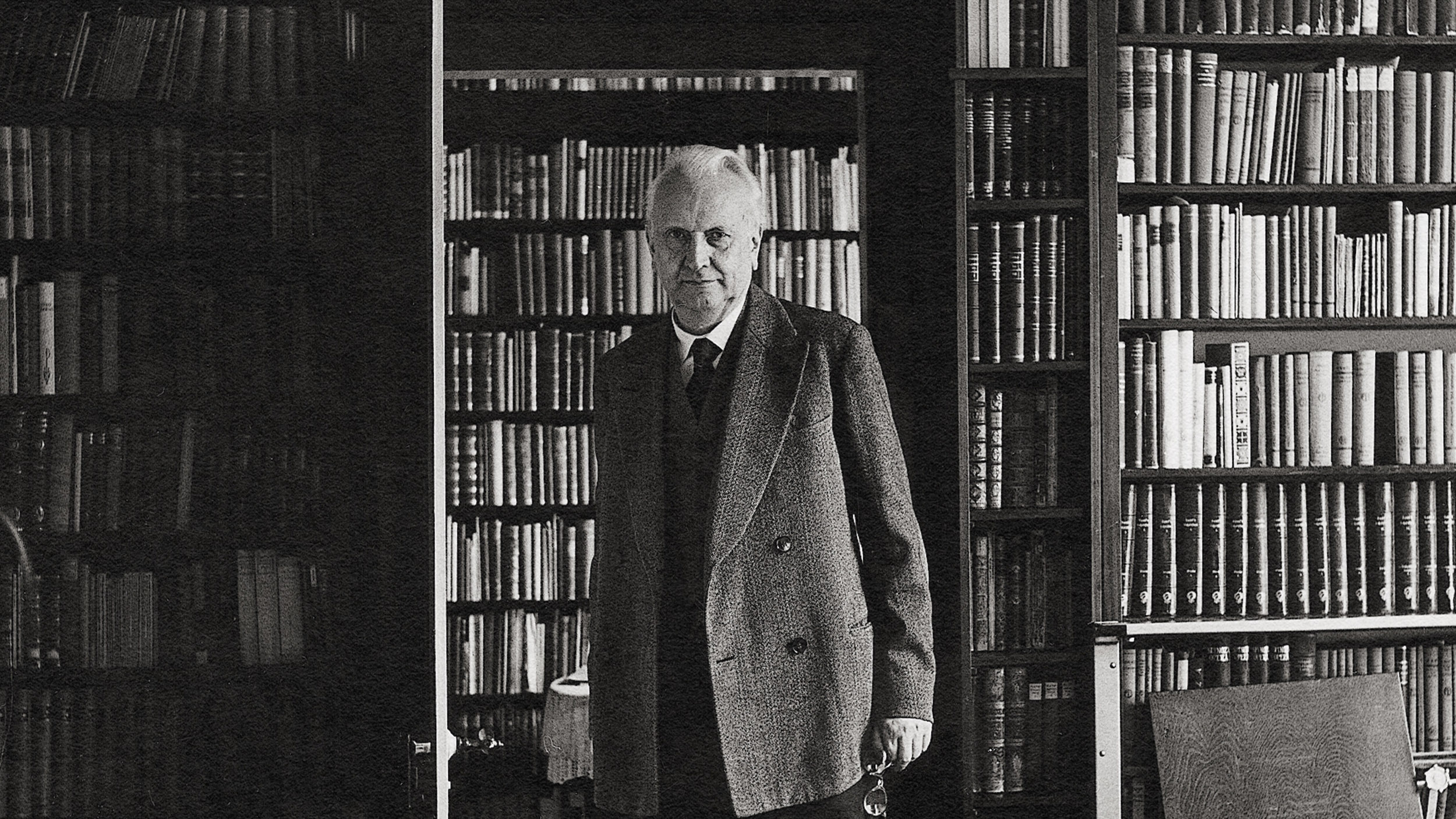

Pete Peterson is the Senior Chairman of The Blackstone Group.

I’ve had so many jobs in my life that you might say I’ve had a checkered career. I haven’t been able to hold onto a job very long. We set up Blackstone in 1985, and it’s a fairly diversified business that on one side of the business, there’s quite a lot of advisory work to corporations. When companies get into trouble, we do a lot of restructuring work. We manage money for people of a more or less conventional type to what we call our alternative assets management business. I guess our business . . . our biggest business is the private equity business in buyouts and real estate, where we essentially get money from investors in very large quantities. Our current fund will be over $20 billion. Our real estate fund will be, I don’t know, eight or nine. . . $10 billion. I think they’re respectively about the biggest. And we go out and buy properties that we think are undervalued. And there’s been a lot of talk in the press these days about private equity and all of the excesses that allegedly . . . In fact, I think a pretty good case could be made that private equity investments contribute importantly to the economy. Let me tell you why. When we buy a business, we don’t buy businesses that are overvalued by definition. We buy businesses that are undervalued. And why are they undervalued? Well technically they haven’t been doing as well as others in the industry have done. So in those cases, we’re very different than many public companies. A public company’s CEO today is under extraordinary short-term pressure. You’ve got the market analysts wanting quarter-by-quarter earnings guidance. And if the poor guy misses his earnings by a few pennies per share, then stock falls. And it creates a kind of a “short-termitis” disease where important decisions for the long term are often set aside in favor of the short term. Well in our business, we’re not terribly interested in the short term. We’re interested in what the businesses are going to be worth four, five, ten years ago when we’re out selling. And the only reason they’re gonna be worth a lot more today is if they’ve been fixed and they’re growing. So if you look at the typical private equity investment we make – and I suspect others are very much like that – to be sure they do some restructuring early on and reduce unnecessary costs. But the vast majority of the time we invest much more in ________ in the future, in development, in research; because what we’re interested in is doing those things that are going to make the companies five years from now go faster so they’ll be worth more than what we paid for them. So I don’t think it’s too fanciful to make the case that many private equity investors improve productivity in this country, improve countries, and provide jobs.

Recorded On: 7/26/07