Don’t Gamble With Employee Pensions

What is the Big Idea?

Pension funds have gone from a state of surplus to a state of deficit in the last decade and no matter what measures are taken to mitigate the risks, struggling companies can’t seem to catch a break.

Stock market crashes, a heavy reliance on equity investment, inflation and low interest rates have contributed to a perfect storm of operational, regulatory and financial risk for company leaders.

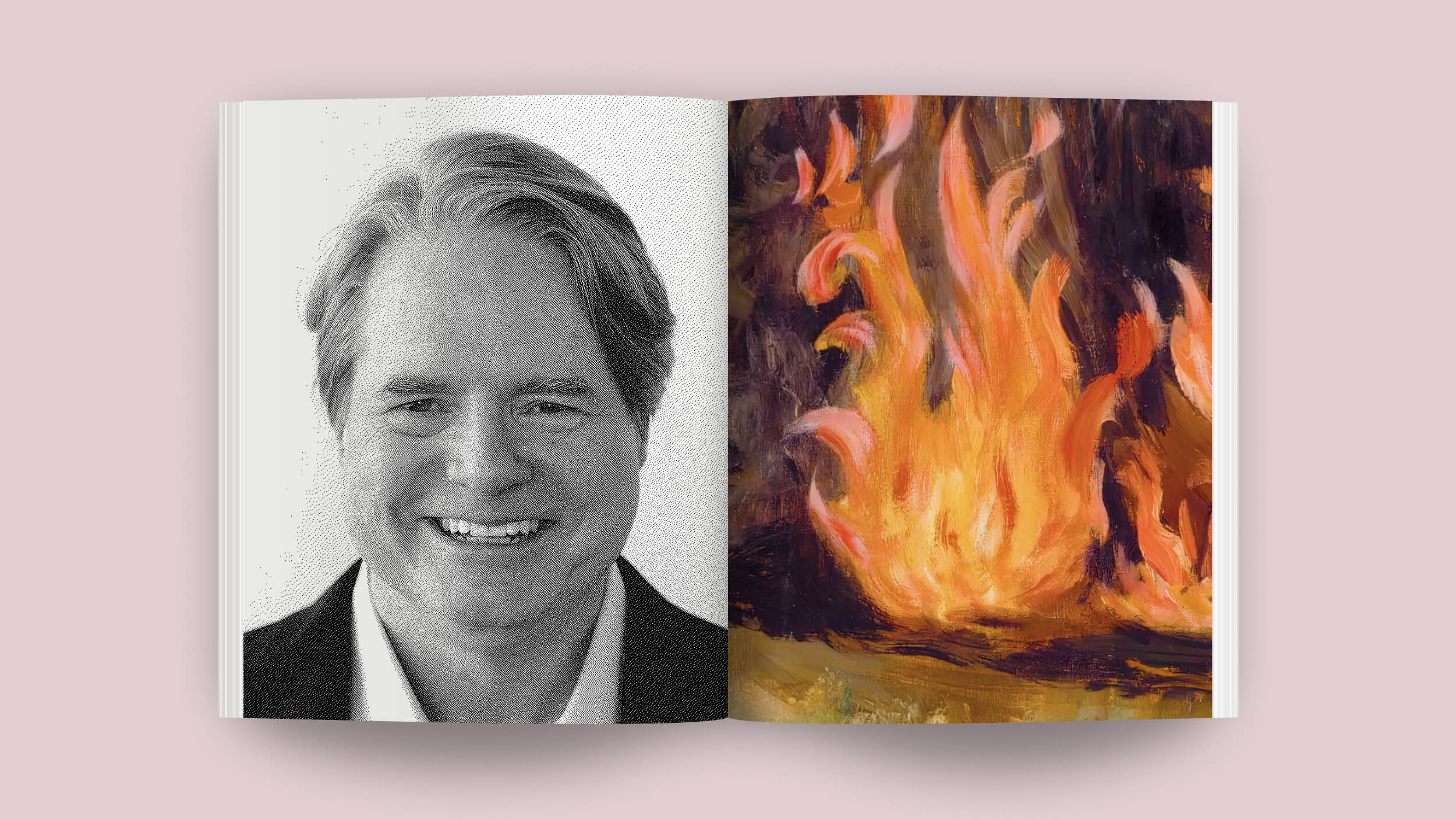

Frank Oldham, pension expert and Senior Partner at Mercer, warns CEOs and CFOs that financial risk is the “most critical one to mitigate.” He also offers some actionable advice for companies mired in pension shortfalls:

Watch Frank Oldham talk about the importance of mitigating pension risks:

What is the Significance?

Simply put: Pension obligations are long term liabilities and therefore require a long term plan. The lack of a long term plan poses additional risks and opportunity costs. When funding levels improved in the last few years, benefit sponsors in many parts of the world failed to act in a way that helps them take pension risk off the table.

“The pension world is full of regret risk in terms of opportunities that potentially have been missed,” said Oldham.

The U.K.’s largest 350 companies put £20 billion ($31 billion USD) into their direct benefit (DB) schemes over the 12 months to March 2012, yet deficits increased by £17 billion, according to a Mercer report.

The picture is equally grim for the U.S. At the end of 2011, the S&P 1500 companies contributed an additional $70 billion to their pension plans over the course of the year, yet deficits increased by $169 billion to reach $484 billion.

Pension deficits are large and volatile, and increased transparency of accounting standards means deficits are on a company’s balance sheet for all to see.

“This is one of the reasons why companies need to get their arms around this issue and around the financial issue now.” he said.

There is, however, a silver lining.

“I think now more organizations see the benefit of having a longer term plan in place, a plan with triggers against which the organization can take prompt action to de-risk, to implement changes in investment strategy when you hit those triggers,” said Oldham.

About “Inside Employers’ Minds”

“Inside Employers’ Minds: Confronting Critical Workforce Challenges” features a dedicated website (www.mercer.com/insideemployersminds) which contains a number of resources focused on addressing each key issue.

Photo courtesy of Andy Dean Photography/Shutterstock.com.