Bad Loans

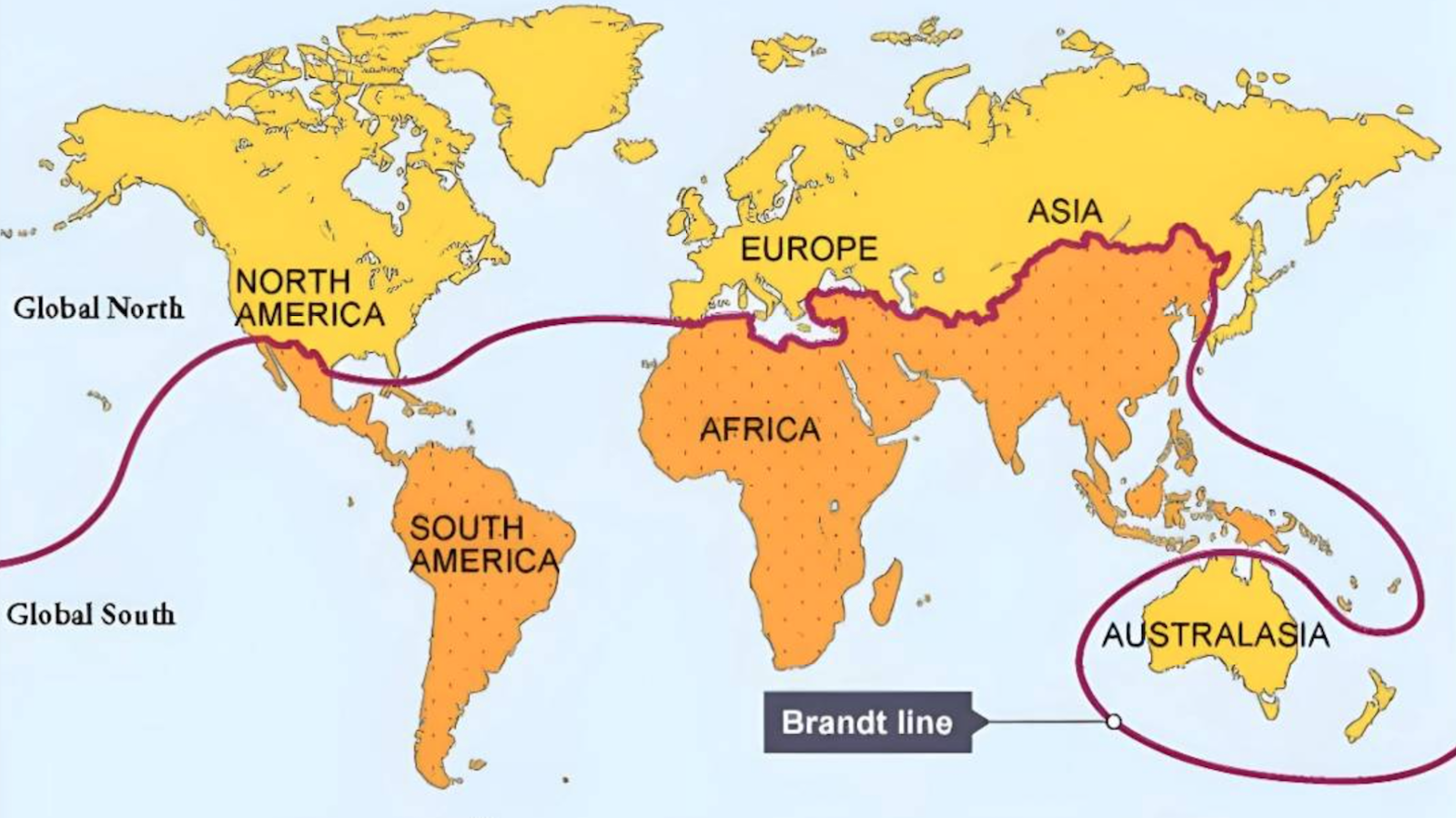

While Greece confronts budget woes, Austria is shoring up its banking sector against questionable loans given to former Soviet countries in Eastern Europe. “Austrian banks have outstanding loans in Central and Eastern Europe totaling some $273 billion, an amount equal to 70 percent of their country’s gross domestic product. With the world financial crisis hitting that region particularly hard, there have been fears that a tidal wave of bad loans could overwhelm Austria’s banks, possibly pulling the country itself into bankruptcy. The government here has already spent $137 billion to shore up its banks, guaranteeing loans and refilling their depleted coffers. In December, it nationalized Hypo Group Alpe Adria, a Klagenfurt-based regional bank overwhelmed by bad loans to clients in the Balkans, for fear a collapse would endanger the rest of the sector. In the event of a regional meltdown, it is unclear if Austria has the resources to save its highly exposed banks. ‘We don’t yet know exactly how the East European countries will overcome the crisis, because they got hit very strongly,’ says Franz Hahn, a financial macroeconomist at the Austrian Institute of Economic Research. ‘Everything is happening in the dark, so we can only hope that there isn’t a monster hiding there.'”