The More Materialistic the CEO, the More Accounting Errors

If a CEO enjoys last minute getaways to the island of Mustique and lavish shopping sprees, favorite pastimes should not concern shareholders. Or should they? It turns out that materialism in the CEO indicates a potential for accounting errors within the company. New research out of Georgetown University suggests that highly materialistic CEOs tend to set a culture of carelessness but not necessarily one of corruption.

Big Think interviewed Robert Davidson, an assistant professor at Georgetown University’s McDonough School of Business, a lead researcher on the study examining whether corporate fraud can be predicted.

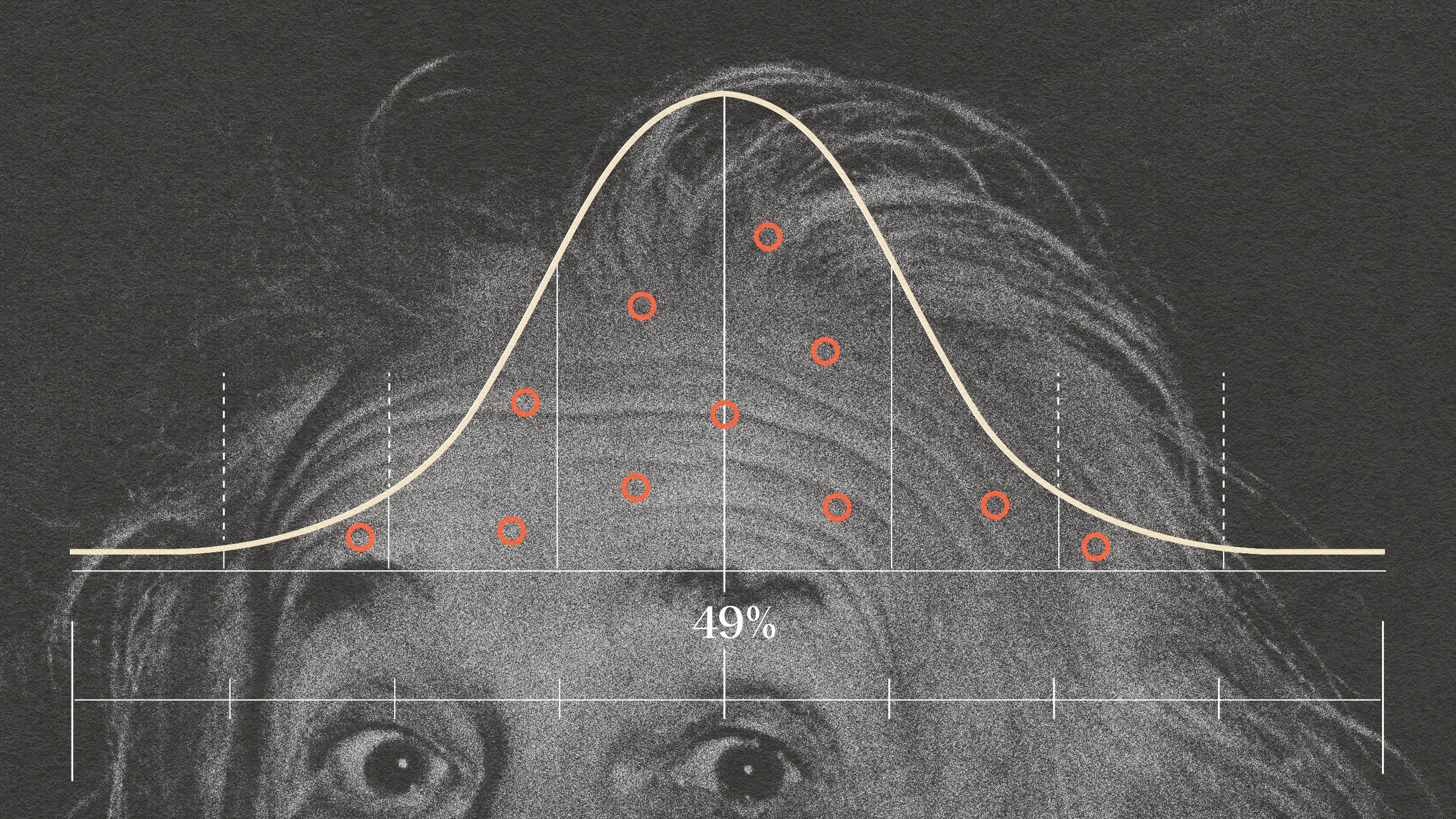

“You look at all these incentives and over a 20 year period there’s thousands of executives who have strong incentives from their career perspectives, from the value of their stock options to inflate the numbers, and only a tiny fraction, you know, less than one percent, that we know of, ever wind up doing this,” explains Davidson. “So maybe there’s something unique that we can find about these people.”

He and his team started brainstorming a list of personal behaviors—from extramarital affairs to breaking the law—that might indicate the likelihood of an executive committing accounting fraud. These types of “extreme behaviors” were the first things they looked for, and they also zeroed in on understanding where the executive fell on the spectrum of frugality vs. materialism.

“We were able to get pretty good data on cars, boats, and real estate that an executive owns,” he says. “We came up with a binary measure whether we treated an executive as frugal or materialistic or unfrugal depending on the value of any vehicles they owned, the length of any boats they may have owned, and then sort of an excess value of their real estate.”

They found that frugal CEOs placed a greater emphasis on controls and on moderating. And this set the trend for their employees. But CEOs who rated as materialistic tended to have more accounting errors in their firms.

For more on Davidson’s findings, watch this clip from Big Think’s interview: