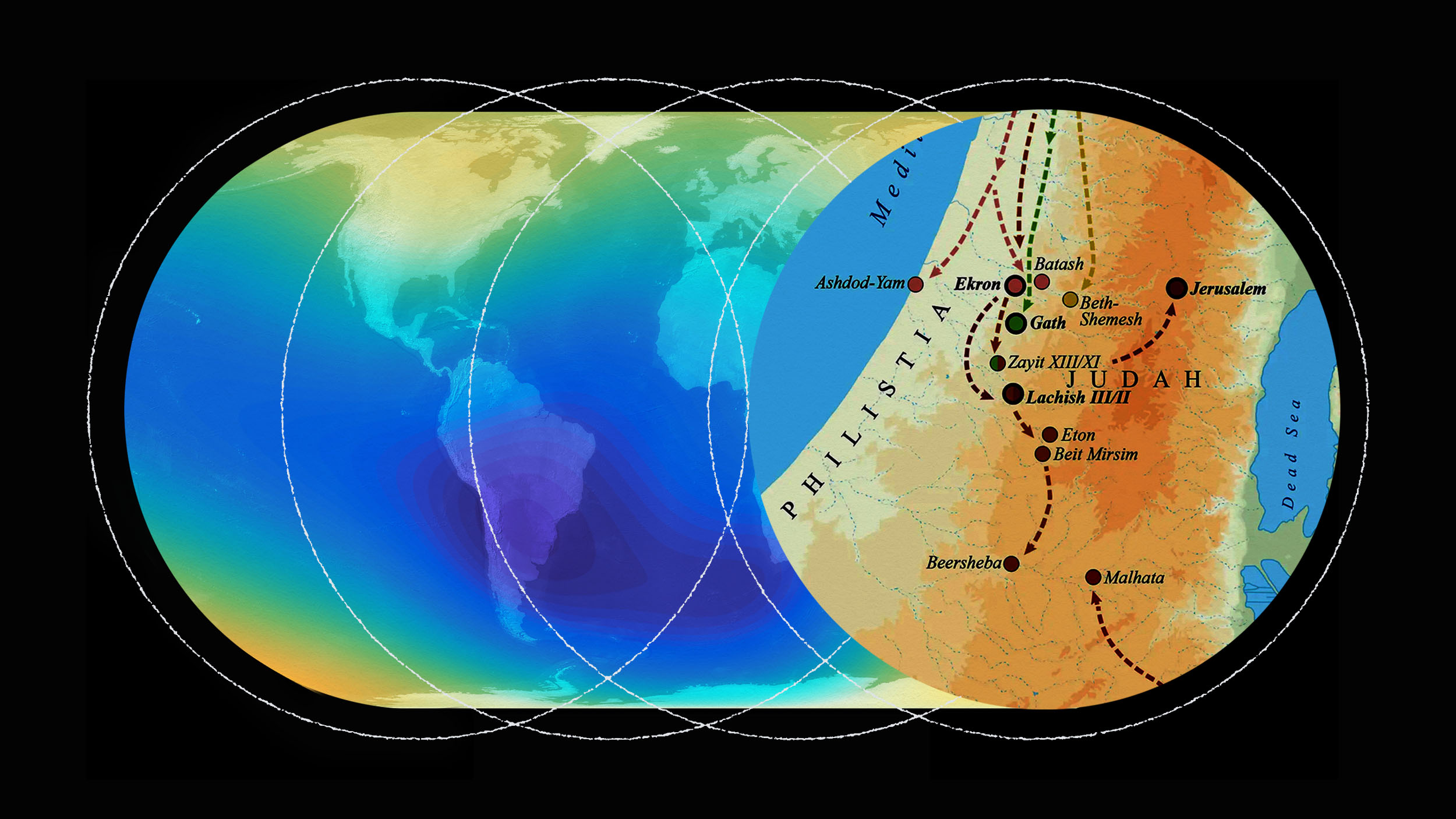

A chronology of taxation.

Question: What are today’s big issues?

Grover Norquist: When you look back on American history, the Civil War was a step back in terms of the government getting bigger and then not getting back in the box. It stayed bigger. It kept putting income tax in to fight the war and kept it. Washington got bigger and more powerful. It said it was doing that to fight the war and save the union, and then they kept going. World War I was another jump in state power. The income tax was made permanent. World War II and then the Cold War. War is the health of the state. When you have wars; when you have demands for lots of state power, the state takes that power. And then when the war goes away, or ends, or has won, the state doesn’t hand the power back. It doesn’t reduce its employment. It was only under Reagan that you saw the defense as a percentage of the economy go from six percent down to three after we won the Cold War. That was good. That was progress. But the rest of the state did not decline similarly.

Going from the ‘50s on, we’ve had a tremendous liberalization, a reduction in the power of the state. We got rid of the draft. We used to have price controls on buses and airplanes. I mean for United Airways to change a price on a plane trip, they’d have to ask somebody in Washington for permission. Can you imagine in this day of going online and asking Priceline and Orbitz and everybody else? You couldn’t do that. You actually had price controls on gasoline, going into the ‘70s; price controls on railroad lines, on trucking, on shipping. The government set these rules on insurance, on banking, and there’s been a tremendous destruction of that kind of power, and a liberalization of free markets and the economy.

Thirty-eight percent of the workforce was forced to pay union dues and work under union work rules. That’s in the private sector, 38 percent in 1958; 30 percent as late as 1970. Today that’s 7.4 percent. That’s still ridiculous, but 7.4 percent is a fraction of 30 and 38 percent of the workforce. So the labor market is more liberalized. Just the buying, and selling, and prices have been freed up. So we have a much freer economy.

Tax rates were at 90 percent under Eisenhower, and they’re down into the mid-30s today. Still too high, but we’re moving in the right direction. And as a result, we remain the world’s preeminent power. We’ve had as much growth during the Bush administration in the American economy as the entire economy of China. People say, “Oh China is so big.” Well it is big, and we grew our economy the size of adding China to the American 2001 economy. So we’re doing okay. We could be doing twice as well if we put the trial lawyers in a bottle and sent them afloat; and reduce marginal tax rates to half of where they are today; and privatize Social Security and health savings accounts in lieu of Medicare. And some of the government programs that were structured to fit a world before typewriters; to fit a world where one size fits all because they couldn’t imagine that people could retire at different ages. Everyone has to retire at 65.

Otherwise the little cards don’t fit – the IBM computer cards. You can’t have some people retire at 62 and others retire at 82. It’s too confusing. With computers, younger Americans are much more open to that. And so you’ll find the people who are least comfortable with individual liberty are those over 75. And those most comfortable with anything goes, I can do anything, “What do you mean I can’t do X?” are people under 40. They just laugh at you when you say to them, “Well everyone obviously has to have the same pension.” Well why obviously? What are you talking about? It makes sense to somebody who is 75. It still does. But it doesn’t make sense today, and it doesn’t make sense to those who are used to working on the Net or playing with a computer. So I think in the sweep of things,it is very difficult for the status ever to put the genie back in the bottle and convince people that they have to live under certain state controls.

Recorded on: September 12, 2007