The unconventional philosophy behind “founder mode”

- Main Story: Investor Paul Graham published a provocative essay on the approach to delegation by founders who are trying to grow their business.

- Graham challenges the prevailing management culture of hiring “professional fakers” and makes the case for Steve Jobs-esque “founder mode.”

- Also among this week’s stories: Why a high degree of company “vitality” matters in the long run, AI chip challengers, and economist Eugene Fama.

A few days ago, the investor Paul Graham published an essay with a provocative central insight: when it comes to growing a business, the conventional wisdom is almost always wrong.

Instead of shifting to “manager mode” as a company expands — i.e. delegating tasks to subordinates — the most successful startup CEOs will continue to stay in “founder mode” forever.

“Hire good people and give them room to do their jobs,” Paul writes. “Sounds great when it’s described that way, doesn’t it? Except in practice, judging from the report of founder after founder, what this often turns out to mean is: hire professional fakers and let them drive the company into the ground.” He adds:

Key quote: “Whatever founder mode consists of, it’s pretty clear that it’s going to break the principle that the CEO should engage with the company only via his or her direct reports. ‘Skip-level’ meetings will become the norm instead of a practice so unusual that there’s a name for it. And once you abandon that constraint there are a huge number of permutations to choose from. For example, Steve Jobs used to run an annual retreat for what he considered the 100 most important people at Apple, and these were not the 100 people highest on the org chart. Can you imagine the force of will it would take to do this at the average company? And yet imagine how useful such a thing could be. It could make a big company feel like a startup.”

One factor that separates good investments from great ones

Harrison Moot, an investor at TDM Growth Partners, suggests in a recent memo that there is one key factor — often overlooked — that can predict a company’s long-term outperformance: its vitality.

This trait — defined as a firm’s ability to successfully expand their total addressable market — won’t appear on an income statement or a balance sheet. Nor is it something that can be easily modeled into Excel. But in practice, Harrison writes, a high degree of vitality can lead to long-term exceptional outcomes for a handful of select companies.

“Vitality is only one of several factors in our assessment of a company’s growth prospects, but more than any other it separates the good investments from the great, multi-decade compounders,” he writes. “Our experience has shown that Vitality is often the key driver of long-duration growth and that growth is the primary driver of superior long-term investment returns.”

Key quote: “The nagging fear that all investors, particularly growth investors, are afraid of is a company ‘hitting the wall.’ A sudden deceleration in growth, not always explainable and often unexpected by both investors and management teams, typically resulting in a painful re-rate downwards… This is why Vitality, a company’s ability to successfully expand their total addressable market (‘TAM’) over time by developing new products and/or services, is so important. It extends the TAM and thus the potential for higher sustained growth.”

A few more links I enjoyed:

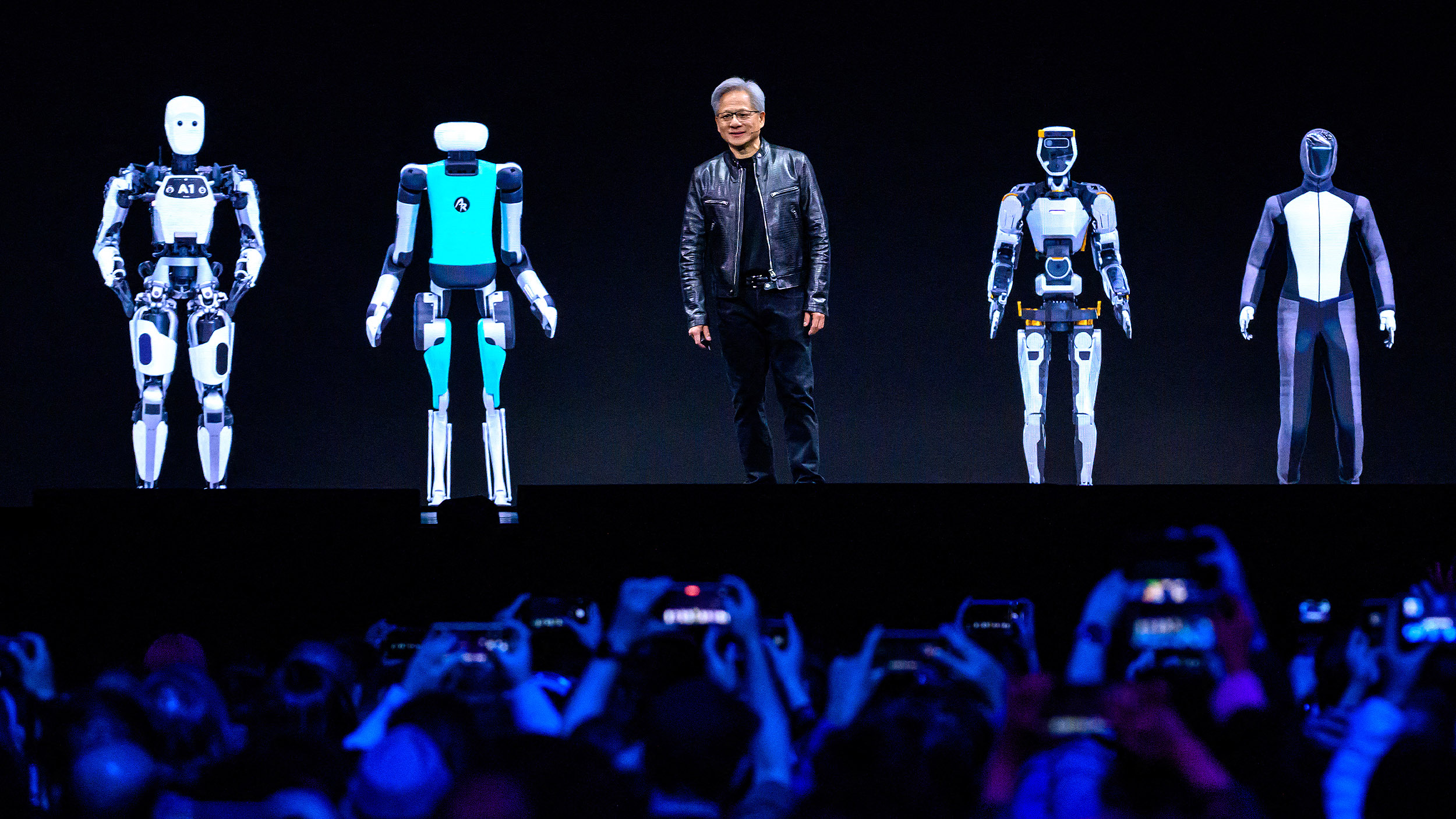

The AI chip startup that could take down Nvidia – via Freethink

Key quote: “In 2022, Etched’s co-founders decided to put all their chips on transformers (so to speak), betting that they would be important enough to the future of AI that a microchip optimized to run only transformer-based models would be incredibly valuable. ‘There aren’t that many people that are connected enough to AI companies to realize the opportunity and also crazy enough to take the bet — that’s where a couple 22-year-olds can come in and give it a swing,’ Etched co-founder Robert Wachen told Freethink.”

Large Positions – Ian Cassel

Key quote: “We normally hold 4-8 core positions (85% of portfolio) and another 4-5 smaller/tracking positions. I view our large core positions similar to veteran players on a sports team. Core positions have earned their right to their position size/salary. You’ve spent considerable time to get to know them. You’ve witnessed how the management and the business react under pressure. They’ve proven themselves and have earned your conviction and trust. The stock has rewarded you with good returns and you have rewarded the management/business with a bigger weighting in the portfolio.”

Economist Eugene Fama: ‘Efficient markets is a hypothesis. It’s not reality’ – via The Financial Times

Key quote: “Fama is arguably the world’s most famous and influential finance professor, thanks to his revolutionary efficient market hypothesis — that stock market prices at any time incorporate all available information, thanks to the cumulative and unending efforts of millions of investors constantly trying to outfox it. The paradox is that as a result of their efforts, the stock market is in practice almost impossible to beat.”

Brain Scientists Finally Discover the Glue that Makes Memories Stick for a Lifetime – via Scientific American

Key quote: “The persistence of memory is crucial to our sense of identity, and without it, there would be no learning, for us or any other animal. It’s little wonder, then, that some researchers have called how the brain stores memories the most fundamental question in neuroscience.”

From the archives:

What Is Strategy? – via Michael Porter (1996)

Key quote: “The root of the problem is the failure to distinguish between operational effectiveness and strategy. The quest for productivity, quality, and speed has spawned a remarkable number of management tools and techniques: total quality management, benchmarking, time-based competition, outsourcing, partnering, reengineering, change management. Although the resulting operational improvements have often been dramatic, many companies have been frustrated by their inability to translate those gains into sustainable profitability. And bit by bit, almost imperceptibly, management tools have taken the place of strategy. As managers push to improve on all fronts, they move farther away from viable competitive positions.”