Peter Thiel sees John Maynard Keynes as his economic villain. He explains why the current financial crisis was caused by short-run thinking.

Question: Which thinkers do you respect most?

Peter Thiel: My favorite thinker remains a French philosopher named Rene Girard. He developed an account of human nature in which one thinks very hard about the question of imitation and the role it plays in the ways in which culture and societies form.

According to Girard, the word "ape" means both primate and to imitate and there's something about human nature in which imitation plays an essential role. It can lead to many good things, so it can lead to education, progress, and sort of this way in which human society compounds on itself. It can also lead to bad things and sort of crazy runaway feedback loops of violence and military escalation and conflict.

And I think one of the challenges in the 21st Century is going to be to figure out a way for people to take what is best in humans and make it better and try to figure out ways to address some of these bad impulses before they spiral out of control and destroy the whole world.

Question: Which economists got it wrong?

Peter Thiel: My favorite economists are probably the classic, the sort of classical economist still, Hayek, Von Misese, Milton Friedman, so that's probably the one I am personally most bias towards. But I think we are going to see some sort of return to the classic economic thinking of the 19th and 20th Centuries.

My villain in economics is clearer. I believe the villain is Keynes and there was a Keynes line that in the long run we are all dead. Whether or not that is true, I believe that in the long run Keynesianism will be dead and that the problem with never thinking about the long run is that in the long run, the short run becomes the long run. And I wonder whether the crisis of 2008-2009 was not just a crisis about finance or about technology, but also a crisis about short run thinking and it was a point in time where short run thinking had run out and there was no more time to think about the short term and that actually a lot of long term problems we have been putting off and deferring had finally come home to roost.

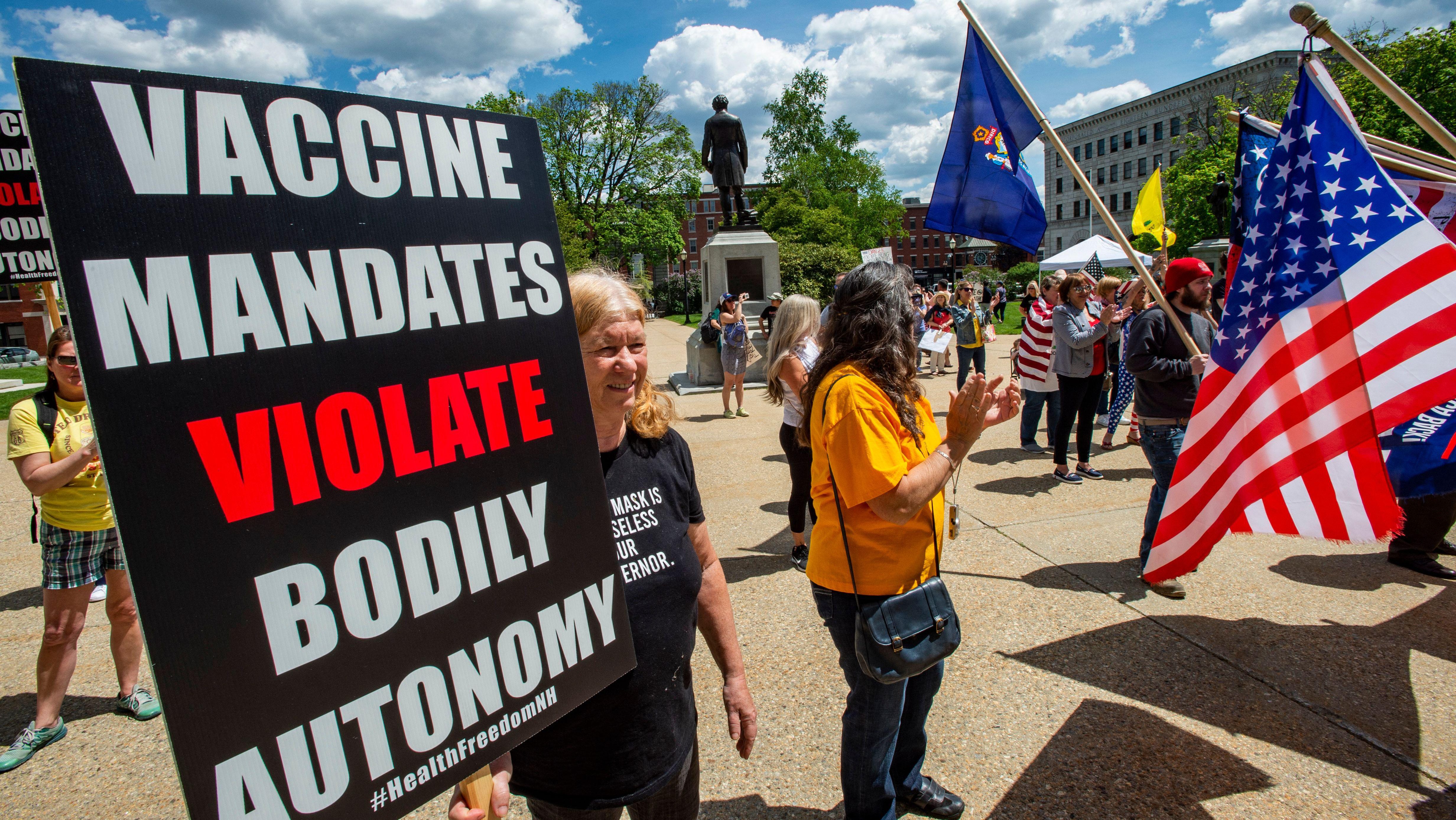

Question: You are known for your support of libertarian ideas. How did you come to this intellectual perspective?

Peter Thiel: It's always difficult to describe where one's ideas come from in various ways. I think I've always been somewhat of a classical liberal. I've always believed in limited government, I believe that power corrupts and absolute power corrupts absolutely and that one of the great challenges in our modern and technological age is to figure out ways to challenge the incredible power that human beings have been given in ways that are not corrupting.

Recorded on December 7, 2009