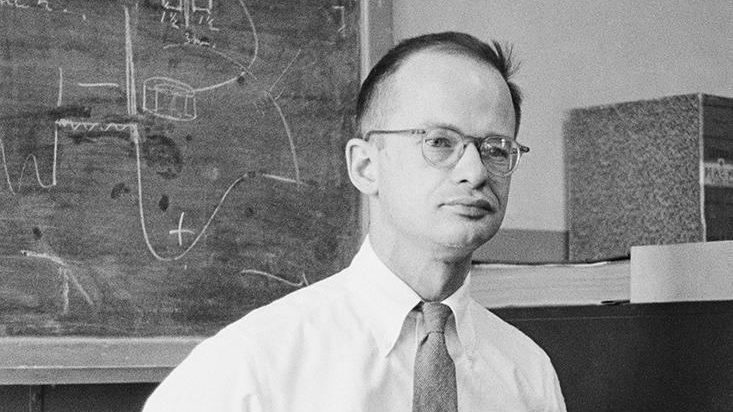

The Columbia economist on the problems with Jeffrey Sachs.

Jagdish Bhagwati: So I say, “Look. Are you with Jeffrey Sachs on Africa, where you raise the aid immediately to very high levels – 0.5 percent of GNP or something from its current 0.1 or something?” So it’s a four to fivefold increase. And then you keep it at a plateau.

Or I said, “Do you think that if you raise it that fast, that it will lead to a lot of corruption and counterproductive things?” And then of course people who stop giving aid say it will go down like that. So that’s another possibility if you follow the Sachs approach of raising it immediately.

And I said the third possible part is where you steadily identify projects and programs. And it is possible to do that if you put a lot of work into it and systematically do it. And you gradually raise the thing to 0.5 percent. Maybe it will take 15 years, but you know it is building on itself.

But 75 percent of the kids in a class of over 150 people chose the gradualist one. All of them said Sachs was going to go this way. And the most vocal critics were African students. They had seen a lot of corruption. They didn’t want aid.

I said, “Look. Don’t throw the baby out with the bathwater.” But the point is this, why did this happen? Because we rush in with monies without looking at how exactly it will be used. We want to throw money at the problem.

We become a lot smarter. There is a reason why I think some people like Jeffrey Sachs are such a big danger, is become when real good Africans who have dedicate their lives to Africa and studying it, many of them in Europe and so on, they are all aghast at this notion that you can just throw money like that.

And the kids, the people there are. And so I think the real danger today in the west is that in our enthusiasm and our reawakened conscious to do things for Africa – which is where the major development problem today is – we may fall for these sort of pseudo-solutions which are going to be extremely expensive.

What I like about someone like Bill Gates on the other hand. You see he has an advantage over people like ___________, because Warren Buffet made money just by making money. By betting against the currency and things like that. He’s made some money on the stock market, but not as much as he claims. He doesn’t have any magic formula about making money on the stock market. But he’s had some lucky breaks and so on. Nobody respects that kind of money.

I tell him frequently, “Don’t ________ your money on politics because when money which is not respected is spent on politics, people tend to get socialistic __________.”

But Bill Gates is adored, because he has invented things, right? And so there is always this notion that those who build things and do things are better than those who just speculate.

So Bill Gates is exactly the man who has been going along this path in my judgment. So I think the best thing that Warren Buffet did was to identify Bill Gates as a guy who really knows how to build, because that’s what we need – the partnership with people like Bill Gates. Because we can’t just throw money away.

And we professors are not particularly good at doing. If I said I was going to do it, you should laugh me out of court. Though I can identify certain problems, but I can’t do what Bill Gates is doing.

For Africa, we need less flamboyance, less recklessness of this kind, less tendency to dismiss people who raise questions as sort or reactionary Republicans or something. I think that that’s not really a correct thing.

I think we need increasingly very steady Bill Gates-like involvement involving businesses which really know how to listen, not hedge-fund types or ________ types. They make money. I don’t know how they do it.

I know there is something like what we call in economics “good and stabilizing speculation”. But I teach it in the classroom, but don’t feel it in my bones as much.

Recorded On: Aug 14, 2007