There are 5 different financial personalities. Which one are you?

Photo by Julia Sudnitskaya on Shutterstock

- There are 5 major financial personality types: big spenders, savers, shoppers, debtors, and investors.

- Your money personality explains why you spend (and save) money the way you do in your day-to-day life.

- Knowing your money personality can help you understand how to make your money work for you, how to save more, and overall how to make smarter financial choices.

The 5 Money Personalities

As human beings, we have a lot of things in common. You don’t have to look further than your family or friend group to know that how we spend (or save) money is not one of them. According to Investopedia, there are generally 5 money personality types, each with its own outlook on finances and way of doing things. Because of these differences, there is no real one-size-fits-all approach for making better financial decisions. Luckily the experts have shared tips for each of the unique group. But first, here are the classifications:

The Big Spender

Big Spenders like to make a statement with their purchases. They are not necessarily materialistic, but they do place a high value in their possessions, often wanting the latest and greatest releases – the latest smartphone, brand-name clothing, high-end vehicles.

Big Spenders are comfortable spending money and would take a big risk on investment if there was a chance it could make them more money. In fact, the act of spending the money that they work hard to earn is one of the things that they enjoy doing the most, even if it adds to their debt.

The Saver

Savers are the exact opposite of Big Spenders. Spending money makes them feel uncomfortable, they always shop for bargains, and they try to save money wherever they can. Savers may very rarely use credit cards to make purchases (or they may not even have a credit card).

Savers are often viewed as “cheap”, but this isn’t always the case. Savers are generally conservative with the things they purchase and don’t tend to take big risks on investments just in case they don’t pan out.

The Shopper

Shoppers often develop emotional ties to spending and receiving money. Their mood often dips and increases with their bank account. Shoppers find it particularly difficult to resist spending their money, even if they are buying items they don’t need.

Shoppers aren’t totally clueless about their debt, they may even be aware of the debt they are incurring but can’t seem to separate their emotions from their spending habits.

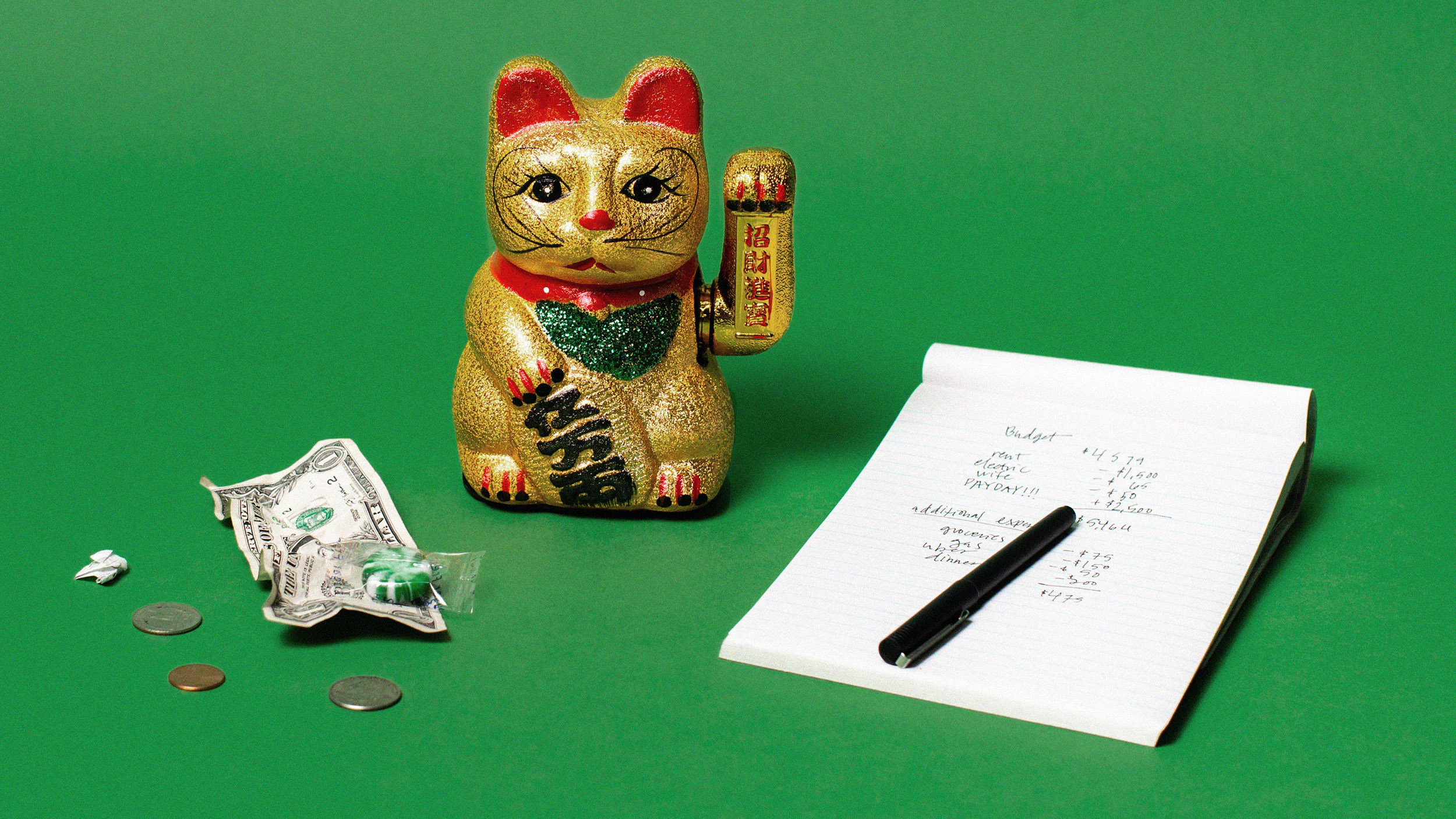

The Debtor

Debtors don’t seem to have emotional ties to their finances. They don’t spend to feel better or feel low when they see a low bank balance, they simply don’t spend much time thinking about their financial situation.

Debtors may be aware they have debt but may not keep track of what/who they owe. Debtors usually spend more than they earn on a consistent basis, meaning they are constantly at a level of debt even when they feel they are “cutting back.”

The Investor

Investors are extremely future-orientated and are consciously aware of their finances, often taking advantage of investment opportunities after carefully weighing their options. Investors typically pay their bills on time, and their spending actions are driven by choices they have given quite a bit of thought to.

Any investment the Investor takes is with the end-goal in mind of earning more money, having better credit, or some other future goal.

How to save more money, according to your financial personality

Big Spenders: Some of the best things in life are (close to) free.

If you enjoy spending money and have an income that can support your spending habits, you may be missing out on some of the finer things in life by constantly chasing the finer things in life.

Consider some fun alternatives to the high-end purchases or splurges you typically make every month. Find a balance between a spending a lot on things you may not need and spending a little on something that will bring real quality and happiness into your life.

An example of this would be choosing to spend $2000 on a jacuzzi for your back yard instead of spending $300 per month visiting a spa where you use their jacuzzi. It doesn’t necessarily have to be about saving money, but it can be about spending less where you can. You may be surprised just how much savings this will lead to in the future.

Savers: Consider quality of life compared to your savings accounts.

Savers are unlikely to fall into financial ruin because they are usually prepared for the unexpected. However, savers tend to put off purchasing things that can make their lives easier (or, in the long run, save them money) because of the price tag.

An example of this could be splurging on a new dishwasher, replacing the old one (which you had to run multiple times to get the dishes clean) with a new one that can save you money on your electric and water bills.

Shoppers: Attach emotion to saving money instead of spending it.

People who consider themselves as shoppers should consider trying to find a balance between the things they enjoy doing and things that will serve their best interests in the future.

Your emotions drive your spending habits, but they can also motivate you to save money.

Consider what emotional value you’re able to place on saving money for the future. Saving money for your children’s education, your dream home, a nice vacation with your spouse – use the positive emotions that come from these future goals to channel your energy into saving money instead of spending money.

Debtors: Make saving your money as simple as possible.

The tricky thing about having this financial personality is that, if you have a good income and steady work, you may be “fine” for a long time. Your debt may not catch up with you for years, but when it does, it can create a financial crisis. Not to mention any big unexpected expense can put you in financial crisis mode because you haven’t prepared for it.

Debtors should consider simple actions that allow you to save money with very little effort, such as setting up automatic deposits from your spending account to your savings account on the day you get paid.

Investors: Balance the “right now” with the future.

Taking risks on big investments that will pay off in the future can be a rush. It’s also a good way to make your money work for you instead of simply working for your money, as most others do. Investor personalities should consider how to best balance savings that you can use to make nice purchases today, with investments that lock you in for a certain number of years.