Financial Crisis

Here’s the psychology that explains why many economists prefer to be narrowly right yet broadly wrong (they suffer from professional “rigor distortis”).

History shows us why we can’t trust centralized power. So what can we trust?

▸

10 min

—

with

It takes four dollars of debt to create a single dollar of GDP growth in China. For context, at the peak of the GFC in 2008 it was taking three dollars of debt to create a dollar of GDP growth in the U.S. China has received the kiss of debt, says Ruchir Sharma.

▸

2 min

—

with

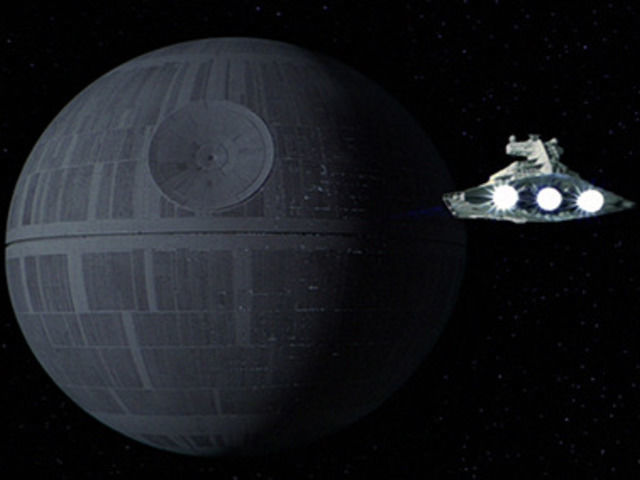

This is not the outcome you’re looking for.