A Day Late and a Dollar Short: The Planning Fallacy Explained

One of the most universal and robustly demonstrated cognitive biases is the planning fallacy. If you’ve ever underestimated how long it would take you to finish writing that paper you’re working on or finish moving or get to your destination, then congratulations, first of all you’re a human being and that makes you subject to the planning fallacy.

So why does this happen? Why do we systematically underestimate the amount of time or money we are going to spend on a given project?

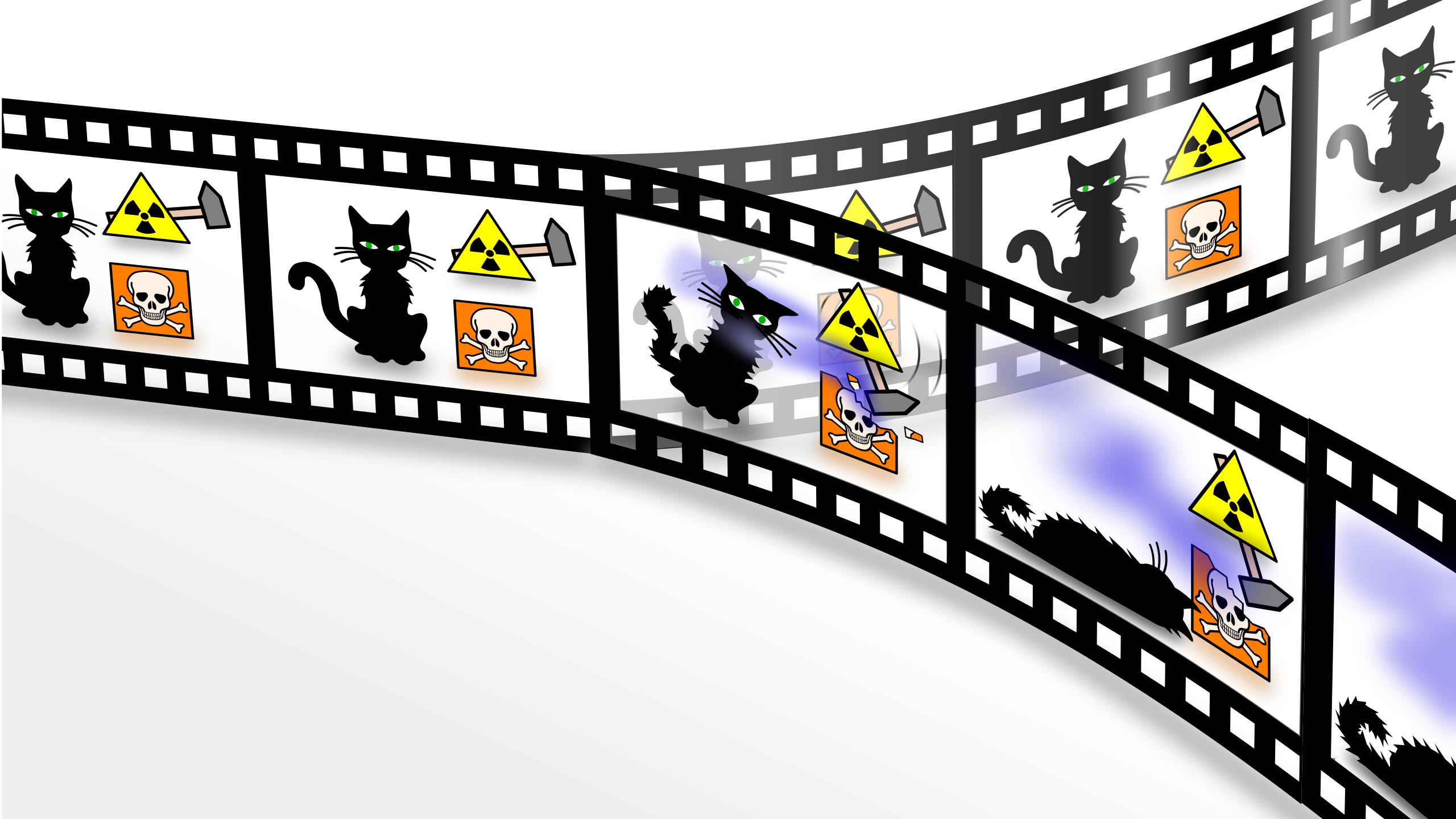

One piece of the puzzle is the fact that our intuitions aren’t very good at thinking about compound probabilities. So here’s what that means. If you think back to the last time you were late completing some errand that you were running and you also think back to how you formed your prediction of how long the errant would take – if you’re like most people, you probably thought briefly about the various steps that make up the task of running an errand like getting ready to go, driving to the store, finding the thing I’m looking for, waiting in line, getting in my car and coming back home.

If you’re like most people you probably envisioned a typical occurrence of each of those steps – so a typical amount of time it takes you to get ready to go or a typical amount of time it takes you to find parking. That’s what formed your rough estimate of the amount of time the whole errand would take. And in most cases you’re going to be correct about your typical estimate. That’s what makes it typical.

But the more steps you have in whatever project or task you’re working on, the greater the chance that in one of those steps you’re going to hit a snag and it’s going to turn out to be atypical.

That probability that the whole thing is going to be atypical in some respect goes up the more steps you have in the process. And it goes up faster than our intuition would predict. One way to tell that this process is partly responsible for the planning fallacy is that when scientists ask people how long would you expect this project to take you if it progressed in a typical fashion, people give estimates that are almost identical to the estimates that they give when scientists ask how long would you expect this project to take if nothing goes wrong.

In Their Own Words is recorded in Big Think’s studio.

Image courtesy of Shutterstock