Do Speculators Wreck Commodity Markets?

What’s the Latest Development?

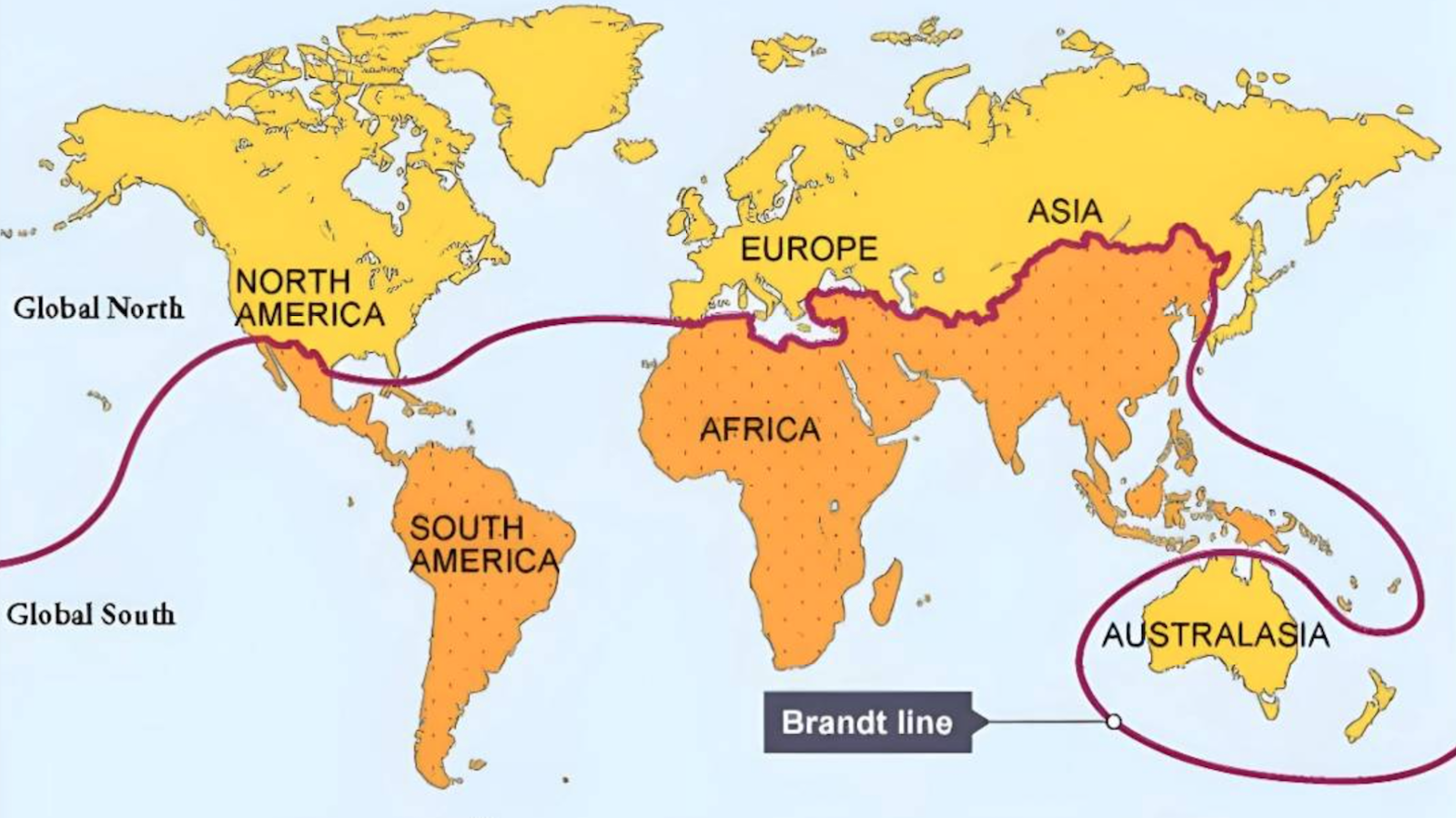

The multinational trading firm Glencore, the world’s largest diversified commodities trader, is soon set to make a stock sale worth $11 billion on the London Stock Exchange. Glencore, which according to Al Jazeera controls half of the global copper market and nearly ten percent of the world’s wheat, is one of the few companies that can actually set the price of commodities rather than accepting the market’s determination. As a result, the firm’s business strategies—making agressive business deals in countries facing political and social turmoil—have become commonplace.

What’s the Big Idea?

It is ironic that food producers in developing countries are being pushed to a point where they can no longer afford to put food on their families’ tables. The U.N. recently reported that food prices are at their highest level since the organization began recording them twenty years ago. Marcus Miller, a professor of international economics at the University of Warwick, blames food price speculation: “A disturbing amount of price increases, I fear, is being driven by speculative activity. Bets [on future price rises or declines] can become self-fulfilling if you are big enough to affect the market.”