Bye, paper currencies: How blockchain and fintech will soon transform money

- In his new book, The Future of Money: How the Digital Revolution Is Transforming Currencies and Finance, economist Eswar Prasad explores how digital technologies are transforming finance and money itself.

- This excerpt explores how paper currencies likely will soon be replaced by digital currencies created through blockchain technology.

- Prasad argues that the digital revolution in finance seems to have been heralded by Bitcoin, an asset whose most durable quality is likely to be its underlying technology rather than the cryptocurrency itself, Prasad argues.

Excerpted from THE FUTURE OF MONEY: HOW THE DIGITAL REVOLUTION IS TRANSFORMING CURRENCIES AND FINANCE by Eswar S. Prasad, published by The Belknap Press of Harvard University Press. Copyright © 2021 by the President and Fellows of Harvard College. Used by permission. All rights reserved.

Racing to the Future

A book is written when there is something specific that has to be discovered. The writer doesn’t know what it is, nor where it is, but knows it has to be found. The hunt then begins. The writing begins. — Roberto Calasso, The Celestial Hunter

In May 2018, Cecilia Skingsley, the deputy governor of Sweden’s central bank, foretold the end of money as we know it. Speaking about the declining use of physical cash in Sweden, she observed that “if you extrapolate current trends, the last note will have been handed back to the Riksbank by 2030.” In other words, the use of paper currency to carry out commercial transactions in Sweden would cease at that point.

Established in 1668, the Sveriges Riksbank was the world’s first central bank and among the first to issue currency banknotes. So perhaps we find cosmic symmetry at play in the prospect that Sweden is likely to become one of the first economies to experience the demise of cash.

China is another country where the use of cash is quickly becoming a thing of the past. In my frequent travels there in pre-COVID times, my habit of carrying actual yuan banknotes in my wallet felt increasingly anachronistic. My Chinese friends would look on with befuddlement as I pulled out my currency notes rather than my phone to pay for a meal or coffee. They could easily beat me to the punch by whipping out their phones and paying before I could even begin counting out yuan notes.

In yet another example of symmetry, China happens to be the country where the first paper currency appeared many centuries ago. In the seventh century, the use of metal coins was proving to be a major constraint on commerce, especially for trade between far-flung cities. The first rudimentary paper currency that appeared around this time took the form of certificates of deposit issued by reputable merchants and backed up by stores of metals or commodities. The merchants’ good reputation bolstered the use of these certificates for commercial transactions, saving traders from the drudgery of having to cart around metal coins.

China also has the distinction of being the country with the first paper currency not backed by stores of precious metals or commodities. This currency was issued not by a central bank but by the government of Kublai Khan, the grandson of Genghis Khan and leader of the Yuan dynasty, in the thirteenth century. The Grand Khan, as he was known, decreed that the paper currency issued by his court was legal tender. It had to be accepted as payment for debts by everyone within his domain—on pain of death (a part of the legacy we can be thankful has not survived).

Now these two countries—China and Sweden—have again moved to the forefront of a revolution that will decisively change the nature of money as we know it. Their central banks are likely to be among the first of the major economies to issue central bank digital currencies (CBDCs)—digital versions of their official currencies—to coexist with, and perhaps one day to replace, paper currency and coins. They will not, however, be the first to experiment with or issue CBDCs. Several other countries, including Ecuador and Uruguay, have experimented with CBDC in various forms. The Bahamas rolled out its CBDC, the sand dollar, nationwide in October 2020. Still, a major global power like China taking the plunge transforms the concept of a CBDC from an interesting curiosity to a milestone in an inexorable progression of the nature of central bank money.

Shaking Up Finance

The shift away from cash (currency and coins), as it turns out, is both a consequence and a manifestation of other big changes afoot. The world of finance is on the verge of major disruption, and with that will come advances that affect households, corporations, investors, central banks, and governments in profound ways. The manner in which people in wealthy countries like the United States and Sweden as well as in poorer countries like India and Kenya pay for even basic purchases has changed in just a few years. Our smartphones now allow us to conduct banking and financial transactions no matter where we are. That cash, once valued as the most definitive form of money, seems to be on the way out is only a small feature of the rapidly changing financial landscape. Consumers are faced with a range of important changes, which they are adopting with varying degrees of enthusiasm depending on their age, technical savvy, and socioeconomic status. Businesses are having to adapt as well.

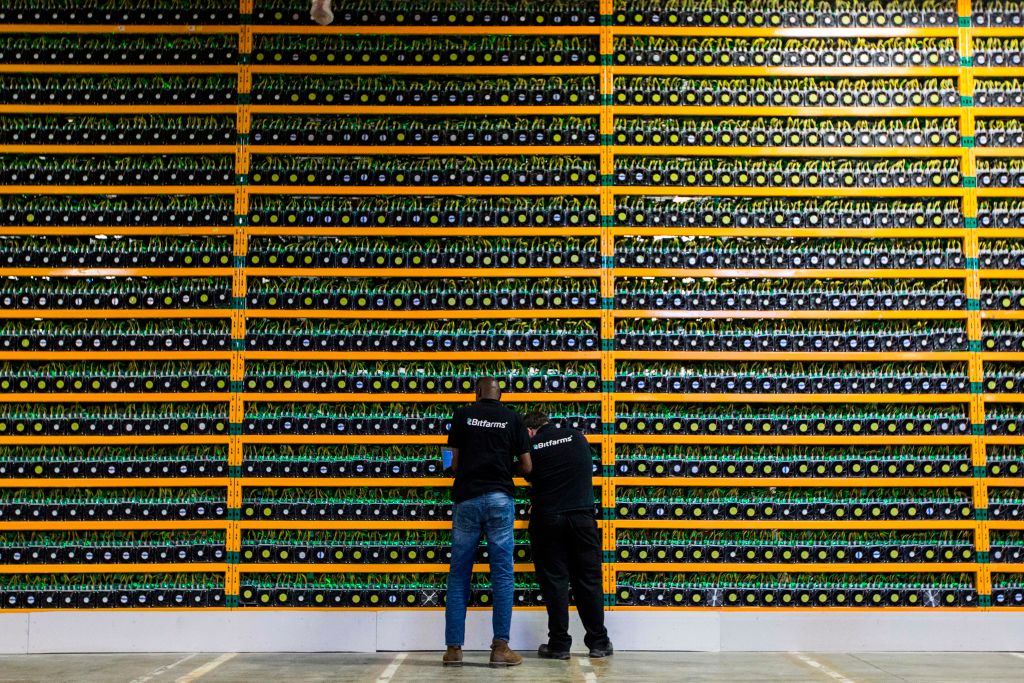

The truly revolutionary change in finance seemed to have been heralded by Bitcoin. It was introduced in 2009 by a person or collective who remains anonymous to this day and is managed by a computer algorithm rather than anyone in particular. This cryptocurrency quickly captured the imagination of the public, including jaded financiers, technologically sophisticated millennials, and those in search of the next big thing. Bitcoin is designed as a decentralized payment system, meaning that it is not managed by a centralized authority such as a government agency or a financial institution. Its technological wizardry, combined with the allure of making an end run around governments and banks, perfectly captured the zeitgeist of the era following the global financial crisis. The price of Bitcoin, which was less than $500 in 2015, hit nearly $20,000 in December 2017. Expectations that Bitcoin’s price would continue to rocket skyward then cooled off; its price hovered mostly in the range of $4,000 to $15,000 for the following three years. Nevertheless, despite skepticism (including from economists such as myself) about the value of what is essentially just a piece of computer code, the mania continued—Bitcoin’s price surged to over $60,000 in March 2021.

For all the excitement about Bitcoin, its underlying technology—which is truly ingenious and innovative, as we will see later in this book—is likely to have more staying power than the cryptocurrency itself. And, while the mysteries of this technology have fascinated the public, other imminent changes in the world of finance herald the arrival of a more significant if less glitzy revolution.

The recent and ongoing innovations in financial technologies have come to be encapsulated by the portmanteau term Fintech. Later, we will see how the Fintech revolution is touching different aspects of finance. Financial innovation is nothing new, of course, and it is worth bearing in mind that revolutions have dark sides as well.