Another BRIC in the Wall?

What’s the Big Idea?

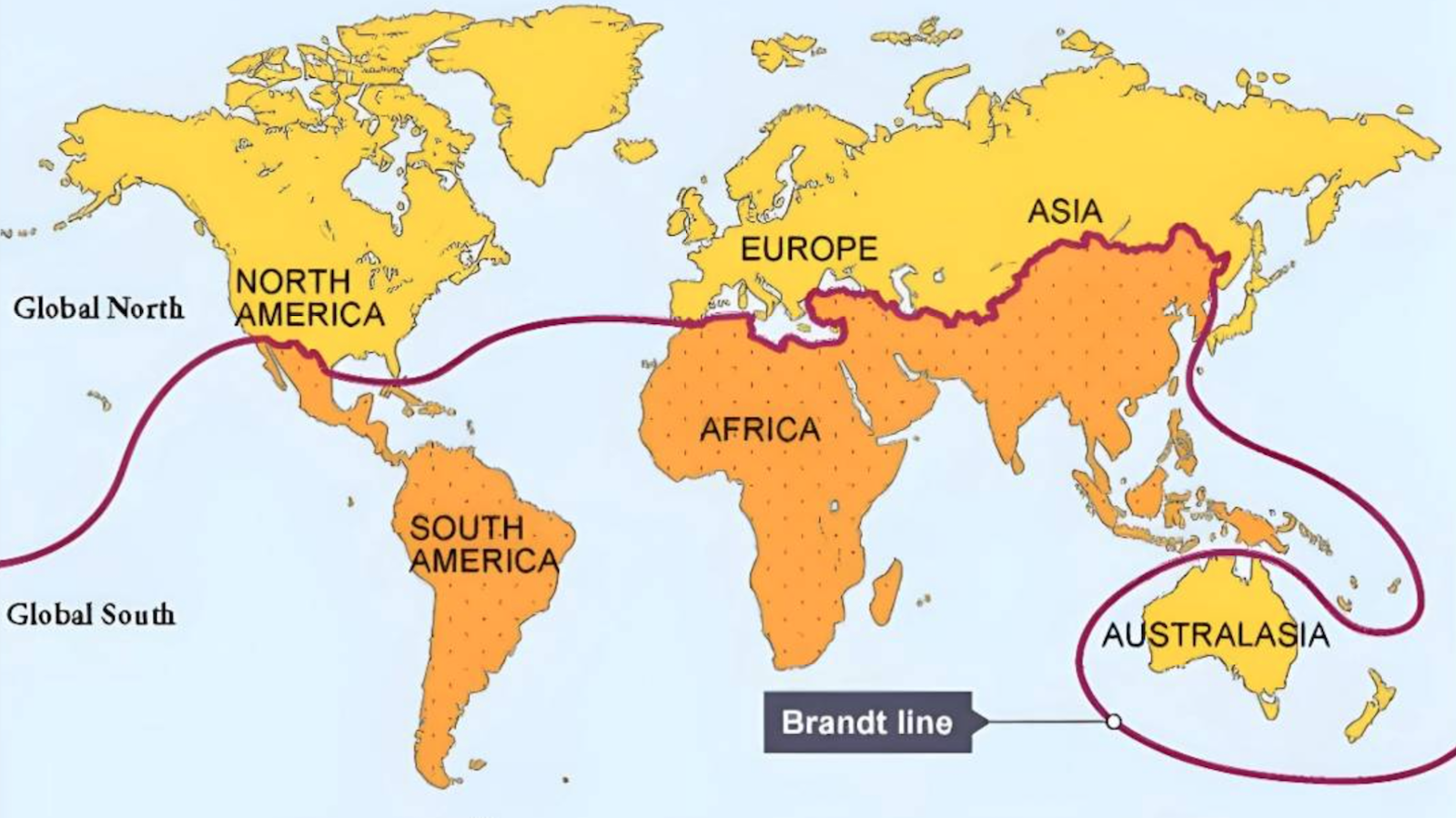

Ten years after Goldman Sachs dubbed the countries Brazil, Russia, India and China BRICs, what does this term still mean? How have these economies changed? Are they good places to do business? Are there other strong candidates to be added to this group?

These questions have particular urgency today as there are many indications that the economy is rapidly changing in places like China and investors are increasingly looking for high growth opportunities in new markets outside of the U.S.

In the video below, Big Think chief economist Daniel Altman explores the economies of all the BRIC nations, and considers new BRIC candidates that represent both large and mid-sized economies.

Watch here:

What’s the Significance?

As Altman points out, Brazil, Russia, India and China represent four very different stories. Investors should consider other countries as places to acquire assets or set up operations for their businesses, Altman says, “because these four countries are not the greatest places in the world to do business.”

Corruption, lack of transparency, lack of protection for investors and a complicated set of regulations are all factors that are negatively impacting the business climate in these countries.

For this reason, Altman suggests looking at mid-sized countries like Peru, Malaysia, or Turkey. Unless you require “an enormous market with hundreds of millions of people who could buy your products,” Altman says it’s a better bet to consider countries “where it’s more likely that the money you earn will make it back to your home country because it won’t be eaten away by all these other little problems.”

Image courtesy of Shutterstock