According to John Allison, the market system did not fail in 2008 and did not need governmental intervention, as this sort of intrusion was responsible for the panic in the first place

Question: In what ways did the market fail?

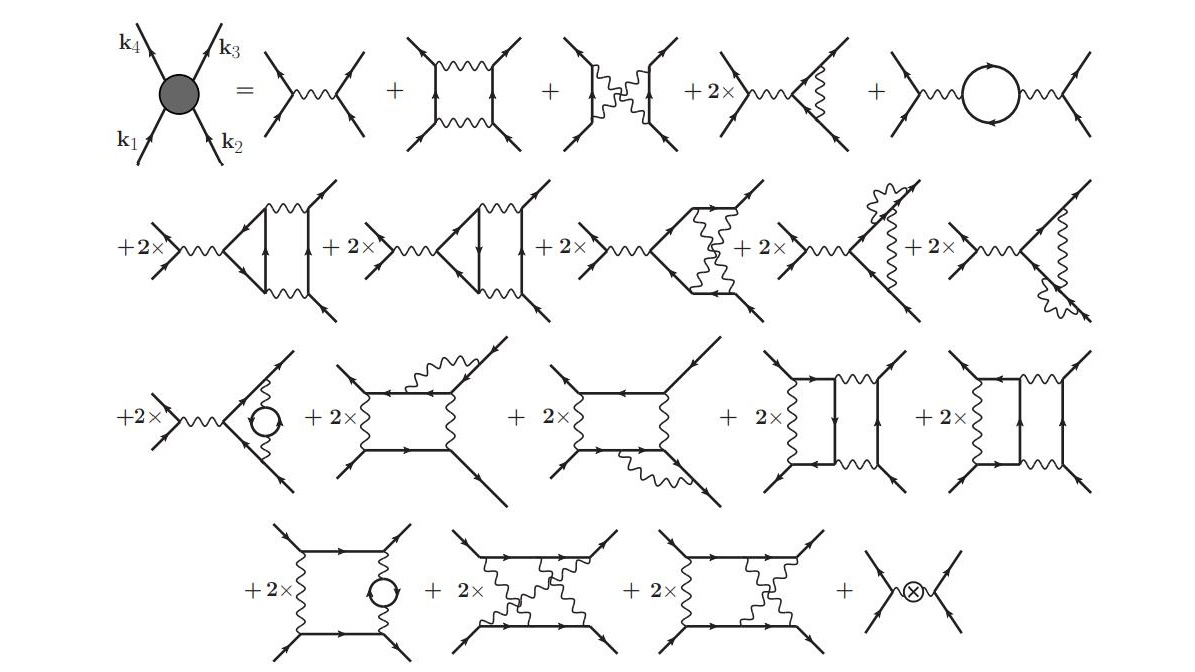

John Allison: I don’t think the market per se failed. I think that government policies create market distortions, i.e.: too much money with the Federal Reserve, the allocation to housing. There was one factor that created an odd market failure and that was fair value accounting. Fair value accounting is supposed to be a good thing because it’s marked to market, but in a panic situation, the market is not functioning, it’s not a market failure, it’s just a nature of panics. And that created distortions. And I’ll give you a simple way that that happened. Let’s say there was a mortgage bond in the market that had originally been $100 million, but because of mortgages not being paid under the bond and people that weren’t expected to pay in the future, economically that mortgage was worth $80 million, and that’s what it should’ve sold for. But because of the panic, the only buyers were deep discounters that would only pay $50 million for it. Now, that had big implications because under this fair value accounting, the financial institution, instead of marking the mortgage bond down $20 million, had to mark it down $50 million. Financial institutions, banks, or leverage, we’ll just use an easy number, 10 to 1. So instead of destroying $200 million worth of lending capacity, which the loss of $20 million in capital would do, it destroyed $500 million in lending capacity, i.e.: 50 times 10 instead of 20 times 10, because of the accounting system. But here’s why the market didn’t work. It was why didn’t the market correct that? Well, there were people like BB&T that have plenty of money, we saw that bond was worth $80 million, we could buy it for 50, if we went in and started buying and everybody else like us had money started buying, then the price would’ve gotten certainly close up to the $80 million. But we wouldn’t buy because we couldn’t take the accounting risk. Because even though we knew bond was worth $80 million, we weren’t going to buy it even for $50 million, because we didn’t know that next quarter, under this panicky market, it would only be, a fair market value quote would only be $40 million because everybody would be scared and we’d have to take a markdown. So fair value accounting created a market distortion that never would’ve existed in a free market. I would just point out that the SEC makes the accounting rules and yes, we do not have a private based accounting system, I don’t know any big firm that runs their internal operations based on GAP accounting, I don’t know of any hedge fund that runs their operations based on GAP accounting and so the SEC, ironically, through the control of the accounting system, created a market distortion that I do not believe would’ve existed in a pure, free market.

Question: Is there any reason to believe that government intervention outperforms markets in the long run?

John Allison: I don’t believe so. I mean, I think that government intervention in the long term almost always creates poor economic allocation processes. You can make some arguments in the middle of a panic that government interference helps you in the short term, but the long-term price for government interference is very high. Let’s face it, you know, there are some really significant, long term economic challenges, however we feel, you know, I think the economy is in some kind of recovery, I think our most likely intermediate scenario is kind of a stagflation environment, but I’m really worried about the US 20 and 25 years down the road. We got huge deficits in Social Security, huge deficits in Medicare, we got trillion dollar plus operating deficits, a dysfunctional foreign policy, we got a big problem with the demographics with the retiring baby boomers, we got a failed K-12 education system. You can paint a very scary picture 25 years down the road if we don’t provide the discipline that’s necessary. And what that means is not more government regulation, but a return to what made America great in the first place, individual rights, free markets, entrepreneurship, increases in productivity. You can’t print your way out of problems, if you could, Zimbabwe would be doing great, right? If somebody gave me a trillion dollars, Zimbabwe, whatever it is, Bill the other day, said it was worth 5 cents. You have to produce your way and we need to create the kind of an environment where productive people are encouraged to take rational risks and grow their businesses and we haven’t been doing that, so that’s our real problem, not market failure.

Question: What will the long run implications of government’s involvement in the financial sector be?

John Allison: I think the long-term implications are very detrimental. If you want to really think about what happened in the housing crises, it was a government policy, through Freddie Mac and Fannie Mae and affordable housing policies, what they call the community reinvestment act, etc., that created a massive misallocation of credit. If the government gets into allocating credit over time it will make sure we aren’t as productive as we should be. So the government regulations usually in the end look like credit allocations usually to those that are politically favored at the expense of making sure credit is allocated to the most productive segments in the economy. So I think government regulation in the long term is almost always destructive.