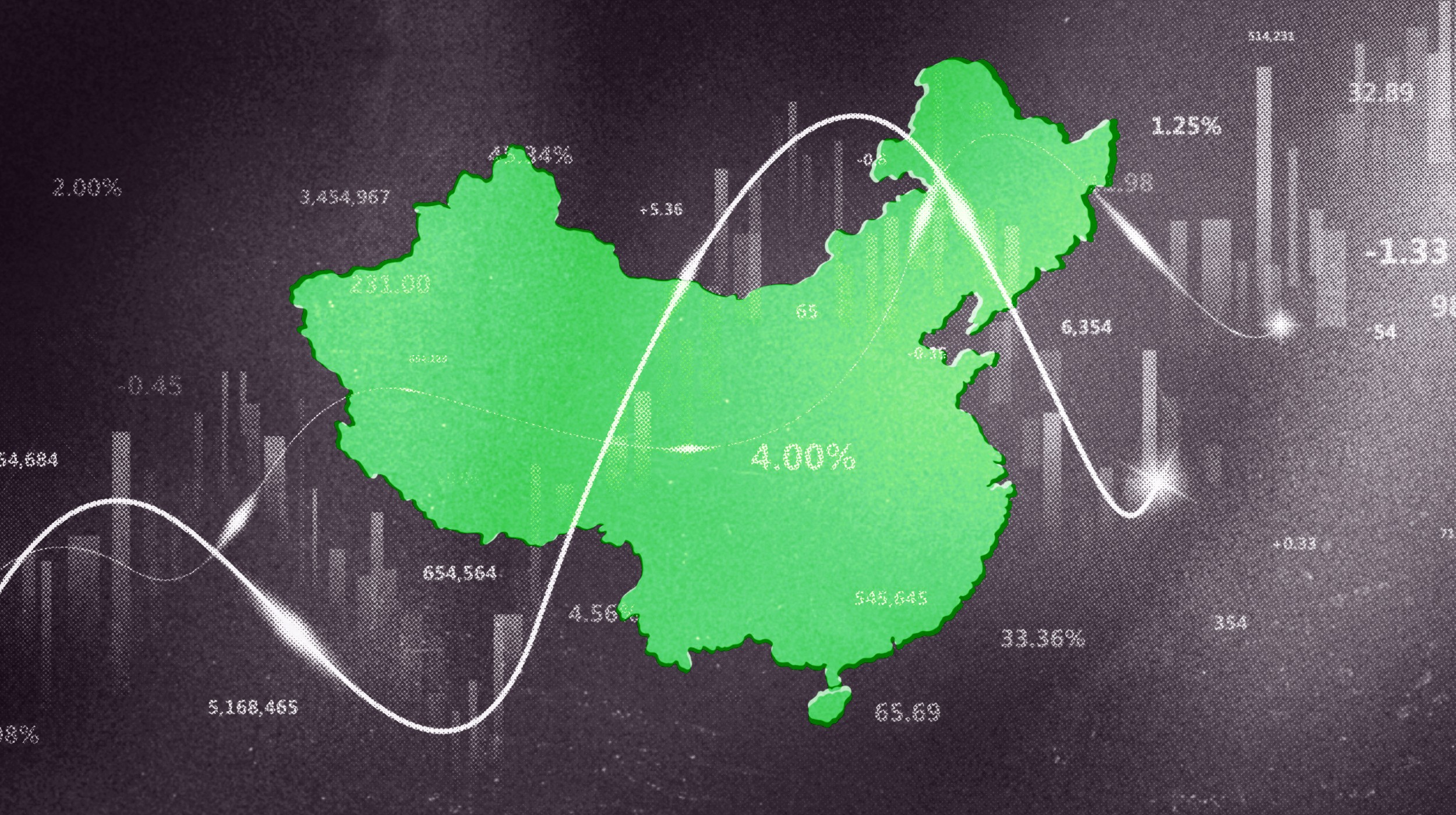

Is China at Risk of Defaulting?

What’s the Latest Development?

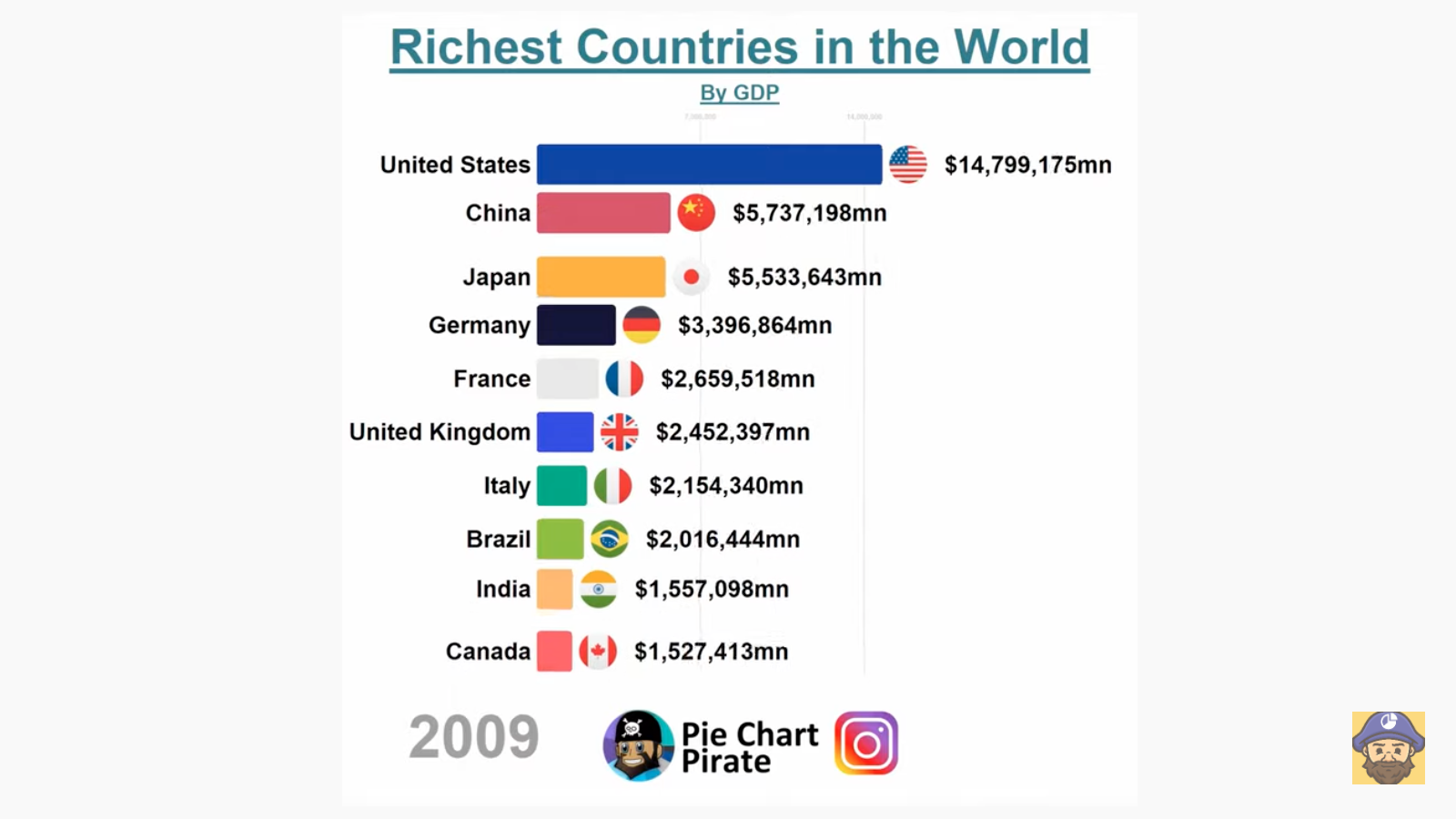

Chinese Premier Wen Jiabao travelled to Europe recently to reassure his country’s biggest trading partner that China will not stand idly by as European economies struggle under the burden of Greece’s imminent default. $2 billion in trade deals were signed in London while Germany, China’s biggest trading partner in Europe, made out even better with $15 billion in trade contracts. But it was not all for Europe’s benefit, of course. Of China’s $3 trillion currency reserve, a quarter is held in European bonds.

What’s the Big Idea?

Considered to be an economic behemoth, few have asked after China’s debt which, depending on how it is measured, accounts for between 60 to 150 percent of G.D.P. While China’s economy is doing better than most, it’s long term welfare depends on market liberalization, says Victor Shih, professor of political science at Northwestern University: “When we take into account all the liabilities of state-owned enterprises, [national debt] comes out to be over 150 percent of the Chinese economy. … There is a huge amount of inefficiency in the economy which will create a big drag on the Chinese economy going forward.”