How Multinational Corporations Dodge Taxes

For all the talk about how taxes are too high in the United States, American businesses are paying less now than they used to. In fact, many major corporations don’t pay the U.S. government any taxes at all.

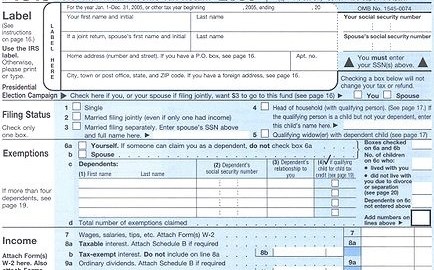

The marginal tax rate for businesses is 35%. But the effective tax rate for large companies is much less in practice. Forbes magazine reports that General Electric, for example, won’t owe any U.S. taxes for 2009, but will instead receive more than $1 billion dollars of tax benefits. That’s in spite of the fact that GE generated more than $10 billion in income last year. GE usually doesn’t pay much—in 2008 it paid just 5.3% of its income in taxes. ExxonMobil paid almost 50% of its $35 billion income in taxes. But according to its own Securities and Exchange Commission (SEC) filing it doesn’t owe any taxes in the United States, even though it’s an American corporation and has its headquarters in Texas. Exxon says in spite of what it reported that when its taxes are finally figured it will owe a “substantial” amount—it won’t say how much. But even if it does owe nothing at all it wouldn’t be that out of line with other similar companies. Chevron, which is based in California, likewise paid almost all of its taxes to foreign governments. And in 2008 a Government Accountability Office (GAO) study found that between 1998 and 2005 two-thirds of companies operating in the U.S—including a quarter of the largest companies—didn’t pay the U.S. government any net taxes at all.

How do they do it? As Forbes points out, General Electric’s tax return would run to 24,000 pages if printed out, so it’s complicated. Just its SEC filing runs to 700 pages. But the basic reason GE has been able to keep its tax bill so low is that it structures its business so that it takes a loss in the U.S. and earns its profits elsewhere. By moving ownership of profitable assets to overseas subsidiaries while incurring expenses in the U.S. companies can avoid being taxed here where tax rates are relatively high. In some cases, corporations simply set up P.O. boxes overseas. According to another GAO study, some 18,000 American companies maintained P.O. boxes in a single building in the Grand Caymans. It makes sense, after all, as Scott Hodge of The Tax Foundation told Forbes, for multinational corporations to “put costs in high-tax countries and profits in low-tax countries.”

The Obama administration is trying to find a way to get a larger share of the taxes corporations pay, since these so-called “transfer pricing arrangements” cost the U.S. government billions of dollars in tax revenue every year. President Obama has proposed getting rid of tax deferrals on income earned overseas, so that if companies pay lower tax rates in other countries we could require them to pay the difference. Companies like Exxon complain—in spite of not paying any—that taxes are too high in the U.S. already. Higher tax rates, they say, would stifle innovation, raise the price of their products, and make it difficult to compete with foreign companies. While there is something to what they say, the fact is that a lot of the money multinational corporations make doesn’t get returned to consumers or plowed back into research and design. Exxon, for example, managed to pocket record profits last year—along with sizable subsidies from the U.S. government—some $27 million of which it spent lobbying the U.S. government for subsidies and tax breaks. And if American companies are taxed at a higher rate than companies headquartered elsewhere that’s because being based in the U.S. brings sizable benefits. It’s only reasonable to ask companies to pay something for those benefits.