How America Learned to Love the Dollar Store

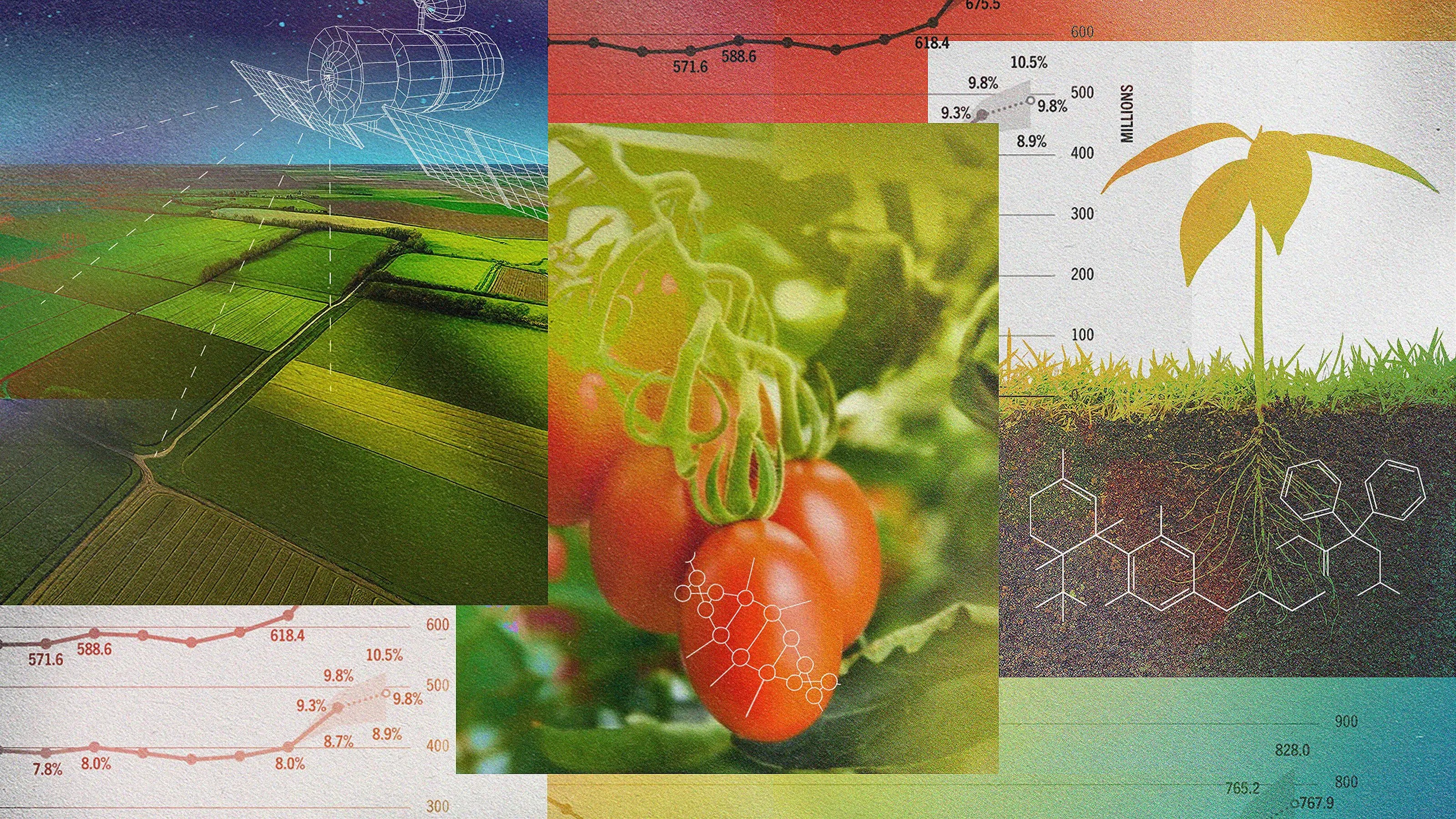

Market-research leader Neilsen studied the opening and closing of retail stores nationwide between 2001 and 2008 and published the winners and losers. The most affordable consumer alternatives saw growth with the super-cheap leading the way.

Dollar stores—they used to be known for racks of worthless trinkets spread out among some semi-useful bathroom and kitchen supplies, but today these thrifty behemoths have managed to expand their inventory and clientele enough to become one of America’s strongest industries. So much for the era of luxury.

Neilsen’s survey found plenty of losers, the biggest among them being toy stores whose outlets shrank almost 60% between 2001 and 2008. Those troubling figures could be attributable, in part, to a growing toy selection at dollar stores, a growth industry that has become a runaway winner with a 34% increase in retail locations since 2001.

Dollar Tree in particular, the country’s biggest discount variety store chain, saw a third-quarter 2008 marked by a sales increase of 11.6% and the opening of 68 new stores against 13 closures and 36 expansions and/or relocations. Family Dollar, another prominent dollar chain, just announced 9% growth in net sales in their most recent fiscal quarter. The franchise has even become one of the hottest commodities on the stock market, its shares doubling in value since January 2008.

While the dollar business model has historically revolved around putting a bunch of cheap merchandise in a store, outlets have now started targeting specific demographics. Most notable has been the work of Five Below (ie: everything under $5), which has made a spirited attempt to target the teen market with affordable t-shirts, posters, and cosmetics. They’ve even spearheaded a grass-roots viral marketing campaign on Youtube.

But the biggest part of that changing business model has been aggressive expansion. With almost the entirety of their inventory priced below $10, dollar stores are now offering everything from clothes to toys to a surprising variety of groceries. While the stigma surrounding the dollar rack has slowly subsided, consumers have started finding their way to the local buck stop. A recent survey from consulting firm WSL Strategic Retail found that 60% of Americans had visited a dollar store in the previous three months. But maybe most surprising was WSL’s findings that 49% of consumers earning $100,000 or more a year have also visited a dollar store in the past three months.

An offshoot of Americans’ appreciation for the dollar has been the rise of the supercenter. With Nielsen showing more than 100% growth among supercenter outlets, these do-it-all mammoth stores have been seeing unparalleled expansion. Of course, the industry king spearheading the rise of the supercenter has been Wal Mart, a company that has seen openings every month. With other companies like Target, Fred Meyer, Meijer, and Kmart/Sears furthering the supercenter movement, the industry is projected to bring in sales of $359.5 billion by 2011 according to industry b-to-b publisher HHC Publishing. But consumers will probably still be finding their way to the local dollar rack as well.