Globalization has created more wealth around the world, but in America, rather than being the rising tide that lifts all boats, money is increasingly concentrated in the hands of the population’s top 10 percent. But robust democratic institutions can turn this trend around, says Thomas Piketty, professor of economics at the Paris School of Economics and author of the landmark 2013 book Capital in the Twenty-First Century.

Thomas Piketty: If you look at a country like the United States, the share of the total income going to the top 10 percent of the population used to be about one-third of the total income back in the early 1980s and now in 2015 it is over one half. So it has gone from 30/35 percent to over 50 percent of total income. Marx in the 19th century says that inequality would have to rise forever. Kuznets in the 20th century on the contrary assumes that there were natural forces that would make inequality go down in the long run. My main conclusion is that there are powerful forces going in both directions and that ultimately which one dominates really depends on the institutions, policy that we choose in the area of education, labor market, taxation, corporate governance, minimum wages. And all of these matter and there are several possible futures.

If your parents are rich, like 100 percent of the generation, almost, goes to college. If your parents are poor, it's like 20/30 percent going to college and these are not the same colleges if you're rich. And so there's very unequal access to education prevents inequality from going down. Now, even if you get education policy right, there are other forces which can lead to rising inequality in the long run. In particular there is a tendency of the rate of return to capital to exceed the economy's growth rate in the very long run — can act as a powerful force to very high concentration of wealth and property as opposed to income inequality, in particular labor income inequality, which is primarily determined by education and labor market institution. So again, it really depends on the institution and policies like progressive taxation of income, wealth that we put in place in order to regulate these dynamics.

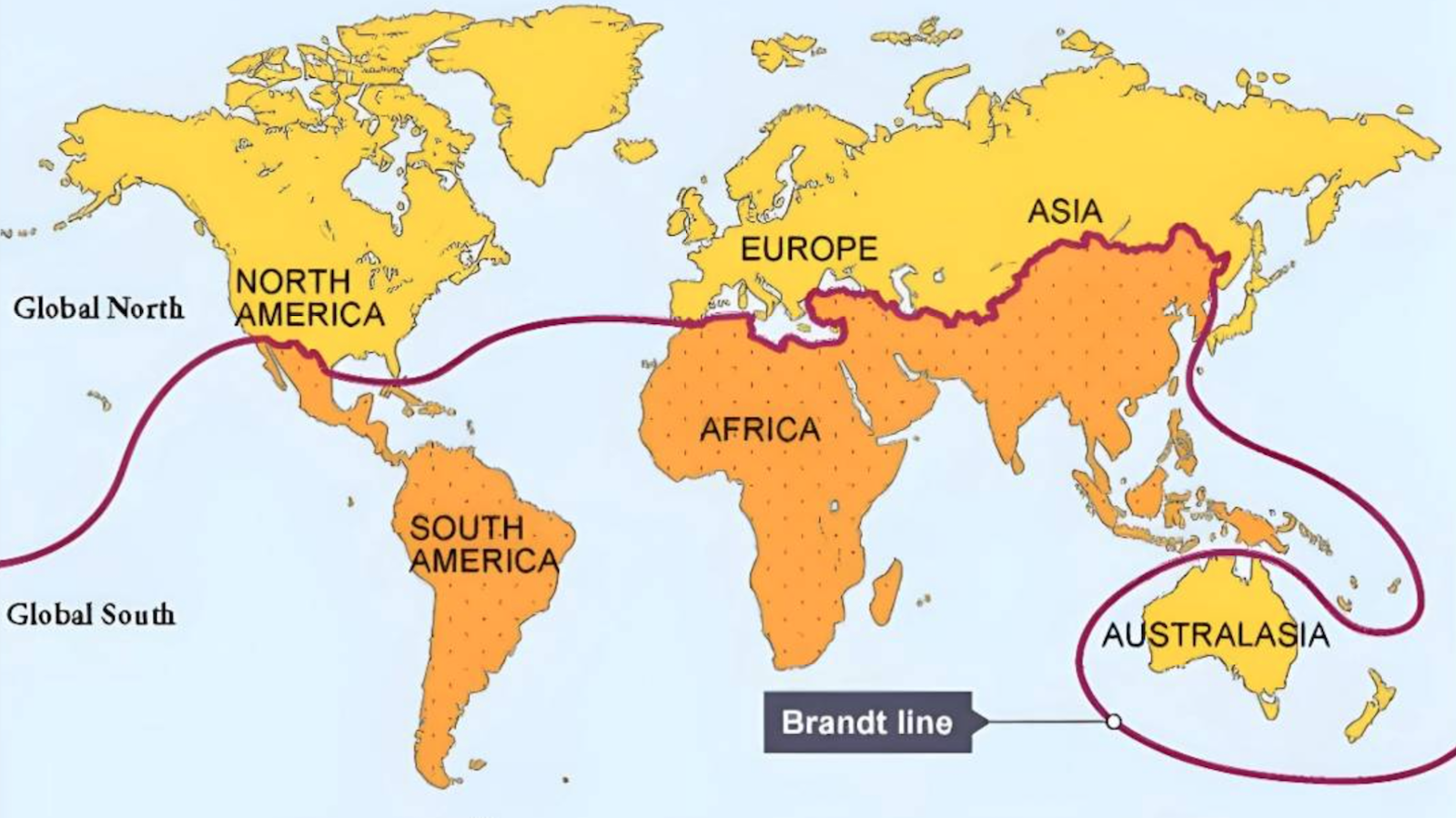

Sometimes people want just to blame globalization and say, well, because of globalization, because of the competition with emerging countries inequality has to increase and in any case there's not much we can do about it; that's just globalization. And I think this is wrong. I believe in globalization, but I believe we also need strong democratic institution and fiscal and educational policies so as to ensure that more people actually benefit from globalization so you don't have the same rise in inequality everywhere. For instance, in Europe and Japan where you also have globalization and competition with the emerging countries, inequality of income or wealth did not increase quite as much as in the United States. So this shows a different course of action can make a difference.