Timothy Geithner on Confidence and Capital

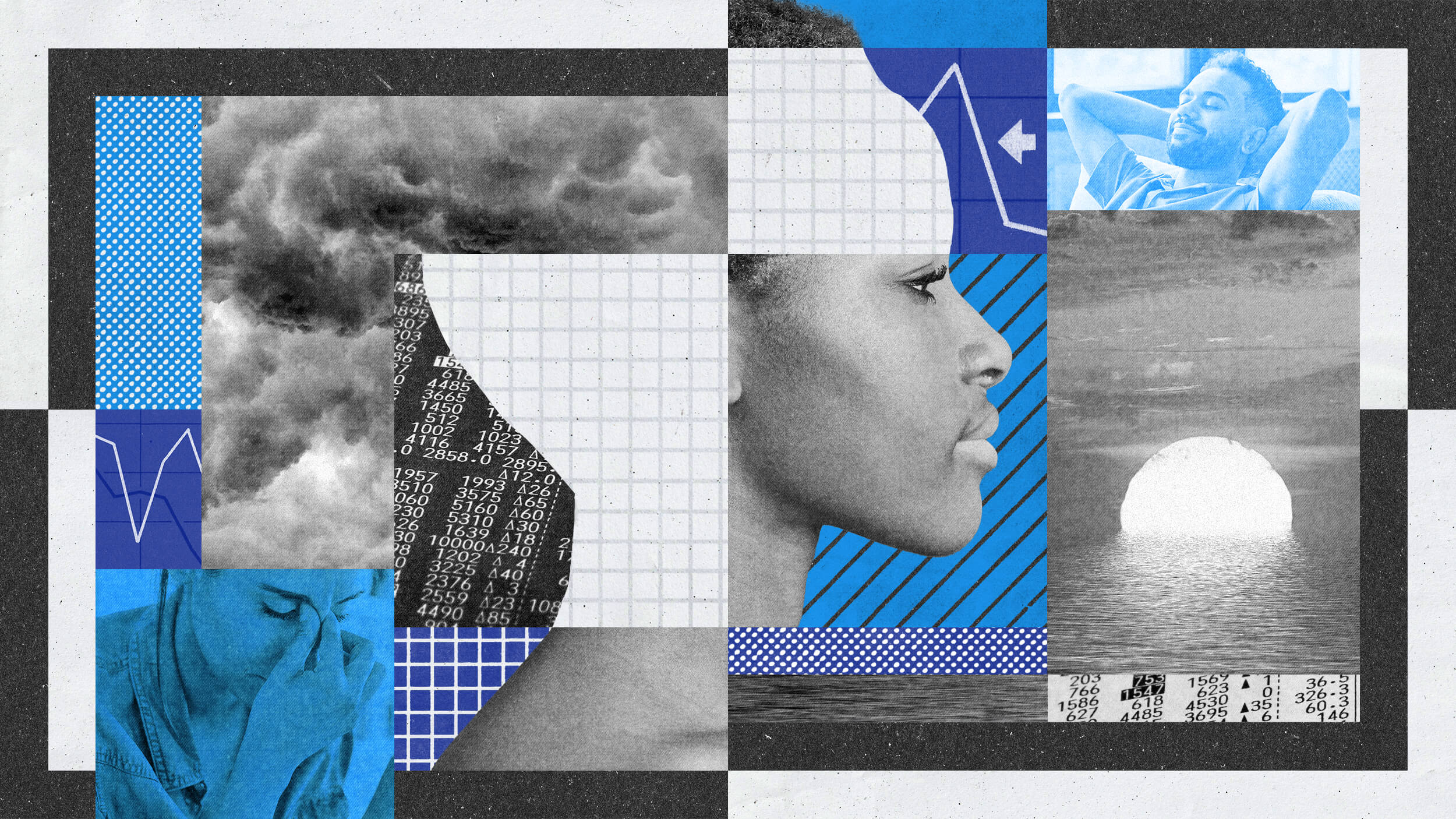

How do you avoid a panic? Timothy Geithner knows quite well. In his memoir, Stress Test: Reflections on Financial Crisis, he gives you a fly-on-the-wall look at how our global economy avoided stampeding off a cliff. The Great Recession could have become the Great Depression 2.0.

Geithner stopped by Big Think to share his stories and insights into how he and other unlucky financial experts were tasked with one of the most difficult assignments in history.

“To break that incentive to run, what you have to do is make sure you push a lot of capital into the system, which we did very effectively. But also that you provide a set of broader guarantees and protections,” explains Geithner. “You need this mix of loss absorbing resources like that money in the window and you need a fire station that can come in and give people the complete protection against or break the incentive to run.”

It was that mix of the “fire station” and the capital that ultimately stopped the economic stampede.

Geithner warns that one distressed institution does not signal a system failure and cautions governments against reacting too quickly to potential early signs of a panic. He explains: “If you decide at the first sign of stress you act – you intervene aggressively to protect people from risk – that’ll be a different kind of mistake. Because in that context you leave too much of the weak parts of the system alive and you’ll end up making a future crisis more likely.”

For more on Geithner’s insights, watch the clips from Big Think’s interview: