Is a VAT Tax the Only Thing Separating the U.S. From a Banana Republic?

On a day of mind-numbing acronyms that few aside from tax preparers can decipher without IRS instructions, we should note one that could mark the way to tax system salvation. It’s spelled V-A-T.

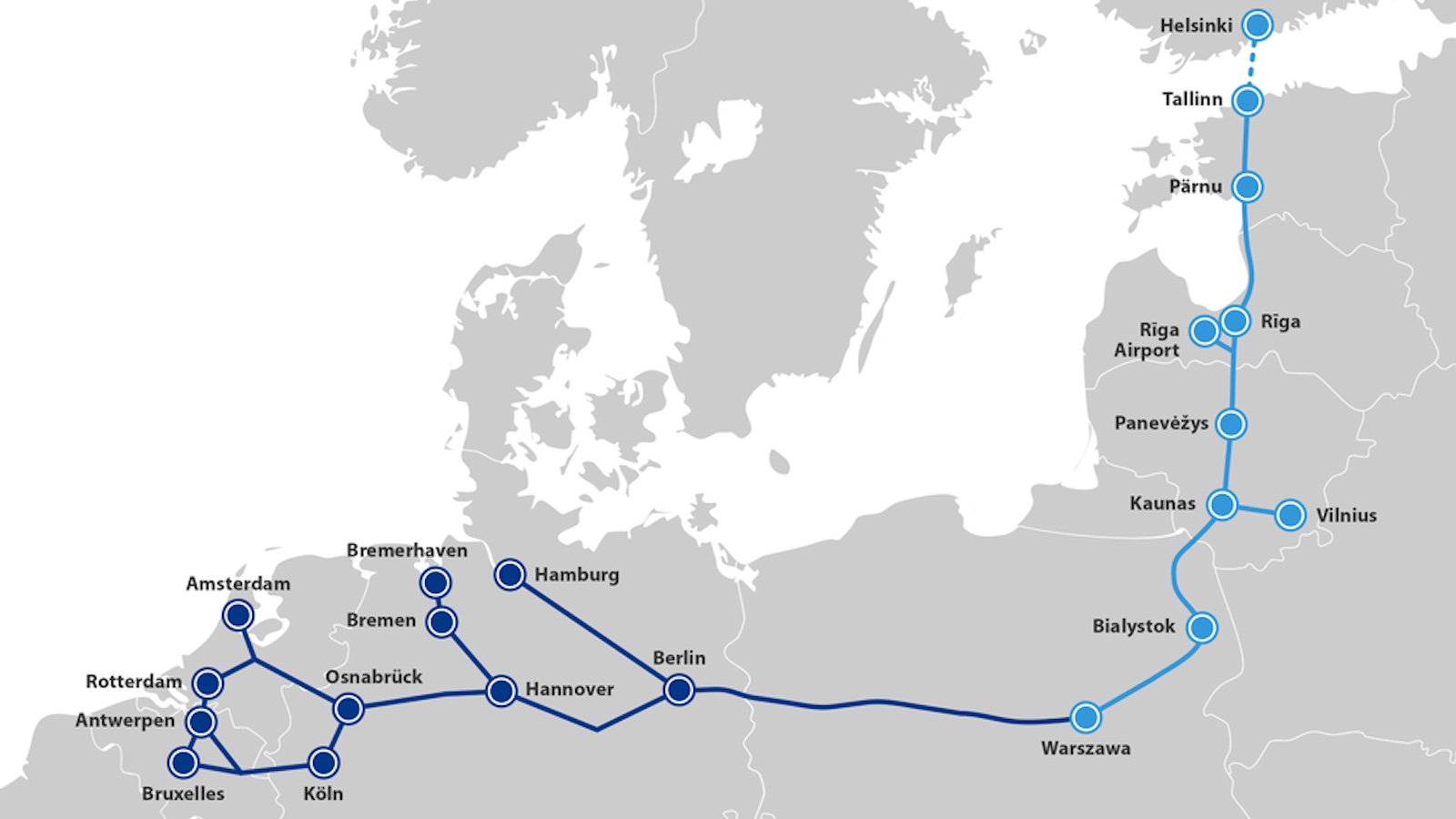

Currently, 143 countries levy some form of a value-added tax, or VAT, on goods and services. The United States is the only OECD country without one. In the European Union, VAT is the gold standard for funneling revenue to the federal level. The slippery socialists in France are able to fund 45% of the French state through VAT. The sales tax common in most U.S. states is similar to VAT, but it only goes toward state expenses.

One of the more viable proposals for an American version of the VAT comes from Yale University Professor, Michael Graetz. He proposes a 10-14 percent VAT in the US, versus the 19-25 percent required in Europe. This would generate enough revenue to allow the direct elimination of 100 million income tax returns. Coupled with a new maximum income tax rate of 25% on the wealthiest and a corporate rate of 15%, it could pave the way to much-needed solvency while simplifying a tax system mired in superfluous paperwork, loopholes and inefficiencies.

Graetz told Big Think today, “it is abundantly clear that we don’t have a system that is well-positioned to raise the needed revenue.”

On the relevance of VAT for the U.S., Graetz said an economic system as interconnected as the world’s is today should have some complementary tax features.

His proposal, elaborated in 100 Million Unnecessary Returns: A Fair, Simple, and Competitive Tax Plan For The United States, is getting more traction in Washington, though Obama is not expected to enact any sweeping tax reforms until 2010 at the earliest

If simplifying a byzantine tax system–one that swallows 7.6 billion work hours per year–was not sufficient reason to consider a VAT proposal, consider a simple projection. At the current rate of national debt, the share of the U.S. GDP comprised of debt obligations is forecasted to jump to 80%. Such a figure would bar a country from membership in the OECD, European Community or any other recognized transnational economic union: in short, a banana republic.