Knowing what empirical data to look for is the key to confirming an idea—especially when that idea is the premonition of a looming global economic crisis.

Question: What was the tipping point that confirmed your prediction?

Nouriel Roubini: Well folks had been speaking about the U.S. and other housing bubbles for a number of years and that people were talking about the bubble in 2002, 3, 4, 5. I started to worry about it and warn about it in the middle of 2006 for the following reason.

A bubble can continue for a while, right, if price is going up. Even if they are artificially going up because of a bubble there is more demand and if there is more demand there will be more supply and the bubble can continue for a while. So as long as in the case of housing prices were rising and as long as the supply of new homes and the demand for new homes was going higher, the bubble was continuing. So if I had predicted or anybody else that the bubble would burst in 2004 or 2005 I would have been proven wrong.

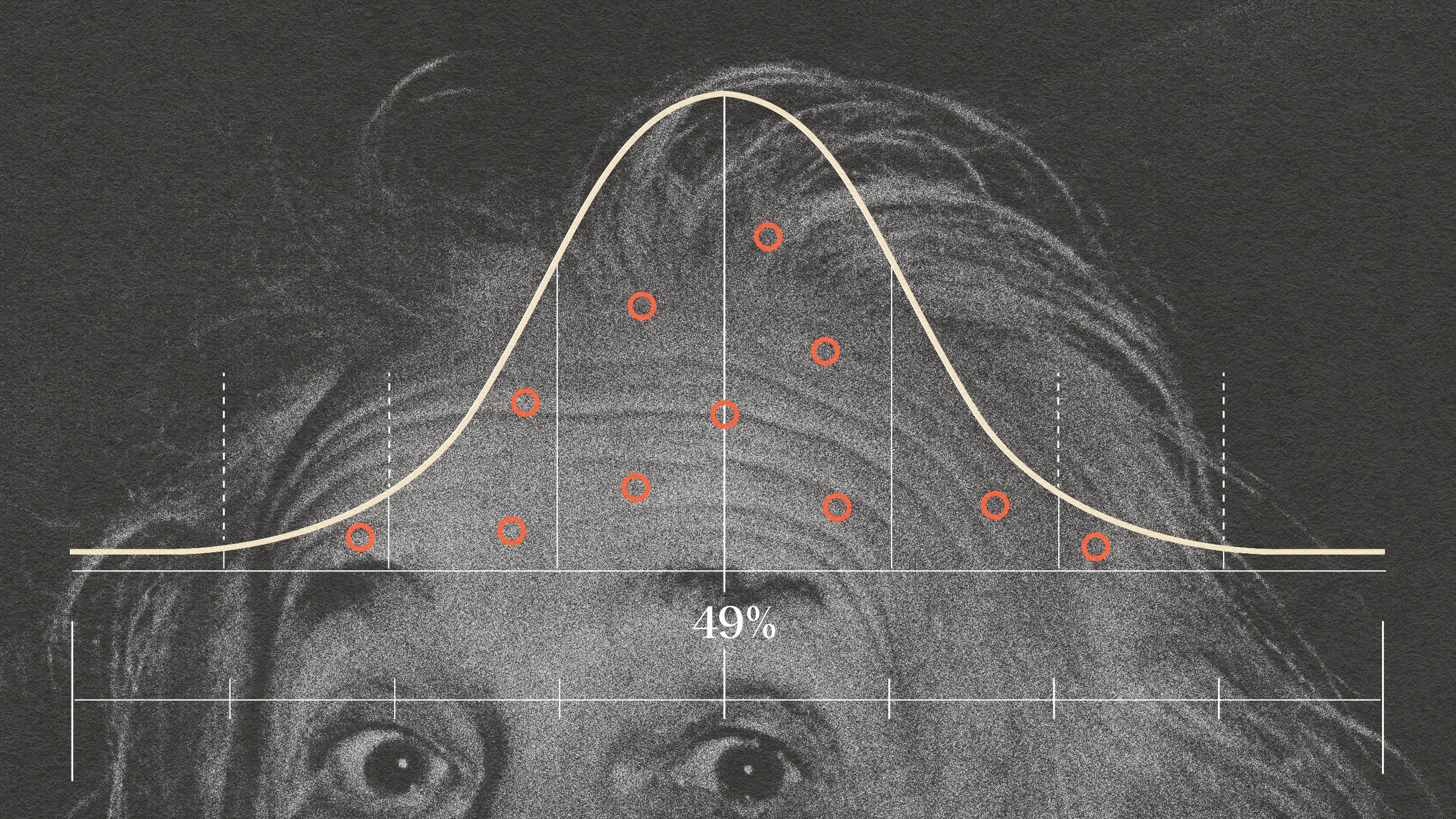

Why did I start predicting the bust in June, around June, July of 2006, because when you were looking at the U.S. data you were seeing that the quantities—both in terms of housing starts and demand—were starting to fall, so they were tapering off and then falling and prices had been rising say 15 to 20% per year. They had also plateaued and they were starting to fall. And a bubble is a bit like a fire that needs oxygen and once the oxygen is gone the unraveling starts. So I knew exactly that we were at the peak of that bubble because the increasing prices and demand and supply had stopped, and the beginning of the reversal had occurred.

And then by looking at how much real home prices had risen in the U.S., they doubled in a decade when usually they are flat over time. There is no reason why home prices should rise more than inflation, so real home prices in the U.S, have been flat for the last 120 years apart from some boom and bust. You knew that if home prices increased by 100% just to go back to their previous value they should fall by about 50%.

Recorded November 30, 2010

Interviewed by Peter Hopkins