We Need Another Teddy Roosevelt

Sign up for the Smarter Faster newsletter

A weekly newsletter featuring the biggest ideas from the smartest people

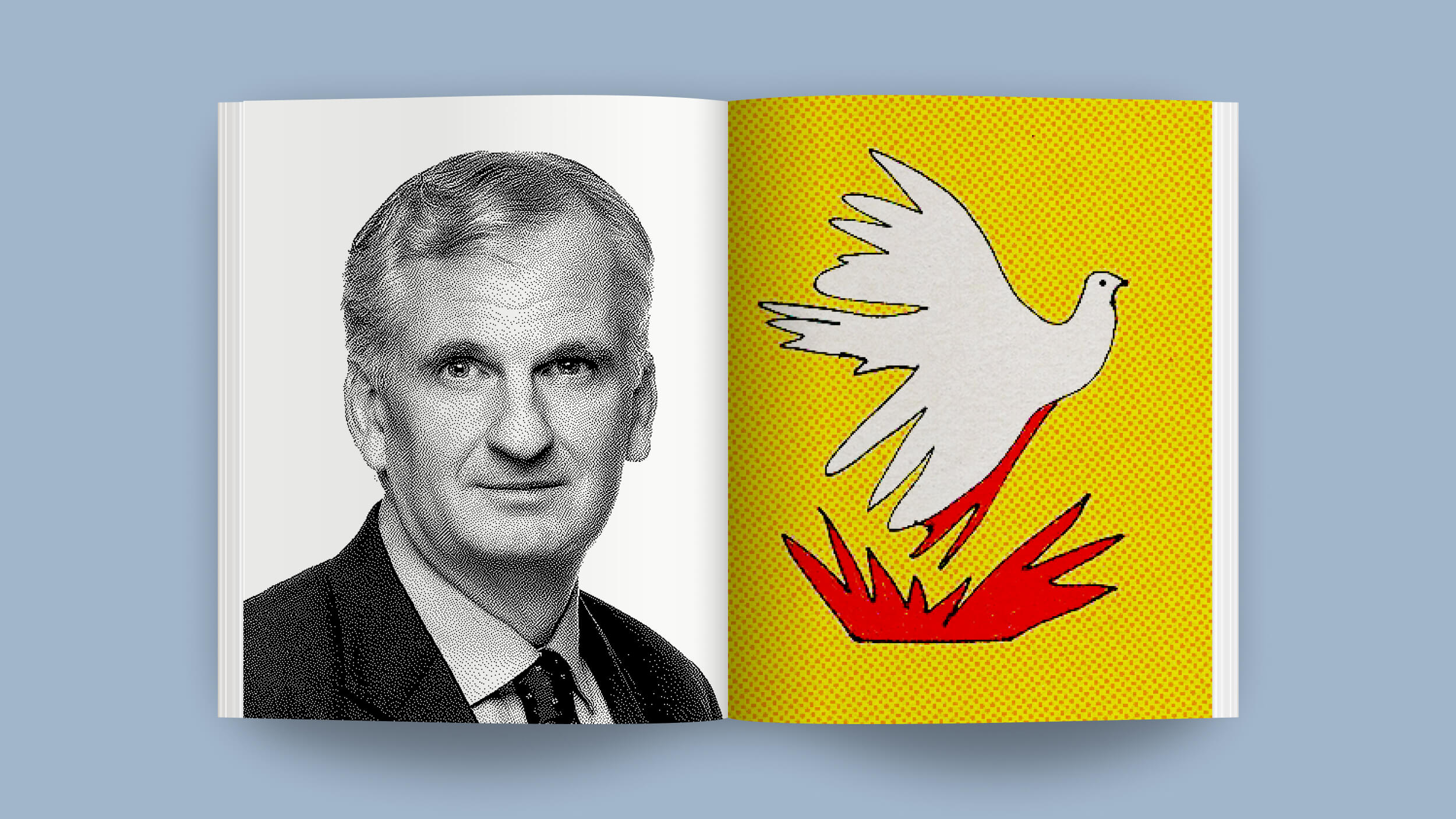

“There’s this core of people who have become very, very powerful who can do enormous damage to the rest of society and honestly, they really don’t care,” says Simon Johnson, the former chief economist of the International Monetary Fund, in his recent Big Think interview. “Many of them just disappear with their hundreds of millions of dollars and they leave it to the rest of us to clean it up. That’s not acceptable. … That’s not how we should organize our society going forward.”

Johnson’s new book “13 Bankers,” which he co-wrote with James Kwak, profiles the U.S. financial sector and its role in the recent economic downfall. To Johnson, it’s preposterous that the government offered the banks massive bailouts last year without any conditions whatsoever. “For a government to save the day so decisively without conditions, without changing anything about the problems and the structures that have created the crisis. … It didn’t make sense then, it doesn’t make sense now, and has created many problems that we have to deal with going forward,” he says. To make reform stick, he thinks we need a new Teddy Roosevelt—someone who can take the message, build an alliance, seize the moment and put us all on a path to a better century.

Johnson also thinks there is no merit to banks being as big as they are. “We’re looking at banks that are $2 trillion, $2.5 trillion, which is the case of Citigroup before the crisis. Of course, there’s bigger bonuses for the guys who work there and the guys who run it, but all of society is getting is this big, downside risk, these massive crises. Push them back to a couple hundred billion dollars.”

Johnson also thinks there is no merit to banks being as big as they are. “We’re looking at banks that are $2 trillion, $2.5 trillion, which is the case of Citigroup before the crisis. Of course, there’s bigger bonuses for the guys who work there and the guys who run it, but all of society is getting is this big, downside risk, these massive crises. Push them back to a couple hundred billion dollars.”

The next crisis, says Johnson, will likely be related to emerging markets: “People are convinced that China, for example, can only go up. Any investment there will make easy money, they tell you,” says Johnson. He thinks the coming crisis, whenever it comes, will be based on unsustainable build up of debt in those places.

Sign up for the Smarter Faster newsletter

A weekly newsletter featuring the biggest ideas from the smartest people