“Time inequality” is the world’s real problem, not income inequality

- The world population is growing, and the world is getting wealthier. If resources are limited, then how is this possible?

- Indeed, resources are limited, but human knowledge is not. As a result, humans can find ever more valuable ways to use our limited resources — and that is exactly what we are doing.

- In this essay, Dr. Marian Tupy and Dr. Gale Pooley highlight a theme from their new book, Superabundance: Wealth and inequality should be understood in terms of time, not money.

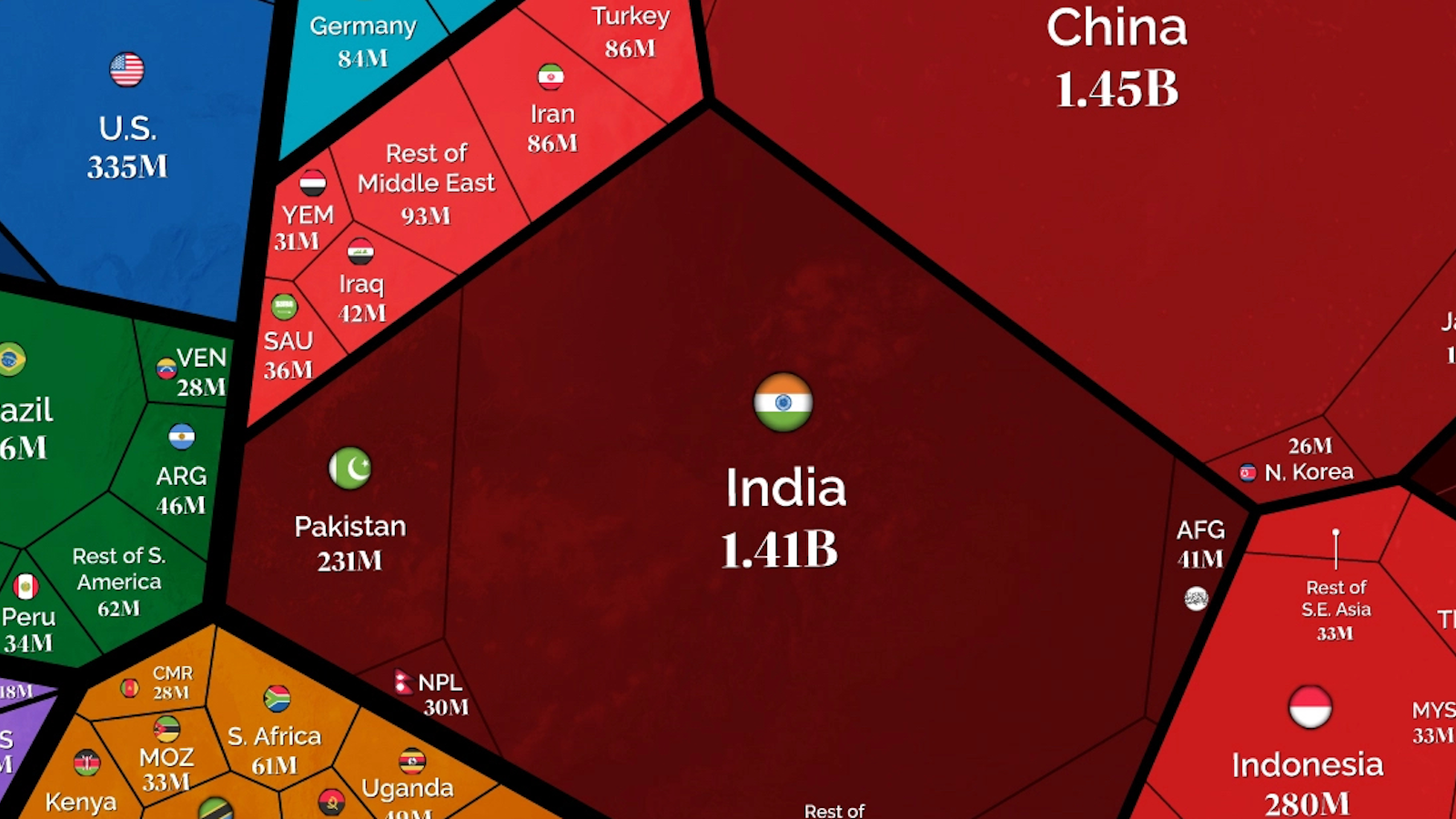

According to the United Nations, the birth of the eight billionth person happened on November 15, 2022. Should we celebrate or mourn that milestone? Many see the expansion of the human enterprise as a calamity. Thinkers from Thomas Malthus and Paul Ehrlich to celebrities from Bill Maher to Tucker Carlson hold that population growth must tax planetary resources to the point of exhaustion. And who can forget Thanos, the supervillain from the Avengers movies, and his famous quip, “This universe is finite, its resources, finite. If life is left unchecked, life will cease to exist. It needs correcting.”

We dissent.

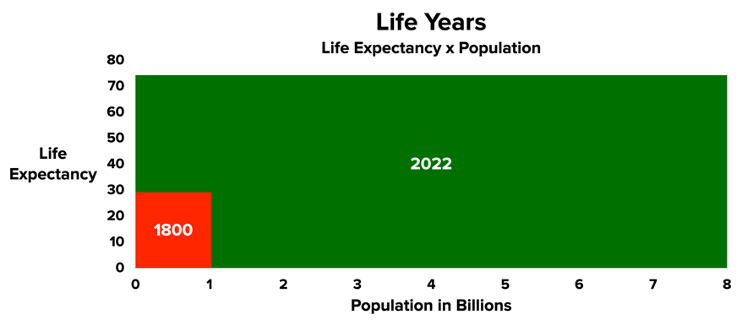

In 1800, there were only one billion people on the planet, and the average life expectancy was 28.5 years. The current average life expectancy in the world hovers around 73 years, with men at 71 years, and women at 75 years. In contrast to our ancestors, we are getting 45 more years to live. That’s a lot of additional life-years, as the chart below shows.

If our resources are “finite,” how did life expectancy increase by 156 percent, while population increased by 700 percent, thus giving us 20 times more life-years (life-years = population x life expectancy)? Because Thanos was only half right. While there are a finite number of atoms on our planet, the value derived from those atoms is potentially infinite. The difference between finite atoms and infinite value rests in human knowledge. It is knowledge that makes combination and recombination of atoms ever more valuable. And knowledge is not constrained by the laws of physics. It is potentially infinite.

The American economist Thomas Sowell noted that, “the cavemen had the same natural resources at their disposal as we have today, and the difference between their standard of living and ours is a difference between the knowledge they could bring to bear on those resources and the knowledge used today.” If Thanos understood that human flourishing is about knowledge, not atoms, and that human beings are the source of discovering new knowledge, he would have used the infinity stones to create more life, not destroy it.

Money price vs. time price

How do we measure the growth in knowledge? We can measure it with time. We buy things with money, but we pay for them with time. That means there are two prices: money prices and time prices. Money prices are expressed in dollars and cents. Time prices are expressed in hours and minutes. A time price is simply the money price divided by hourly income at the time of the purchase.

If a pizza costs $20 and you are earning $20 an hour, the time price is one hour, or 60 minutes. If the price increases to $25 but income increases to $30 an hour, the time price has fallen to 50 minutes. You now get 20 percent more pizza for the same amount of time. One reviewer observed that “if you can produce the same amount in half the time, you’re twice as smart. Your knowledge has doubled.” Time prices are elegant, intuitive, and simple. They are really the true prices we pay for the things we buy in life.

Why time price is better than money price

Time prices makes sense for at least five distinct reasons.

First, time prices contain more information than money prices. Since innovation lowers prices and increases wages, time prices more fully capture the benefits of valuable new knowledge. To just look at prices, without also looking at wages, only tells half the story. Time prices make it easier to see the whole picture.

Second, time prices transcend all the complications associated with trying to convert nominal prices to real prices. Time prices avoid the subjective and disputed adjustments such as the Consumer Price Index (CPI), the GDP Deflator or Implicit Price Deflator (IPD), the Personal Consumption Expenditures price index (PCE), and Purchasing Power Parity (PPP). Time prices use the nominal price and the nominal hourly income at each point in time, so inflation adjustments are not necessary.

Third, time prices can be calculated on any product with any currency at any time and any place. This means you can compare the time price of bread in France and the U.S. (Calculating how many minutes the French and Americans must work to buy a loaf of bread tells you who is better off.) Or you can compare the time price of bread in the U.S. in 1850 and 2022, which tells you how much today’s Americans are better off compared to their ancestors.

Fourth, time is a constant and independent variable. The International System of Units (SI) has established seven key metrics. Of those seven metrics, six are bounded in one way or another by the passage of time. Time cannot be inflated or counterfeited.

Fifth, everyone has perfect time equality with 24 hours a day. That allows us to compare the standard of living of the rich and poor.

Resource abundance as measured by time

We hold that economics can be much more illuminating by going beyond money and atoms to knowledge and time. Using time prices, we developed an analytical framework to measure resource abundance at the personal and global level. It is the change in time prices over time that reveals how much better off we are.

We found that the time price of 50 basic commodities, such as oil and wheat and lumber and iron ore, fell by an average of 75.2% from 1980 to 2020. That means that for the time required to earn the money to buy one unit in our basket of 50 basic commodities in 1980, you would get 4.03 in 2020. That’s a 303% increase in 40 years. Personal resource abundance was increasing at a 3.55% compound annual rate, doubling every 20 years. Over the same period, the global population increased by 75.8%. Given that global resource abundance is equal to personal resource abundance multiplied by population, we found that global resource abundance increased by 608%. For every 1% increase in population, personal resource abundance increased by 4% and global resource abundance increased by 8%.

To make this immense wealth expansion more comprehensible to our American audience, we looked at a period between 1850 and 2018. We discovered that a typical blue-collar worker in the U.S. saw time prices of 26 basic commodities fall by an average of 98.3%. For the time required to earn the money to buy one unit in our basket of 26 commodities in 1850, blue-collar workers would get 58.62 units in 2018. All the while, the U.S. population grew by a factor of 14.22. That suggests that resource abundance increased by over 83,000% at the U.S. population level. Every 1% increase in the U.S. population corresponded to a 63% increase in population level resource abundance.

Time inequality is the real inequality

A concern for many is income inequality. Since we all get exactly 24 hours in a day, perhaps a better way to compare inequality is not with money, but with time.

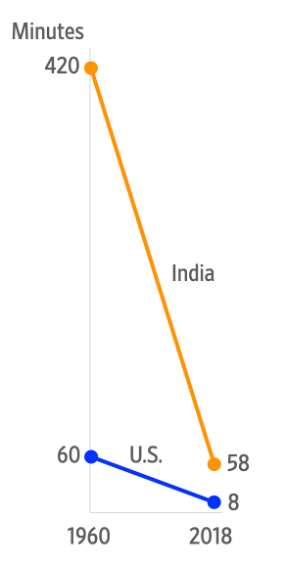

Consider Raj in India and Ray in Indiana. Assume that in 1960, Raj spent seven hours a day earning the money he needed to buy rice for his meals. (That’s not uncommon in very poor countries even today.) By 2018, the time price of rice had fallen 86.2%. Now Raj’s grandson works only 58 minutes to buy his rice. Raj’s grandson has six hours and two minutes to do something else.

In 1960, Ray may have spent, at most, one hour a day earning enough money to buy wheat for his meals. By 2018, the time price of wheat had fallen 87.5%. Now Ray’s grandson works less than eight minutes to buy his wheat. Ray’s grandson gained 52 minutes, but Raj’s grandson gained 363. In 1960, time inequality was 360 minutes. By 2018, it had dropped to 50 minutes.

Unlimited knowledge, unlimited wealth

The growth in knowledge is only limited by the number of human beings who are free to act on their ideas for creating value. Economics is the study of how human beings create value for one another by discovering and sharing valuable knowledge in free markets.

Some believe that our objective should be sustainability, but sustainability is thinking in finite atoms. Innovation is thinking in knowledge. We can’t create more atoms, but we can create more knowledge and, therefore, more wealth for everyone on the planet. Just as there are no limits to the number of songs you can create with 88 keys on a piano, there are really no limits to the growth in knowledge that can combine and recombine existing atoms.

Looking at the world from the perspective of time and the growth in knowledge, one can only feel profoundly grateful for the billions who have gone before us and who worked, discovered, created, and shared their ideas so that our lives could be much better than theirs were. Let’s celebrate and welcome the eight billionth addition to our family of abundance creators.