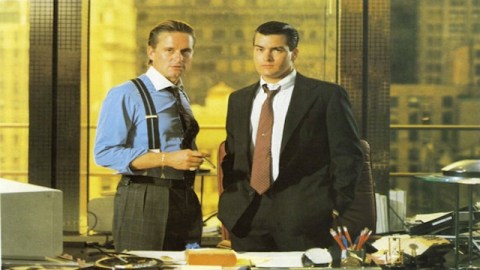

Getting Over Gordon Gekko

Wall Street II features a hedge fund manager. What will he be like? N+1 editor Keith Gessen has published a book,Diary of a Very Bad Year: Confessions of an Anonymous Hedge Fund Manager. It consists of interviews between Gessen and a friend/acquaintance of his who works at a hedge fund in Manhattan. It is Gessen’s Ivy League wonder—evolved from a sort of standard (also perhaps classically Cambridge) disgust—that, in additional to his literary skill, creates a compelling dynamic between Interviewer and Subject. And yet: is someone who knows nothing about finance attempting to write about finance so unlike someone who knows nothing about literature attempting to write about literature?

One might be tempted to say, “allegedly consists,” in the hope/suspicion that Gessen’s book might be a work ofexperimental fiction, but Gessen is convincing in his lack of knowledge of his subject, a crime no journalist—or novelist—would commit.

To profess ignorance about economics is not unusual; it’s in some way this trend that landed us where we are now. To profess ignorance about hedge funds is—unless you work in one, or work for Wall Street—almost a cliché: these are organizations “known for their secrecy,” etc. Our failure to find new ways to discuss, and blame, the men and women in this industry for whatever we feel they’ve done wrong has become as much a native right as summer fireworks, and ice creams. So why would a literary novelist care to look more closely at this word? Who is his audience, and what are they looking to learn?

Here is an excerpt:

n+1: But what I’m saying is, the witch doctors were making a lot of money during this period, and they got to keep that money. Whereas I, me, I didn’t make any money. And now they’ve ruined the economy and I might never make any money.

HFM: Ah, right, and your point is we should try to get that money back from them?

n+1: I don’t know. No . . .

HFM: They don’t have it. They spent it.

n+1: No! They couldn’t spend all of it.

HFM: The mortgage brokers probably spent all of their money. The mortgage-backed securities structurers maybe didn’t spend all of their money. But when you have an economy where contracts can be rewritten and you can go back and try to claw back money from people years after the fact, that’s going to be tremendously destabilizing and it’s going to really disincentivize investment in human capital. And it’s going to incentivize people to work in the gray economy. I think the answer is, you need to contract, for some of these jobs, jobs like in the investment business, going forth contractually, we should make it easier, we should create compensation arrangements where there are claw backs. But you have to do that by agreement and in advance. You can’t reopen contractual arrangements years after the fact. At least not without some strong indications of knowing fraud.

n+1: Actually, the people who made a lot of money were the people on Wall Street, right?

HFM: Well the physicists who…

n+1: Not the physicists! The brokers of this stuff…the sellers of these securities…

HFM: Those people made a lot of money, sure.

n+1: OK, those are the people!

“Disincentivize” is not a word. “Incentivize” is not a word. But because they are widely used, they are acceptable, like cliches. Is the ineloquence of hedge fund managers (see David Brooks most recently) also a cliche? This is partially what the presence of Gessen’s book challenges. The book says, Let’s listen to what someone who knows what they’re talking about has to say.

This is not a book for MBAs; they will read Liaquat Ahmed, or Niall Ferguson. This is not a book for English majors. Yet this is a book that captures, in its highly self-conscious contrast between interviewer and interviewee, the widening gyre dividing most Americans from “HFMs.” Gordon Gekko is dead. Long live Gordon Gekko? Gekko was not, technically, a hedge fund manager, but his character, and its legacy, stand for the same thing. The more people in finance who speak eloquently about what actually they do to a wider audience, the more we are able to see Gekko for what he was–and is: a beautiful monster, a relic, a cliche.