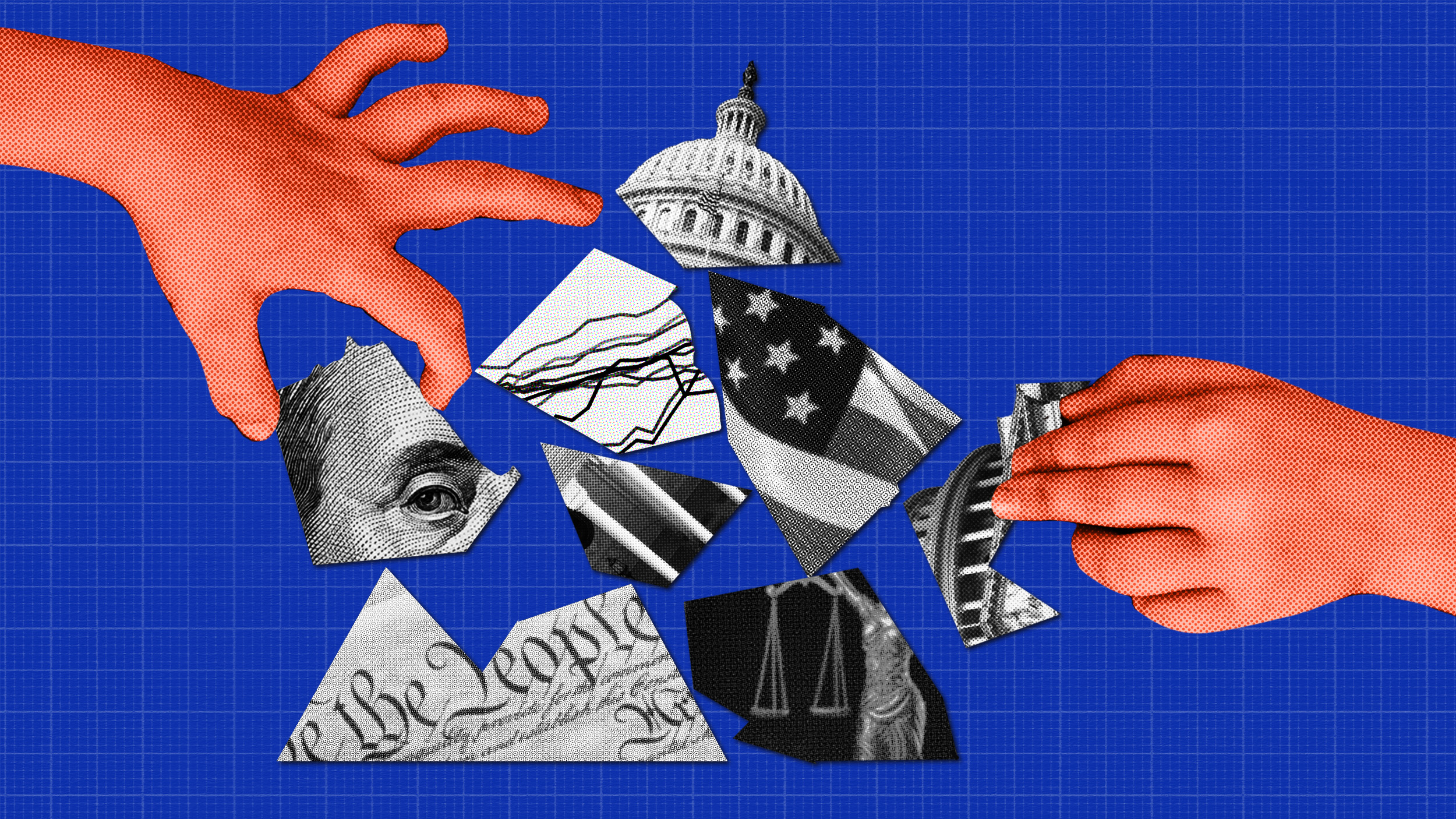

Congress’ Bad Debt Ceiling Deal

By passing a deal to raise the debt ceiling, Congress averted a crisis that is entirely of the own making. If Congress had failed to reach an agreement, it would have forced the government to shut down essential services as well as to default on many of its financial obligations. What people usually call “default”—not paying investors who have loaned the government money—could probably have been avoided for a while, but only at the cost of not sending out Medicare reimbursements or giving soldiers their paychecks. Failure to reach an agreement would have done long-term damage to the U.S. position in the world economy, forced the government to pay more interest on its debt, and probably plunged the faltering economy into another real depression.

But it’s not as if Congress acted to avert an asteroid. There would have been no crisis at all if Congress simply agreed to spend the money it had already voted to spend. The federal government is not otherwise about to default on its debts. As I have argued before, the country isn’t broke. The real problem is that, in spite of historically low tax rates, we don’t want to pay for what we buy. In fact, if Congress simply did nothing—and let the Bush tax cuts expire on schedule—the national deficit would mostly go away. We have a long-term financial problem largely because Congress refuses to raise tax rates to the level they were at ten years ago.

This deal, meanwhile, is at best a temporary solution to the federal government’s fiscal problems. It doesn’t either cut spending or raise taxes enough to do more than push the issue a little further down the road. Worse, as Annie Lowrey writes, cutting spending now—while states do the same thing—may derail whatever recovery is occurring. If it does, it will only make the deficit problem worse by causing tax revenues to fall even further. Defenders of the deal invoke what Paul Krugman calls “the confidence fairy,” arguing that increased confidence in the government’s ability to pay its bills will spur new investment. But there is little reason to believe that concerns about government debt are much of a drag on the economy. In fact, as Bruce Bartlett says, the deal is reminiscent of President Roosevelt’s 1937 attempt to balance the budget, which many economists blame for extending the Great Depression.

House Minority Leader Nancy Pelosi (D-CA)—who voted for the deal—called it a “Satan sandwich” with “some Satan fries on the side.” Republicans got almost everything they wanted in exchange for a voting to do something that their leadership admitted they had to do anyway. Liberal commentators like Paul Krugman tore into President Obama for having negotiated poorly and caved too easily. But, as James Fearon suggests, Obama’s may never have held that many cards when the Republicans control the House and can filibuster in the Senate—especially when you consider that Tea Party Republicans may genuinely have been willing to force the country to default. It’s hard to know any case which party came out of the debt ceiling negotiations looking worse. But one thing is clear: it’s no great victory for the American people.

Photo credit: Pete Souza