uber

Your next payday could be all digital.

On Friday, Uber will start publicly trading on the New York Stock Exchange, and drivers want to see some of that money.

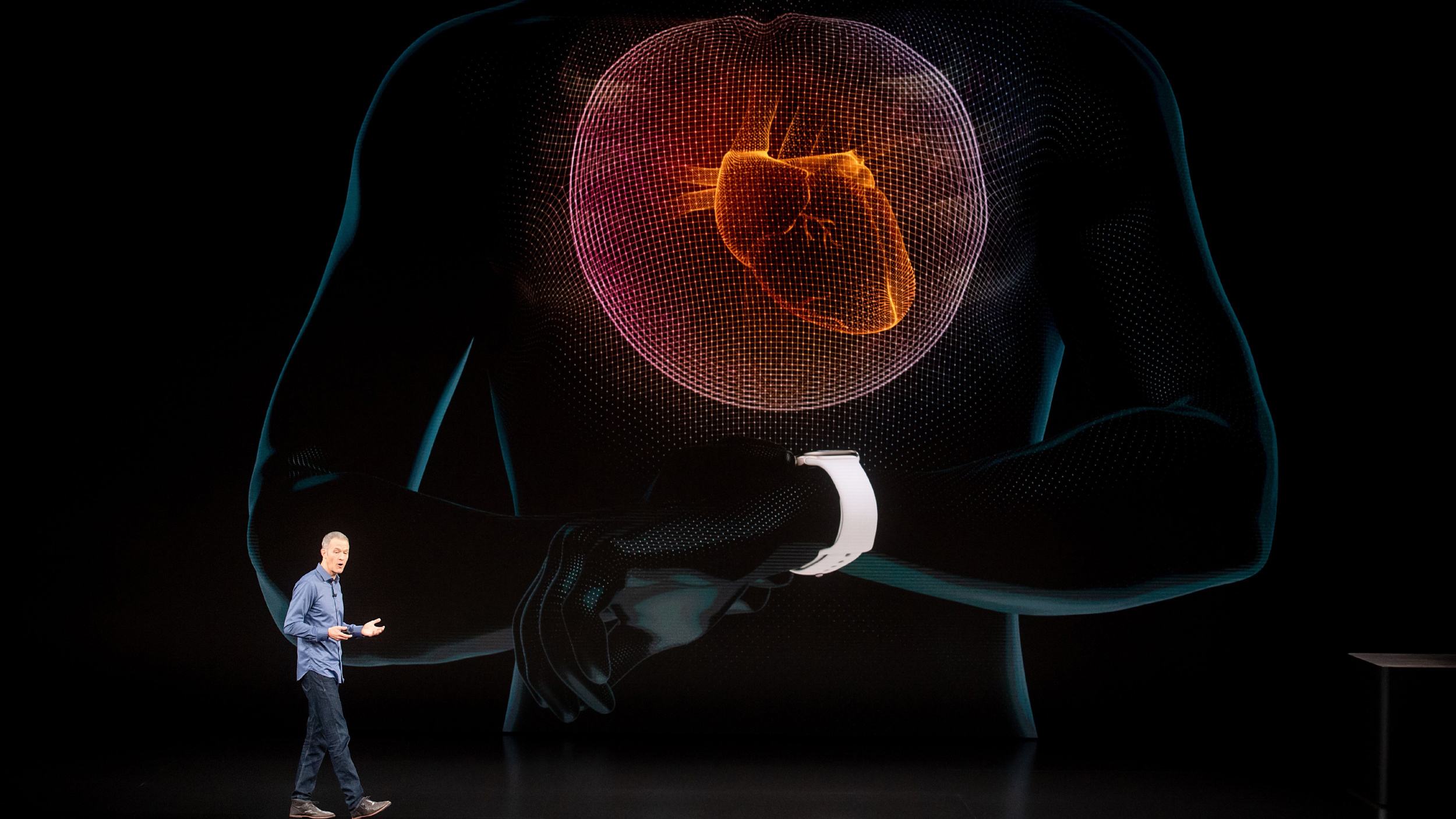

Big tech is making its opening moves into the health care scene, but its focus on tech-savvy millennials may miss the mark.

This economy has us in survival mode, stressing out our bodies and minds.

▸

5 min

—

with

The report outlines some bleak numbers for drivers who work for ride-hailing apps like Lyft and Uber, though those companies don’t quite agree with the researchers’ methodology.

How did Lego survive a near-total financial ruin? Why is Lyft way more popular that Uber amongst drivers? And how did Marvel gain a second wind some 60 years after it was founded?

▸

9 min

—

with

The most make-or-break aspect of job automation? How policy makers handle your transition into a new career.

▸

9 min

—

with

If you want to get from A to B more safely, be a little more choosy at the cab rank.

Here’s something to think about the next time you see a filthy Abe Lincoln on the sidewalk.

A recent study has found “significant evidence of racial discrimination” in ride-hailing services Uber and Lyft. If you’re black, you may be more likely to find your ride canceled or be subjected to longer wait times.

Driverless cars are nothing short of a revolution – not a technological revolution, but a social one, that will determine how fast we can accept, adapt and trust these new systems to change our lives.

Driverless cars may be borne out of science fiction, but they are fast becoming realities on tomorrow’s roadways. The transition from driver to robot is nothing short of a revolution. Not a technological revolution, but a social one, that will determine how fast we can accept, adapt and trust these new systems to change how and where we live, work, play and interact with each other.