Rational or Misrational? Logically Pursuing Mad Goals

The word “rational” is widely misapplied. Scientists sometimes mistarget it unnaturally (un-biologically, un-evolutionarily). Nobel laureates Daniel Kahneman and Gary Becker are on opposite sides of this breach with our nature.

1. “In common language a rational person is certainly reasonable,” and “generally in tune with reality,” writes Kahneman. But economists generally use rational to mean logical coherence whether “reasonable or not.”

2. For example, Becker’s “Rational Theory of Addiction” defines rational as having “a consistent plan to maximize utility over time.” Utility is econo-speak for any benefit (see Bentham’s bucket error). Becker’s “rational” agent model sees drug addiction as just another method of utility-seeking.

3. Kahneman says Becker’s “faith in human rationality” ignores abundant contrary evidence that inconsistencies are “built into … our minds.” Measuring these “cognitive biases” created the field of “behavioral economics”—its name amusingly and alarmingly highlights what’s been lacking. It studies empirically our everywhere-evident imprudent behavior.

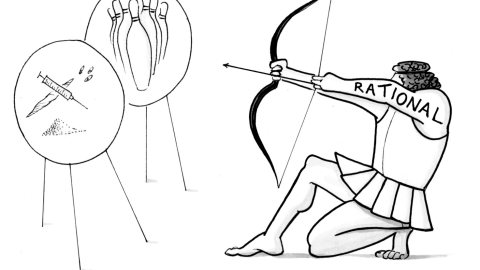

4. “Rational” entails at least three types of, usually unsung, assumptions, about: a) desirable goals; b) effective methods of attaining them; and c) whether agents have the needed skills.

5. Un-behavioral economists (like Becker) risk “mis-rational” errors (i.e., rational, but mistargeted). Focusing only on logically coherent methods, they’re unconcerned if goals are biologically incoherent or have plainly undesirable consequences. Their theory assumes, and so always finds, our only goal is self-centered utility maximization—so heroin is like bowling, just another source of utility. Paraphrasing Shakespeare, though this has method, yet there is madness in it.

6. Un-behavioral models risk “revealed preference” circular cosmetic coherence: If your only goal is utility maximization, whatever you do must have been done to maximize utility. Why jump to conclusions? Just jump back to your assumptions.

7. Kahneman vs. Becker = prudent empiricism vs. zealous “monotheorism” (monomaniacally preaching the one true theory’s idealized models). Beware the one-trick hedgehog.

8. Kahneman’s side also errs, but on methods/skills. They often study risky financial decisions with numerical probabilities. But “humans didn’t evolve to think about numbers, much less money,” (Marcus) and market logic “remains cognitively unnatural” (Pinker).

9. Methods to calculate maximum benefit using probabilities require training. Without these as second-nature skills we won’t reliably behave econo-rationally.

Thomas Hobbes in 1651 understood this: Reason isn’t like “memory, born with us; nor gotten by experience only, as prudence is; but attained by industry.” By diligent learning and practice.

Humans can be “rational,” only with training (in goals, methods, and skills).

Illustration by Julia Suits, The New Yorker cartoonist & author of The Extraordinary Catalog of Peculiar Inventions