What Small Businesses Should Know About the Affordable Care Act

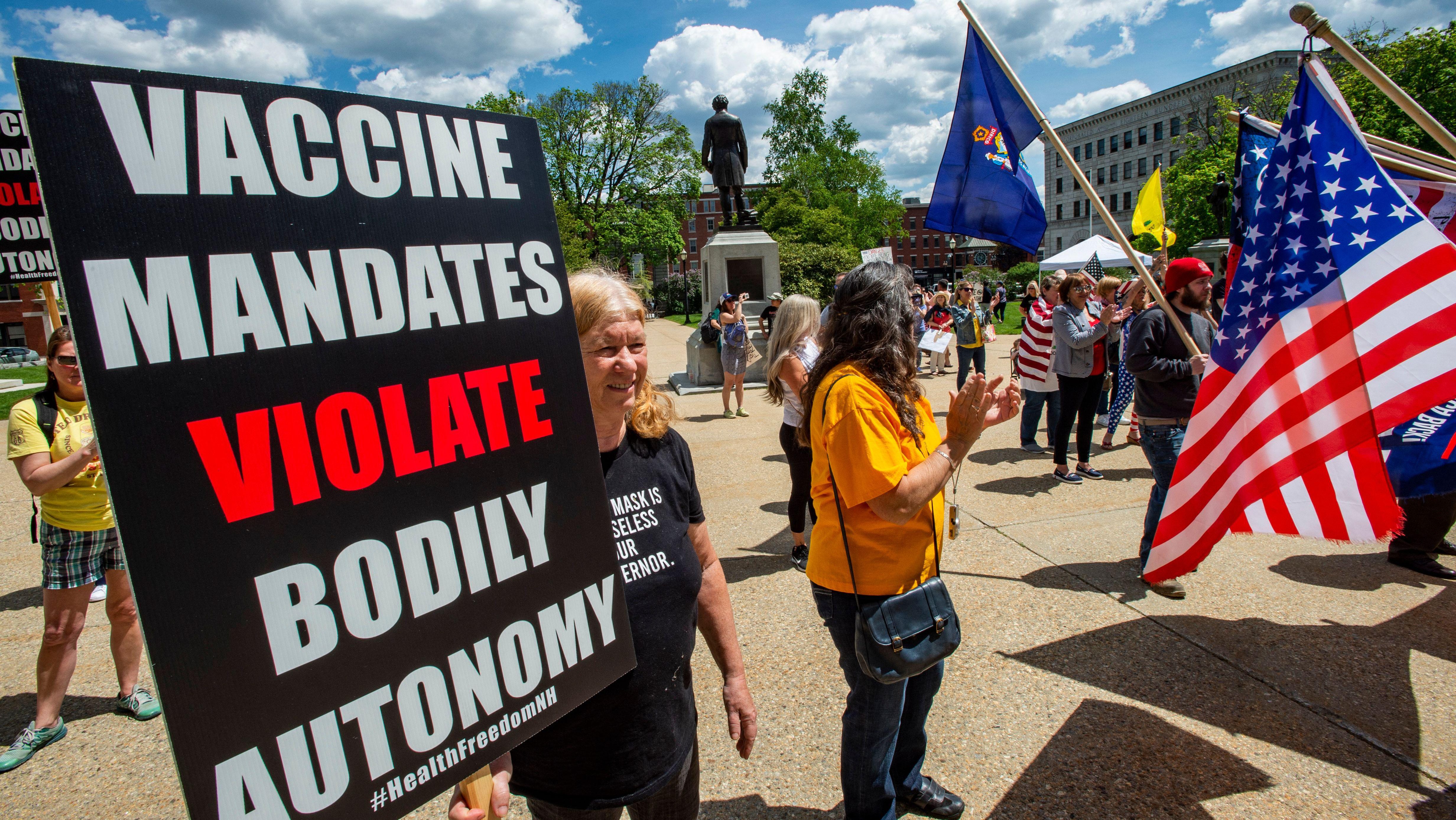

The noise in our nation is deafening as the Affordable Care Act, takes hold.

This loud back-and-forth may ultimately require us to wear ear-plugs, but I’m fine with the debate, because we live in America, and it’s a democracy. That said, I’m not okay if the noise prevents small businesses from truly understanding this landmark in health care coverage. And I’m definitely not okay if the noise drowns out rational and well-thought-out business decisions that could affect small companies and their employees as they try to choose the right health care options and benefits.

So there’s a lot at stake in this regard with the Affordable Care Act, which will change how Americans receive health care. The change will be especially pronounced for those working in small enterprises. And it’s the owners and employees of these businesses that I want to help.

From my perspective, the best way I can do this is by being a neutral voice of reason, a helpful guide who assists small-business owners and their employees as they navigate this significant transition, and a fact-based purveyor of much-needed information. Having said this, let’s get educated with some background.

In the past, small businesses were able to make a free-market decision about whether they wanted to provide health insurance benefits to their workers. If they did provide these benefits to their workers, they were able to partially deduct the cost of the benefits from their taxes. Businesses that did not provide insurance to their employees probably did not do so because of economic reality, lack of value placed on the benefit by employees, or because it was too administratively difficult to shop for insurance for their workers. Maybe the time was better spent running the business, and any employer penalty for not providing insurance to employees was emotional – not financial.

Based on the numbers, there’s been a lot of emotion out there. Only 49 percent of firms with 3 to 9 workers, and 78 percent of firms with 10 to 24 workers, offered any type of health insurance to their employees in 2008. In contrast, 99 percent of firms with more than 200 workers offered health insurance. Workers at small firms that offered health insurance also tended to have less generous plans than workers at large firms.

One of the reasons for this problem is that small businesses have been struggling with the rising cost of health insurance more than other employers. They have been paying about 18 percent more than other employers for the same kind of health insurance, and their struggles are a big reason why people have been losing coverage. In 2008, fewer than four of 10 small businesses provided health insurance, compared with six out of 10 in 1993. Under the Affordable Care Act – which will require small businesses to consider the question of providing insurance to their workers – it’s likely that the wide gap between what small business pays for insurance and what big business pays for insurance will narrow, because smaller employers will be grouped with other buyers in a health exchange that will increase the insurance pool.

We’ll have to see how this ultimately plays out; but, if you’re like me, you’re probably most concerned about what’s going to happen to your workers, your premiums, and your business. As always, my best advice is simple: Do the math before rushing to judgment or making any decisions here.

This is particularly important, because, in the end, we don’t know what’s going to really happen – even though a research survey from Deloitte tells us that about one in 10 employers in the United States will drop health coverage for employees in the next few years as the major provisions of the Affordable Care Act take effect. Fortunately, however, enforcement of the Affordable Care Act’s employer mandate has been delayed until 2016 for employers with fewer than 100 full-time equivalents (FTEs). As a result, these employers don’t have to immediately confront the dreaded and complex “pay-or-play” decision: either provide insurance for employees, or pay into a system to subsidize the uninsured worker. And that’s a good thing.

Pay-or-Play was going to be a difficult decision for employers, because it just isn’t clear yet how to “play.” The delay gives employers time to do some research and take a hard (and more informed) look at “playing” before they decide on “paying.”

This is the first part in a series providing Carla Corkern’s take on small businesses and the Affordable Care Act, appearing on Big Think on Tuesdays.

Image credit: Dustin Hardin/Shutterstock