advice

When a ‘Rick and Morty’ fan recently tweeted at Dan Harmon asking how to deal with depression, it didn’t take him long to reply.

Hertz Foundation Fellow Dr. Christopher Loose sold his first startup for $80 million. His advice is probably the kind you want to hear.

▸

7 min

—

with

There are four main stages. Each has its own particular set of advancements and challenges.

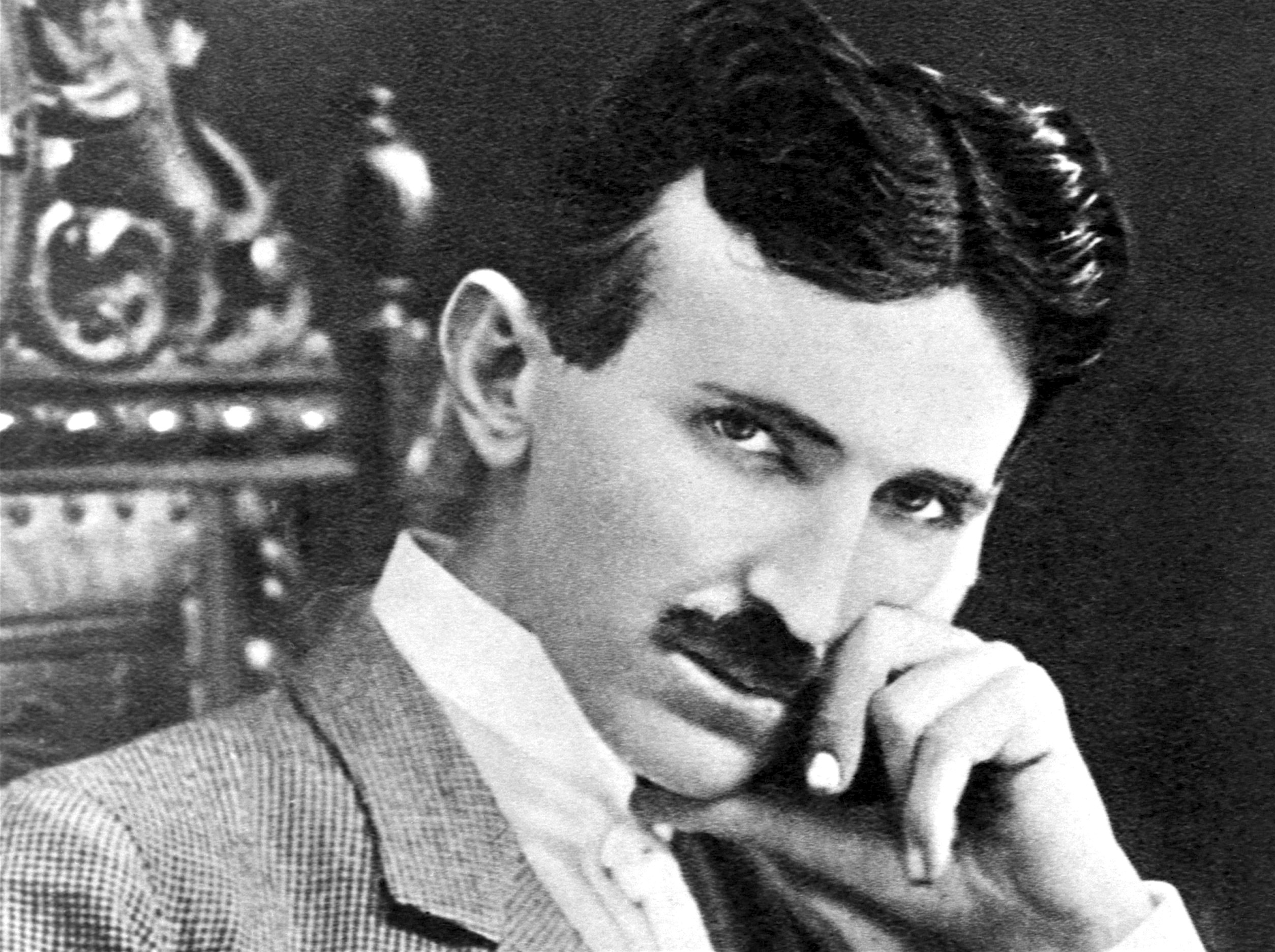

The famous inventor Nikola Tesla shared his views on dieting and exercising that helped him think better and live longer.