David M. Rubenstein is a Co-Founder and Managing Director of The Carlyle Group, one of the world’s largest private equity firms. Mr. Rubenstein co-founded the firm in 1987. Since then,[…]

Sign up for the Smarter Faster newsletter

A weekly newsletter featuring the biggest ideas from the smartest people

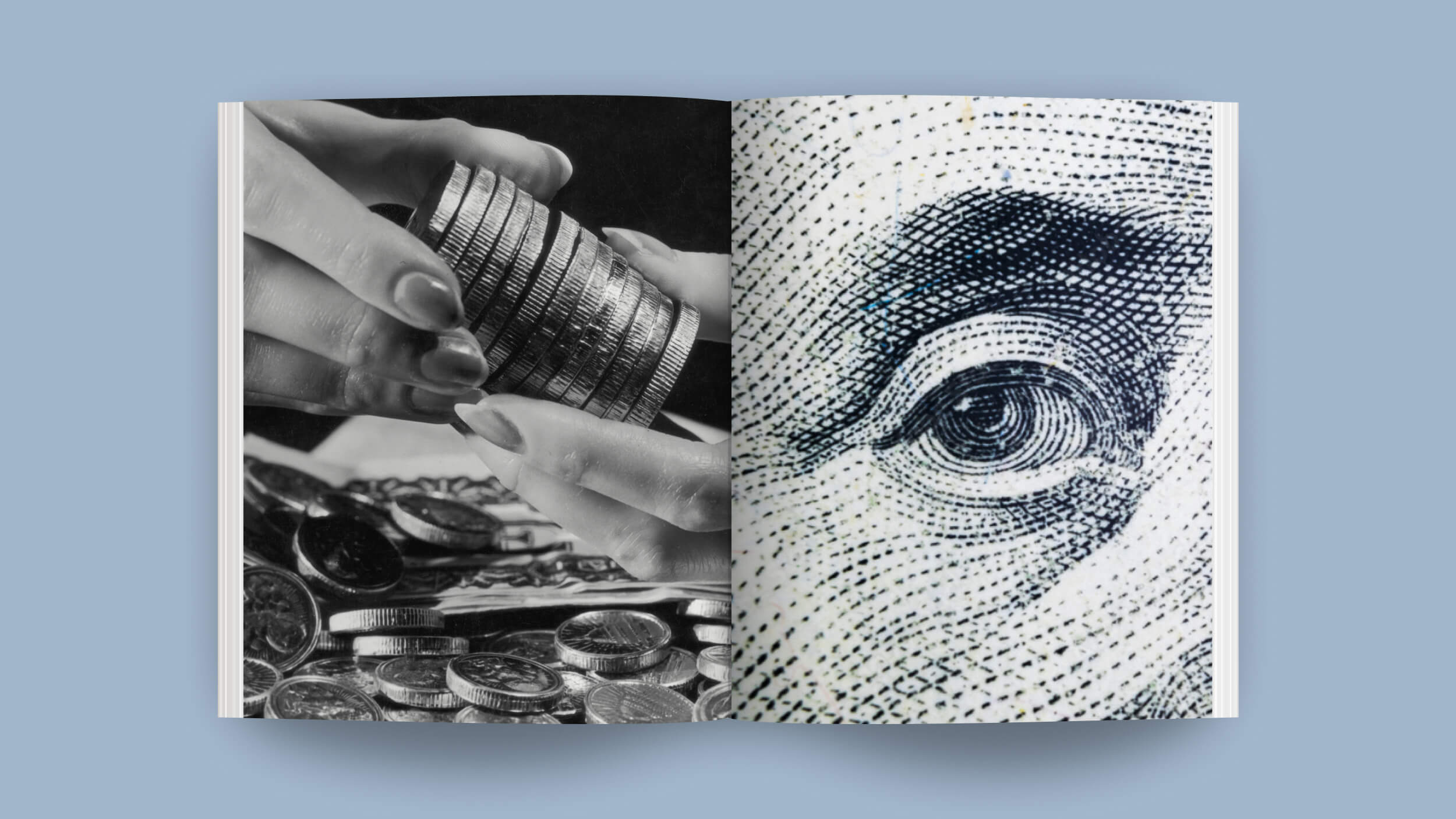

Rubenstein thinks we should simplify the tax code.

There’s no doubt that there has become a growing concern about the income disparity in the United States. CEOs are making incomes than ever before, and the gap between what CEOs are making and the lowest paid workers in those companies are making is increasing. And there’s no doubt that after 30 or 40 years of a war on poverty, we still have a great deal of poverty in the United States and we are the wealthiest country in the world. Clearly in other countries in the world, in the developing countries, emerging countries, the poverty level is far greater than even here. I’m not sure that increasing taxes on private equity is gonna solve all these problems. I do believe, though, that Congress needs to look at how to reform the tax code in ways that does make everything work a little bit more fairly. For example, right now the tax code is 10,000 pages or more. It’s virtually incomprehensible. At our firm, the former head of the IRS is . . . is an employee, and he cannot fill out his own tax returns. And I doubt if any former head of the IRS or current head of the IRS can fill out their own tax returns because it’s too complicated. I think we need to simplify the system much better. And I think with simplification would come greater equity. That’s one of the things we should do. But there’s no doubt that the income disparity in our country has increased, and we should do some things to deal with it as soon as we can.

Recorded on: 9/13/07

▸

5 min

—

with