Why We May End Up No Longer Carrying Cash

England’s central bank has inspired the development a cryptocurrency. Dubbed RSCoin, it will operate on blockchain technology similar to the digital ecosystem that powers the much-maligned digital currency Bitcoin. Originally motivated by the Bank of England’s digital currency agenda, the University College of London announced the creation of the new cryptocurrency at the Network and Distributed System Security Symposium (NDSS) in San Diego. If RSCoin moves forward, the implications of a central-bank-controlled digital currency may usher in a new era of innovation and creativity in the financial services sector. It may also mean that we no longer carry wallets.

In a research report released last year, the Bank of England posited that “while existing private digital currencies have economic flaws which make them volatile, the distributed ledger technology that their payment systems rely on may have considerable promise.” And just this month in a speech given at the London School of Economics, Ben Broadbent, the Bank of England’s Deputy Governor, said that the distributed ledger technology encompassed in the blockchain “goes right to the heart of what central banks do.”

According to Bitcoin.org, “all confirmed transactions are included in the block chain. This way, Bitcoin wallets can calculate their spendable balance and new transactions can be verified to be spending bitcoins that are actually owned by the spender. The integrity and the chronological order of the block chain are enforced with cryptography.” Simply put, the blockchain is a shared public ledger. That is, all transactions on the network are public and visible to everyone, but they are shared in such a way that limits counterfeiting and bolsters the integrity of the system.

Dr. George Danezis, one of the researchers working on RSCoin, argues that the use of digital currencies by businesses is a matter of staying solvent. “Whoever reacts too slowly to these developments is going to take it on the chin,“ he told The Telegraph. “They will lose their businesses.” Danezis says that a national pilot project, running RSCoin, could be up in eighteen months.

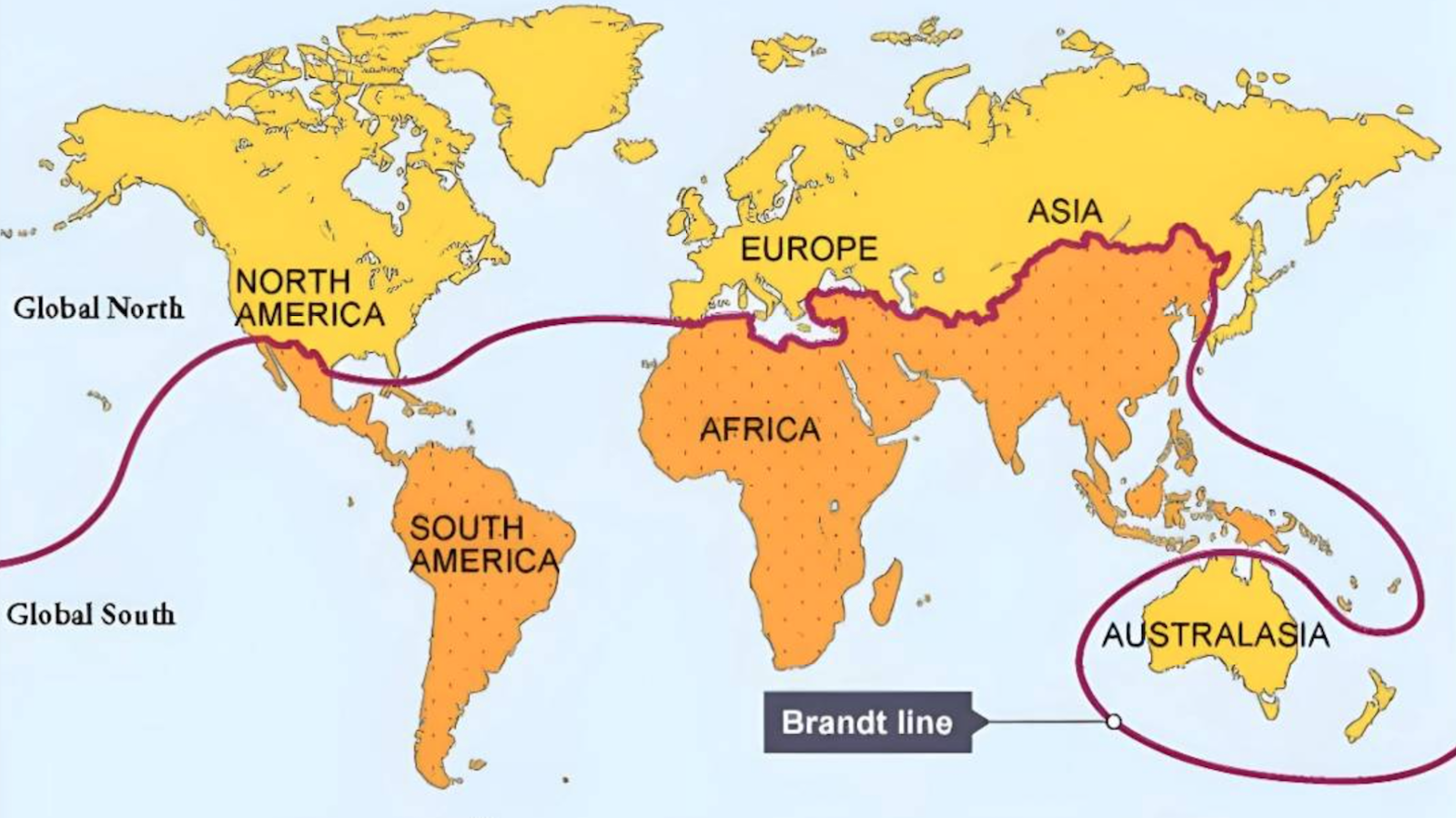

While all this sounds deeply complex and puzzling, its future impact on the global financial system could be enormous. For years, proponents of bitcoin have argued that the cryptocurrency has the potential to disrupt traditional stores of monetary value and transfer. They argue that by reducing transfer fees and removing third parties from the payment process, more people are brought into the global economy.

The challenge however is that it doesn’t scale. According to Dr. Danezis, “the Bitcoin network (currently by far the most heavily used) can handle at most 7 transactions per second and faces significant challenges in raising this rate much higher, whereas PayPal handles over 100 and Visa handles on average anywhere from 2,000 to 7,000.” That is, the technology can’t handle the number of transactions required to compete with other payment systems. Hence, the development of RSCoin, a cryptocurrency that its creators intend to be run by a central bank unlike Bitcoin and other currencies that are decentralized by nature.

By moving the development and management of cryptocurrencies to a centralized banking system, Dr. Danezis will make their adoption by governments more palatable. “Central banks [will] maintain complete control over the monetary supply, but rely on a distributed set of authorities,” he writes. Thereby taking advantage of the benefits of a distributed ledger, while at the same time, ensuring the currency is not used illicitly.

What does all this mean? It means that at some point in the future, we may not have to carry physical cash anymore. Instead of a wallet full of dollars, pounds, or yen, we’ll instead carry a mobile phone full of their digital equivalents.

I, for one, welcome the change (pun intended).