What Contract Theory Is and Why It Deserves a Nobel Prize

Bengt Holmström of the Massachusetts Institute of Technology (MIT) and Oliver Hart of Harvard University were unknown to everyone except economists (and Milhouse van Houten) – until October 10th, when they were awarded the most high-profile award in the world: the 2016 Nobel Prize. Why? Their work in contract theory showed us the best ways to get people to work together.

The creation of ideal contracts was already covered under general equilibrium theory – what you and I know as “supply and demand.” General equilibrium theory asserts that wants and needs in any market will sort out ideal conditions of business; contracts will structure themselves accordingly. That idea was revolutionary enough to earn economic Nobel prizes in 1972, 1983, and 1991, but it did not account for real-world problems like informational gaps between parties and incomplete contracts. Hart and Holmström focused on those deficiencies to create modern contract theory.

Contract theory “studies the design of formal and informal agreements that motivate people with conflicting interests to take mutually beneficial actions,” reports Business Insider. Simply put, contract theory explores how contracts form and how beneficial they have to be to get people to stick to them. “One of the theory’s goals is to explain why contracts have various forms and designs,” states the Royal Swedish Academy of Science in its Nobel statement. “Another goal is to help us work out how to draw up better contracts, thereby shaping better institutions in society… Hart’s and Holmström’s research sheds light on how contracts help us deal with conflicting interests.”

Holmström has been conducting his research since the 1970s. He focused on informational gaps in contracts – meaning agreements where some parties weren’t able to observe what others were doing. That work led Holmström to develop the idea of “moral hazard in teams” where “dividing a firm’s income income among its workers could lead to a free-rider problem, in which some employees contribute less than others, relative to their compensation,” according to MIT. “In this case, Holmström suggested, outside ownership of firms can produce more flexible compensation and boost individual incentives.” The paper has been widely cited since its 1982 publication.

Additionally, Holmström developed and published the “informativeness principle” in 1979, which addresses the “principal-agent problem” (the structure of contracts between employers and employees),” as MIT explains:

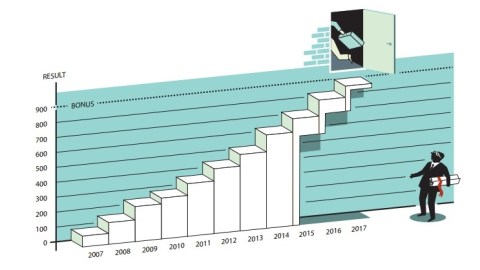

This principle suggests that optimal contracts should structure compensation based on all outcomes that can potentially provide information about actions that have been taken. In the case of setting an executive’s compensation, for instance, that means a firm would reward the executive based on not just its own performance but also the performance of other firms in that sector — as way of evaluating not just the actions the executive took but those that he or she could have taken.

Credit: Royal Swedish Academy of Science

Oliver Hart’s research is equally impressive. His focus was on incomplete contracts, and his research centered on “the roles that ownership structure and contractual arrangements play in the governance and boundaries of corporations,” explains Harvard. In particular, Hart examines the idea of corporate privatization, “whether providers of public services, such as schools, hospitals, or prisons, should be publicly or privately owned,” explains CNN Money. “Privatizing those types of services can lead to a reduction in quality greater than the advantages of cost savings.” As Hart discovered, the decision to privatize largely depends on the types on non-contractible investments. The Royal Swedish Academy of Sciences offers this example:

Suppose a manager who runs a welfare-service facility can make two types of investment: some improve quality, while others reduce cost at the expense of quality. Additionally, suppose that such investments are difficult to specify in a contract. If the government owns the facility and employs a manager to run it, the manager will have little incentive to provide either type of investment, since the government cannot credibly promise to reward these efforts. If a private contractor provides the service, incentives for investing in both quality and cost reduction are stronger.

An example of factors weighed during the privatization process. Credit: United Electrical Union

Hart also co-authored a 1986 paper on “The Costs and Benefits of Ownership: A Theory of Vertical and Lateral Integration,” which determined that when problems arise from multiple parties investing in an asset, all sides need to bargain for the best possible solution.

Their focus on fleshing out the unknowns of contract theory allows anyone to create better, fairer contracts. As the Academy puts it, “we now have the tools to analyze not only contracts’ financial terms, but also the contractual allocation of control rights, property rights, and decision rights between parties.” Their work has been particularly helpful in the area of private prisons, as the academy explains in their statement: “Federal authorities in the United States are in fact ending the use of private prisons, partly because – according to a recently released U.S. Department of Justice report – conditions in privately run prisons are worse than those in publicly run prisons.”

For his part, Holmström “observed that a famously failed company such as Enron had misaligned incentives allowing executives to cash out, which he regarded as misguided — and said he hoped the academic research could further inform the corporate world. “I wish they would listen a little bit more to what we know and understand,” Holmström said,” MIT reports.

That’s a big wish, but at least we have the research to draw from.