall speeches. Short questions,rnshort, to the point, and let’s try to keep the dialogue constructive and goingrnforward because that’s what we’ve been having so far. And please, I also want – the other thing I want to do thatrnwe have, at this moment in line we do not have any women and I want to seernwomen in line. And I want to makernsure that we are getting a diversity of points of view here.

rnrnSo,rnsir, why don’t we start with you.

rnrnLavernernWilliams: Yes. I’m LavernernWilliams, I’m the Founder and CEO of Environment Associates ArchitectsrnConsultants, we’ve been doing green architecture now for 35 years and we arernbased right here in Houston. Myrnquestion is directed mostly to Mr. Khosla, but anybody else who wants to answer;rnI’d like to hear your thoughts too. rnFor the technologies that you are elating to, okay, will there be enoughrnbasic resources available on the planet to eventually, for everyone to benefitrneventually? You know, we’re up tornnine billion people on this planet. rnAlso, what about the costs of implementing these technologies, are thernPrinciples of Cradle-to-Cradle and the Precautionary Principles going to bernemployed in their implementation?

rnrnVinod Khosla: Yes and no. It’s hard to give a blanket answer, sornI will give you an example. Forrnevery kind of coal mine produces roughly 2 ½ tons of carbon dioxide, which thernprocess I was talking about earlier turns into five tons of building materialsrncarbonates; calcium carbonate, magnesium carbonate, things like that. Not only that, to produce that fiverntons of building materials would have taken seven tons of limestone mining forrnaggregate for production, things like that. So, one ton of coal eliminates seven tons of mining. Okay? So, you multiply your resource. You’ve taken your waste, carbon dioxide, and embedded itrninto something that produces five tons of building materials. By the way, the other piece we needrnfrom that to make this happen, to combine with carbon dioxide is all therngeologic brines Peter keeps digging up. rnEvery time you draw a barrel of oil, you’re pulling up five to sevenrnbarrels, 15 barrels in some cases of brines. Those brines have the calcium hardness and some alkalinityrnthat we need to drive our process. rnSo, I can remediate his brines with the power plant’s carbon emissions,rnor the refineries carbon emissions, produce a building material that reducesrnmining by 80 percent or more. Notrnonly that, because I’ve remediated his brines, and I don’t have any of the hardrnstuff in it, no calcium in it, I can desalinate that at a fraction of thernenergy cost it would have taken to desalinate that and fresh water is myrnbyproduct. That’s a creativernsolution of this one example.

rnrnNow,rnI can give you other examples that don’t give the Cradle-to-Cradle, but in factrnthis is actually a stunningly attractive example where all of it works at zerornprice of carbon.

rnrnQuestion: So, byrnCradle-to-Cradle to clarify, that simply means that we are looking at the wholerncycle of that carbon molecule from beginning to end. We’re not sort of throwing some of it out back –

rnrnVinod Khosla: And the base productsrnfrom oil extraction and –

Question: It sounds like a casernof two wrongs making a right actually when you put those two thingsrntogether.

rnrnVinod Khosla: It does. It’s quite true, that’s what peoplerntell me.

rnrnQuestion: Thank you veryrnmuch. Yes.

rnrnRobrnStavins: Good afternoon, I’m Rob Stavins, Professor of Business and Governmentrnat Harvard University. Thank yournfor a wonderful discussion. Irnagree with much of what’s said, although a few of the things that were said, Irnfound to be, I want to say this nicely, inconsistent with the facts, as I knowrnof them. Having said that. And I believe something upon which yournagree is that eventually anything that will happen with climate change willrnhappen through markets. And Irnthink there was also some agreement, not complete agreement, I guess, that thatrnwill require price signals being implemented essentially, additional pricernsignals, through governments. AndrnI think you would also agree that individual governments really won’t findrninteraction in their interests and take action on climate change because it isrna problem, the benefits to an individual jurisdiction are inevitably going tornbe less than the cost and therefore international cooperation is required. So, I have two questions. On that as the premise, since you seemrnto agree that the United Nations process is probably not the key process goingrnforward, Question number one: rnwould you agree that the more promising process going forward would berneither the G20, the Finance Ministers of the world, often of course, the headsrnof state participate in those meetings, after all the G20 representsrnapproximately 86 percent of global emissions; or for that matter, the majorrneconomies forum which is almost the same set of countries which accounts forrnabout 90 percent of the emissions? rnThe first question.

rnrnThernsecond question related to that is; would you agree with me the two keyrncountries in the world this year who are exceptionally important for progressrnin terms of international cooperation, and I’m not referring to China and thernUnited States, the two major emitters, are rather Korea and Mexico? And the reason I say that is, Korearnthis year has the Presidency and is hosting in November, as you know, in Seoul,rnthe G20, and they set the agenda, and of course, Mexico is going to be hostingrnin Cancun in December, team of the U.N. framer on convention on climaternchange. So those are my twornquestions, if you’re forgive me, I’m going to sit down, I have a very bad backrnand I’ve been standing too long right now.

rnrnTom Stewart: Those are two veryrninteresting – Marc, you want to, we’ll take these apart and we’ll spend arnlittle time with them, Marc.

rnrnMarc Stuart: Yeah, first of all, Irnwould very much agree with the assessment that the G20 or the MEF’s process isrnvery likely to be a major pusher in this whole process. Completely agree with that. As I say, you can get five signaturesrnand get about 60 percent of the world’s emissions, get another 10 to 12 andrnyou’re up to 85 percent range. rnAbsolutely. It’s far morernefficient and those countries have far more intertwinings of their economiesrnalready.

rnrnInrnregards to Korea and Mexico; yes, Mexico absolutely. Mexico has a huge responsibility, we’ll here a little bitrnmore about that later, to basically pick up the ball and sort of show that werncan as a community of nations take this forward. Korea, 100 percent agree. I’m really glad that you said that. I’ve been spending a lot of time inrnKorea the last couple of years. rnThey have been very deeply engaged in trying to figure out how they arerngoing to be engaged in the carbon world. rnTheir emissions profile versus the 1990 cap would be insane for them torntake on just as it would be for China or India or anybody like that. And they’re very, very – trying to comernup with some innovative solutions on how they can engage and part of this asrnclearly an industrial country right now, but without the modalities of the oldrnKyoto system. And obviously beingrnhead of the OACD is a big part of that, but I think it goes well beyond thatrnand it’s been really active for the last two years. I think what comes out of there is what’s going to be arnvery, very important precedent.

rnrnTom Stewart: So, what we’re sayingrnis in effect, if I may paraphrase Rob’s statements is of the second questionrnhere that agenda management and agenda setting is an absolutely key element ofrnthis process and perhaps often overlooked. That it’s the people who set the agenda and set the tablernwho can drive a lot of progress just by that. Peter, do you want to comment on that? And then we’ll turn to you Vinod.

rnrnPeter Voser: Yeah, just a sortrncomment. I fully agree with that,rnbut I think we also have to be careful that we are not going at only thernG20. I think it should not be arnmagic number. I think it will bernmore than the G20. I think it willrnbe a larger group over time. Irnthink we have done all the damage with G2, in my opinion, so G7, G8, G6, or G5rnwhatever we had and now we have G20. rnbut I think we should focus on the right countries, whatever they arerncalled, but I think we should not limit it because I think today’s countriesrnwhich are important may not be entirely those who are important in 20 or 30rnyears time because the growth of energy will not be the same across thernworld. So, that’s a more generalrnpoint.

rnrnTom Stewart: And also, if I mayrnsay, if we think about biofuels, the coming online of biofuels may show up inrnunusual places because there maybe this perfect biofuel somewhere that yournhaven’t imagined that could suddenly make somebody a major player in biofuelsrnand who is just off the radar screen. rnYes ma’am.

rnrnTerrirnHinton: Thank you, my name is Terri Hinton and I actually represent Big Thinkrnand some of the other more cutting edge media companies, you know, carrying onrnthis conversation, trying to elevate culture through that process. And my question is, let’s kind of steprnback and pardon me if it’s a little over simplistic, but the sense that I havernin terms of what it takes for true leadership to actually emerge is a level ofrnabsolutely responsibility. And I’mrnwondering if, in any of your minds, if there is a sense of a leader orrnleadership, whether it’s an organization, a company, an individual, or arncombination of individuals that, you know, has anybody grappled or understoodrnthat and wants to take absolute responsibility for this change that we’rerntalking about. And has thatrnleader, is that leader insight, has it emerged as either an organization or –

rnrnTom Stewart: Sort of the Arch BishoprnTutu of climate change, if you will. rn

rnrnTerrirnHinton: That’s right, that’s right. rnYou know in an absolutely kind of – the best leaders emerge through thatrnkind of absolute responsibility, so I’m just wondering if there’s any commentsrnon that?

rnrnTom Stewart: Any thoughts onrnthat?

rnrnVinod Khosla: Well, I’ll give it arntry. I think I have to disappointrnyou on this one. I don’t think yournwill have one leader. I think thisrnhas to be shared because sovereignty will play a big role here and interferencernin sovereignty will play a big role, so I think, what I tried to say before, Irnthink you will need a group of countries, 20 or 25 counties, 15 maybe, whornreally drives this. And thus allowrnactually a real discussion to actually happen, but as soon as you get intornthemes like monitoring of achieving targets, setting targets, etc. you arerngoing to get really into the country by country issues and I cannot see thatrnsomeone can actually lead that discussion through. Leadership is possible to bring a group of 15-20 togetherrnand drive that, but I think I wouldn’t see any country, and that’s why Irnmention the G2 in my opinion doesn’t actually help in this whole discussionrntaking the absolute lead in this one. rnSo, I would rather –

rnrnTom Stewart: Let me ask you thisrnbecause in the information technology industry that you know so well and helpedrnto shape, there were rock stars, you know Bill Gates and Steve Jobs and Irnactually remember when I was at Fortune Magazine we had a cover once that hadrnScott McNeely in a Superman costume, right in a super hero costume. So, there were super hero rock stars inrnIT. Will there be super hero rockrnstars in clean tech?

rnrnPeter Voser: I think in a certainrnway. Let me be clear. Many of you, I probably sound like arnnut ball with all my forecasts. IfrnI sat here two years ago and said to you that Citibank could go under, orrnGoldman Sachs could be in danger, you would have said I’m a nut ball. What happened? It was getting just a little bitrntechnical; it was the tail of the probability distribution of what Nassim Talebrncalls it, Black Swan phenomena. Irnbring that up for the following reason, I have pieces on energy transformationrnthat is almost entirely based on black swan’s affinity and I’ve given a numberrnof talks that I call “The Black Swan Affinity.” The answer is, there will be heroes, but if you look atrnNassim Taleb’s explanation of a black swan, it’s highly improbable, largernimpact, and retrospective but not prospective predictability, okay? So, you can’t sit here and say, he’srngoing to be the black swan of the Bill Gates of energy. You can’t. But 10 years from now, you will be talking in those termsrnalmost all large transformation happens through the tail of probablyrndistribution, if I can get rigorous statically, it never happens out ofrnextrapolations of the past which is almost all Professor Stavens, almost everyrnother forecast is based on taking the past and looking at incrementalrnimprovements and disruptive change – he is disagreeing with me. A lot of expertrnforecasts are based on past incremental changes – but the model of change willrnbe different.

rnrnTom Stewart: Let me keep thernconversation going, but I do want to point out that we can’t predict there isrngoing to be a Bill Gates or a Steve Jobs of energy technology, of cleanrntechnology. We’ll know his name,rnor her name, in 10 years, and we can’t predict it now, but in 10 years we willrnall say that we knew him then. rnRight?

rnrnMarc Stuart: I think you’re looking atrnhim.

rnrnVinod Khosla: Can I make anotherrnpoint?

rnrnTom Stewart: Yeah. I want to – we have just a few morernminutes and I want to make sure – are there any other questions here. We have one more minute. All right, so, a quick point, and thenrnsir if you have a quick question, we’re going.

rnrnVinod Khosla: You see thousands ofrnexamples of things you should do to be greener. Ninety-nine percent of them are complete nonsense and irrelevant. There’s only two or three things thatrnmatter, and 80 percent of the carbon impact will be because of less than fiverntechnologies 10 years from now.

rnrnTom Stewart: Right. And that will be –

rnrnPeter Voser: I think you will haverntechnology heroes because they have the right technology and they are thernfathers of those, or the mothers. rnBut I think in energy and as I said beforehand, it just drives our livesrnso much, you will not get away from very clear sovereign issues and you can’trnhave those – absolutely great heroes, but it will always be driven –

rnrnTom Stewart: The great heroes in anrnenvironment a lot of negotiation and some are very technical questions. One – a chance for one quick questionrnand then a quick response and then we’re going to have to move on. Yes sir.

rnrnTomrnValone: My name, Tom Valone, Integrity Research Institute, Washington D.C. I wanted to address the Climatologist’srnposition here which may or may not have been represented successfully in the panel,rnand specifically Jim Hanson, who is a colleague of mine, has a voice and shouldrnbe heard, specifically about his demand for 80 percent reduction by 2030 inrncarbon emissions. This seems likernan impossible task, but the fact is, he’s tackling the coal industry which isrnonly 20% of our energy consumption. rnForty percent is petroleum. rnMy question to Shell is; can Shell make such a commitment of 80 percentrnreduction by 2030? There arerntechnologies across the street, bio-gasoline and so forth, but the otherrnincentive, market incentive I believe, from our institute’s futurernperspectives, and we’ve had three conferences on future energy, by the way, isrnthat there are technologies that now allow and will allow in just the nextrncouple of years people to drive cars without gasoline. Not only electric rechargers, butrntotally new types of technologies. rnWill the Shell of the future be able to adapt when their product becomernobsolete?

rnrnTom Stewart: That’s a greatrnquestion, can the fossil fuel company become the renewable company, and in thisrnenvironment, where as many people say, we have to actually think of an absoluternserious reduction of carbon overall. rnI’ll leave this with you Peter, and then I’m going to wrap it up. Thank you.

rnrnPeterrnVoser: Irnthink, as any energy company in the world we’ll have to deliver the energies ofrnthe future and this will be a mixture of fossil driven energy, it will bernrenewable energy driven, and whatever you can come up with, but these are mostrnprobably the two. I think by,rnthat’s our calculations by the mid of this century, you will still bernpredominately fossil resource driven – hold on, hold on. These are our calculations. What is our objective is very clear, tornprovide the world with energy, but we also are absolutely clear that we have tornmeet the increased demands with a much lower cost to the environment and thatrndrives our innovation, it drives our technology, and it drives our targetrnsetting for the longer term. So,rnwe are not committing to 80 percent, 50 percent or whatever, these are for thernstates to governments to do so and we will do our piece actually to drive it.

rnrnTom Stewart: This is a great, thisrnis actually a great way to end it, and a great point because I think what we’vernheard and continue to hear and its part of what has made these negotiations andrnthese development so complicated, and so difficult over the years is how manyrnforces are engaged. We have thernforce of the development of emerging markets and development of demand and of arnhigher quality of life for people who have had a very low quality of life andrnthat’s – there’s no way to resist that. rnWe have the question of how much Earth can take and is there a cap? Is there some number where we have tornsay, sorry it’s not BTU’s per unit of GDP, there’s got to be some absoluternnumber, we’ve just got to suck it up and bite that bullet. We have the emergence of newrntechnologies, some of which may be so revolutionary that, as you said, they arernunpredictable now – we have to watch our time. I have to do this. rnI’m sorry – I hate to cut anybody off because it’s been too good arndiscussion. But we have thernemergence of new technologies that could complete change the paradigmrnhere. And we have the complicatingrnquestions of continuing to live in the house we have while we are building a newrnhouse, and this very complicated policy environment in which we want to creaternthe circumstances across complex jurisdictions so that what you rightly calledrnthe economic gravity can start having it’s full and eventually internet armrnwrestling metaphor is eventually very dramatic, affect it’s tipping pointrneffect, which may eventually get to that resolution of that need to reduce –rnthat opportunity to reduce Co2 by 80%.

rnrnIrnwould like to ask everybody – the panel discussion now has ended, but we’re notrnquite done yet. But I would likerneverybody here to and on the web, to join me in thanking Marc Stuart, Vinod Khosla, and Peter Voser for whatrnI think was a really terrific discussion.

Recorded on March 26, 2010

rnrnrnrnrn