Markets, Unnatural Laws and Choices

We’re letting unnatural laws unduly influence us. A fuss about “simple economics” can remind us that markets aren’t like gravity, and their so-called laws are neither laws of nature nor commandments carved in stone. Ask yourself: should markets fit our needs, or should we fit theirs?

A company that tells customers it uses “surge pricing” caused irritation by increasing prices 700% during a snowstorm. Market pundits groaned: People just don’t understand “simple economics.” But conversely some market pundits simply don’t understand people. Surge pricing might be labelled “logical and fair” or rational and efficient, but it smacks of exploitative (“markets uber alles”) thinking, which upsets people.

The relevant “simple economics” is the misnamed “law of” supply and demand. Roughly: Price signals tend to push markets to “clear.” Rising prices indicate greater demand and encourage more supply, and vice versa. “Clearing” means all supply is sold (though not necessarily used).

Now imagine I’m a successful entrepreneur and that manufacturing 100 widgets costs me $700. Using cost-plus pricing, I sell all widgets for $10 each, yielding $300 profit. High-demand price maximization might mean a surge price of $70 clears for $6,300 profit. Way better for me. But overall? Is it better for my 100 customers to have $60 less? How they use $60 might be better for “the economy” (higher multiplier).

The point is market norms aren’t facts of nature. They’re choices, which shape incentives and guide markets toward certain goals. These needn’t privilege current supplier interests. (Note: Cost-plus doesn’t limit profit. To make more, satisfy more customers.) Whatever reasons free-marketers have for preferring price-gouging they aren’t self-evident or widely understood. Market logic remains “cognitively unnatural.”

The unnaturalness of markets raises many issues, but let’s focus on optionality. What are rightly called the laws of nature are nonnegotiable. They work the way they work whatever we do. We can’t legislate gravity. Not so with markets. And unlike gravity, markets have empirically worked differently in different places and times.

Before deferring to the “markets in everything” crowd, remember that markets are human-made social tools. Before letting markets (thoughtlessly) coordinate countless transactions, remember how flat-out wrong economists can be (and how potentially misleading their use of “rational” and “efficient” is). The laws of nature can’t be broken, but economics and its “laws” break often. Free markets neither automatically convert self-interest to social good nor generate “spontaneous order” leading to the best outcomes. It’s much more complicated than that.

We can, and must, regulate markets to accord with collective goals. Including, perhaps, some of the goals of our Founders, such as being “wholesome…for the public good” (e.g. correcting externalized costs) and promoting “the general Welfare” (e.g. curbing price gouging).

But if you’d prefer a world safer for surge pricing, let’s start “simple economics” training earlier: mandatory market-gouging drills in kindergarten?

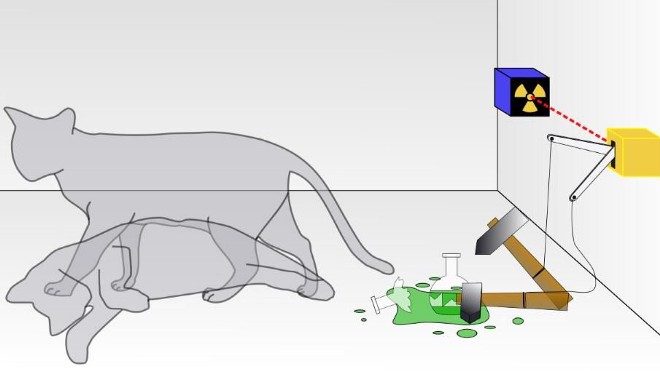

Illustration by Julia Suits, The New Yorker Cartoonist & author of The Extraordinary Catalog of Peculiar Inventions.